US inflation was relieved more than expected in February star-news.press/wp

Inflation relieved more in February, a welcome symbol for federal reserve as a result of higher prices and slower growth due to the trading war of Trump President.

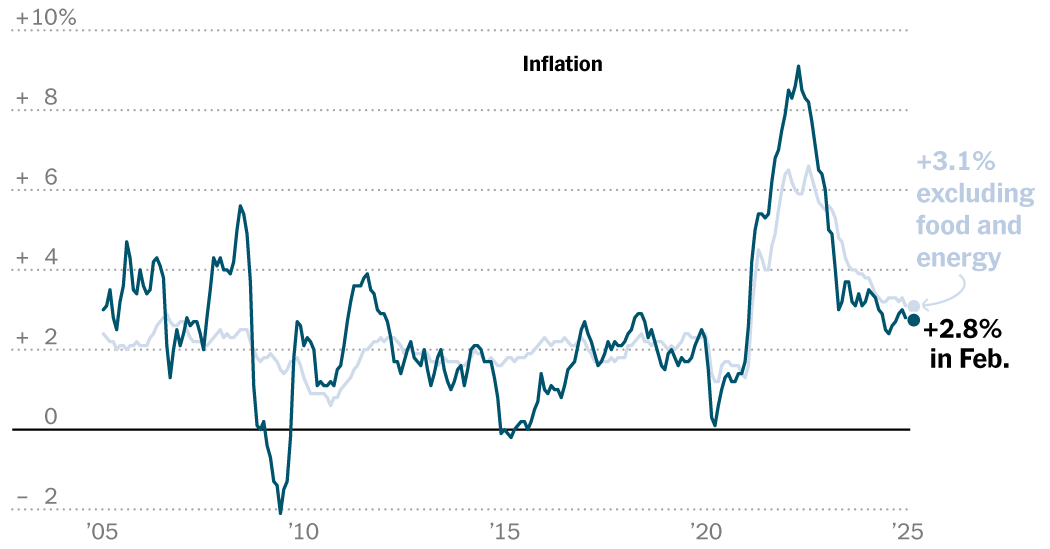

The consumer price index was 2.8 percent in a year earlier, after rising 0.2 per month. It was a step of January It’s amazing to increase 0.5 percent and came to below economists expectations.

The inflation “nucleus”, which draws volatile prices for food and fuel, to provide a better sense of the underlying trend, the lower has also been marked. The index rose by 0.2 percent compared to the previous month, or from 3.1 percent. Both were below the growth of January.

The data of the work statistics offices stressed the hard nature of the Fed Percentage. Consumer staples, such as eggs and other food, are constantly rising, but gasoline fell to other categories of categories. In February 4 aerial percentage driver was the best driver of the best data than expected.

Egg prices rose by 10.4 percent in February, the Avian flu explosion continued to increase the shortage of eggs. Eggs prices are almost 60 almost 60 last year. Food prices rose by 0.2% compared to 0.2%, or 2.8 percent compared to the same period last year.

The cost of used cars has also risen by 0.9 percent in February, although the new vehicle prices slightly down. Car insurance was a great rise in the index that accidentally increased in January, but 0.3% rhythm was much slower. It’s more than 11 percent in the last year.

The home-related cost noticed the lowest winner of December 1221, the shelter index rose by 4.2 percent. Between January and February, it rose by 0.3 percent.

The great question symbol will begin to affect the price of Mr. Trump at consumer prices. The only fits in the time covered by February data were 10 percent of the early 10 percent of the Trump Mr. Trump imported. Sweet Ryan, a delicious economist in the US Oxford Economics, said it was not “affected in February, including clothing, furniture and electronic prices.” Rather, this month he charges in China before they doubled earlier.

Peter Tchir, responsible for the Academy’s Macro Strategy, has said that the biggest effect appears in the coming months in the coming months if the Trump continues with mutual tariffs about commercial partners. The President threatened to match the costs of other countries in the US, raising the cost of products that Americans buy abroad.

Over the possible price, Mr. Tchir said he was very worried about the point of view of the economy, spending charges and administration costs.

“The fear of growth is real,” he said.

Uncertainty about the career of the President’s policies, even the fears that start freezing business and investments will even amplify the scope of the plans of Mr. Trump’s plans and scale.

These concerns also follow the final measures to follow how consumers feel about the future. According to the last survey of the New York Federal Bank, consumer expectations about the economic situation in the year “significantly worsened, as inflation stuck around 3.1 percent. The current year is economically poorer situation.

Slowing growth and resurrection prices are placed food in a difficult attitude, causing his authority to achieve low and stable inflation, as well as a healthcare market.

In January, Fed officials knew it in a turn of other interest rates and waits for more progress to inflation because the economy was doing well. If this resilience begins to show signs of crack before inflation completely disappear, the FEDs can be more limited.

When Fed had to deal with the trade war in the first tenure of Mr. Trump, he reduced interest rates in 2019 in an effort to protect the economy more.

In his specific comments about Trump’s rates, Jerome H. Powell, Fed Chair, acknowledged that this time was a different economic back. “We went out very high inflation and we didn’t completely return to 2% to a lasting base,” said on Friday at an event.

Mr. Powell added that the typical fed response would be a temporary increase in a temporary increase, but he stressed that officials would see any blows and the expectations of long-term inflation. “When we analyze incoming information, we are focused on focusing on separating the signal from noise.” We should not be in a hurry, and are well placed to have greater clarity. “

This suggests that the FEDs reduce rate cutting rate when the officials are collected next week, maintaining the current percentage of the current and 4.5%.

They bet on future market traders who can cut the food this year three times this year, each one point in a quarter. Therefore, it is more cuts than planned a couple of weeks ago, which reflects an increase in anxiety about the economic point of view.

2025-03-12 15:40:00