Bitcoin drowns less than 115,000 amid Trump’s nuclear threats star-news.press/wp

Bitcoin fell to less than $ 115,000 on Friday as renewed political pressure from former President Donald Trump, unstable markets.

The upper cryptocurrency has decreased to $ 113,164, its lowest weeks, which led to more than $ 200 million in the rank of high long positions and increased new concerns about the investor confidence. The decrease comes amid an escalation of geopolitical tension.

Trump orders the submarine to move amid Russia’s tensions, Bitcoin interacts with risk of fears

Trump Declare Re -putting two American nuclear submarines in response to the comments of former Russian President Dmitry Medvedev, Vice -President of the Russian Security Council. Trump’s warning criticized the warning that Russia is ending its struggle with Ukraine within ten days, describing it as a “step towards war.”

“Based on the very provocative data of the former president of Russia, Dmitry Medvedev, (…) I ordered the placement of two nuclear submarines in the appropriate areas,” Trump, Trump books On the social truth.

“The words are very important and can often lead to unintended consequences. I hope this is not one of these cases.”

Follow the Bitcoin price low these notes from Trump, which reflects the wider investor’s concern with high nuclear forces.

The market reaction on Friday also follows Trump’s public attacks on American economic institutions. The former president accused Erika Mcentarfer, a work statistics commissioner, to process job data before the 2024 elections to help Kamala Harris.

He called for its immediate removal and claimed that the office is “fake jobs numbers” by exaggerating employment growth.

“We need accurate job numbers,” Trump wrote. “It will be replaced by a more efficient and qualified person.”

He also drew his attention to the federal reserve, and he sharply criticized his boss, Jerome Powell. Trump claimed that the discounts in the rate of elections at the Federal Reserve were of political motives and described Powell as a “stubborn disobedient”.

“Jerome” is very late, “Powell should significantly reduce interest rates.” “If he continues to reject it, the council must bear control and do what everyone knows must be done!”

While presidents traditionally avoid interfering in the central bank’s decisions, Trump urged federal reserve officials to cancel Powell prices and reduce support rates what he described as a prosperity economy under his leadership.

The Federal Reserve kept fixed rates of five consecutive meetings, noting inflation concerns. But Trump, in a wave of jobs, was accused of Powell of destroying the economy and failing to act on the consequences of the new customs tariff.

The governor of the Federal Reserve, Adriana Kogler, resigns, and opens the main seat of Trump

Amid political pressure, the ruler of the Federal Reserve, Adriana Kojler Declare Her resignation on Friday, and created a major vacant in the central bank. Kugler, one of the two appointed Biden, joined the Council of Governors at the Federal Reserve Bank in 2023 and was a permanent member of voting in the Federal Open Market Committee.

She did not give a reason for her early departure, but she stated that she would return to Georgetown University in the fall.

“It was an honor for life to serve,” Kogler wrote in a letter to Trump. Its exit, nearly 18 months before the end of her mandate, is making Trump’s path to nominate an alternative.

Kugler has recently expressed its support to maintain fixed rates, pending a clearer image about how the definitions affect the inflation. It was absent during the policy of this week’s policy, as two members appointed from Trump, in favor of a price reduction.

She thanked the President of the Federal Reserve, Jerome Powell Kogler, for her service, noting that her contributions brought “great experience and academic visions” to the council.

Bitcoin slides as political tensions and market cracks weighing feelings

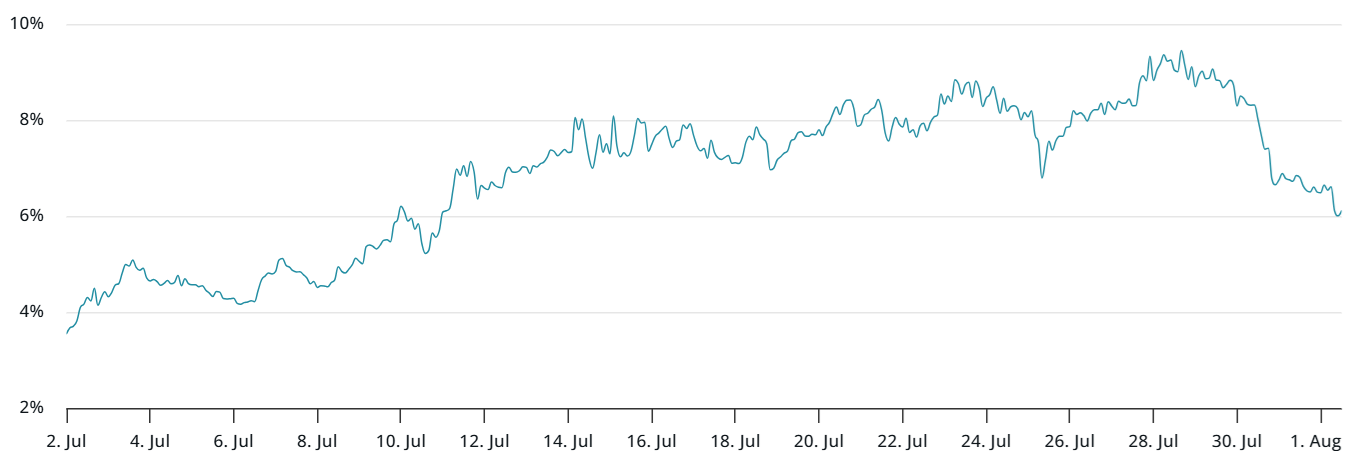

Bitcoin fell on Friday, with increasing geopolitical tensions and cautious investors added pressure on fragile markets already. The cryptocurrency is now traded by only 7 % of its highest level ever at 123,182 dollars in mid -July, although the momentum in the derivative markets show signs of cooling.

It is worth noting that Bitcoin’s monthly futures premium has narrowed to 6 %, a decrease from its highest levels this month. Analysts say that the decrease reflects the decrease in appetite for long situations with benefiting, indicating that traders have become more jet despite the ongoing institutional interests.

The last bitcoin behavior also contributed to the uncertainty. Instead of behaving as a hedge, the original moved in a step with technology shares, exposing it to a wider macro and political shocks. With tensions between the United States and Russia again this week, the appetite appears to be turning.

The political decline added to the market, which is already struggling with commercial friction and weak economic data. Although gold remained stable about 3350 dollars, it has not provided little rest to those who hope that Bitcoin would serve as a safe alternative. Merchants appear to be in short -term government bonds with increased volatility.

Despite the decrease, Bitcoin is still much higher than January levels. However, as global uncertainty, merchants may remain cautious in the short term.

Amid the broader withdrawal, some investors reassess the role of Bitcoin in the long run. Bridgewateer Associats Ray Dalio, who was previously skeptical, updated his outlook. Speaking of a newly podcast, Dalio recommended allocating up to 15 % of the gold or bitcoin portfolio as a hedge against American debt and inflation.

“The United States is entering a debt debt ring,” he said, referring to the treasury expectations of $ 12 trillion of new debts during the next year.

Dalio noted that although Bitcoin is still volatile and facing organizational questions, her role as a value store has become difficult to ignore.

https://cimg.co/wp-content/uploads/2025/08/01232742/1754090861-8dc8b073-e234-40ea-9e85-a6fb12071aa5_optimized.jpg

2025-08-01 23:38:00