Bitcoin qualifiers rise where BTC breaks $ 118,000 star-news.press/wp

Bitcoin derivatives market recorded only new records as BTC continued climbing, exceeding $ 118,000. Bitcoin’s open interest reached the highest level at all times, however more than $ 1.25 billion of liquidation came in one day.

This increase highlights the increasing participation of trading. At the same time, it raises questions about the sustainability of the current trend, especially amid increasing warnings of the possible long qualifiers.

More than $ 1.25 billion has been filtered, 90 % of short centers

According to Coinglass liquidation data, the total market qualifiers have exceeded $ 1.25 billion over the past 24 hours. From that, $ 1.12 billion came from short positions. Bitcoin alone witnessed more than $ 656 million in liquidation.

“During the past 24 hours, 265,106 traders have been filtered. The total liquidation is at $ 1.25 billion,” Coinglass I mentioned.

This indicates that traders were betting heavily to correct the market once Bitcoin crossed $ 112,000. But this correction never happened.

A clear example is James Win, a well -known trading that is used frequently a high lever at the liquid height. according to LookonchainThe short center in Wynn was fully liquidated on BTC in less than 12 hours, lost 27,921.63 dollars.

In addition, BYZANTINE GENERAL, a VELO consultant, reviewed data from many exchanges and concluded that this may be the biggest short pressure on Bitcoin years ago.

“This is the biggest BTC shorts liquidation event for years,” is it He said.

More filters may come when it strikes the open interest ATH

References can grow larger in the coming days. Open benefit (OI), which reflects the total value of futures contracts, has just reached the highest new level in July.

Total Crypto Market OI is now $ 177 billion, the highest level ever. Bitcoin OI alone amounted to $ 78.6 billion, another record. This indicates a great interest from traders in the current market.

These new highlands indicate that the market is in a very sensitive stage. High Oi explains that many merchants use great influence. Even small prices in bitcoin can lead to huge losses.

Trading morale transformations from short to long

Market morale also transforms. With the rise in BTC prices, traders are increasingly moving from short positions to long posts, betting that the gathering will continue.

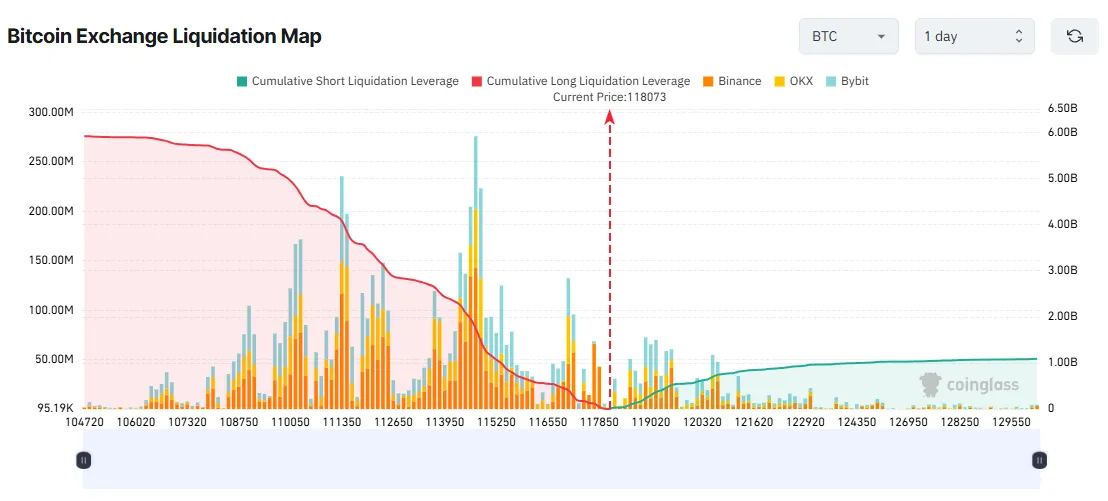

The Coinglass Heat Map shows that the long cumulative qualifiers (as shown in red on the left) on the main exchanges now outperforms the short rank (green on the right). Analyst Joe Konsorti warned of the risks of this preparation.

“Long liquidation raises now outperforms a short 10: 1 crane in this range. Be careful there,” Consurate He said.

This shift indicates that the Bitcoin and the last altcoins gathering persuaded the merchants to change their expectations. However, this optimism comes at a cost. Sudden news or sudden volatility still leads to great losses.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2023/07/bic_rekt_meaning_what.jpg.webp

2025-07-11 07:36:00