Analysts say the liquid height holds 80 % of the Perp DeX market in one year star-news.press/wp

HyperLiIID now controls nearly 80 % of the permanent decentralized futures market, highlighting its rapid hegemony over competitors. However, this focus raises concerns about sustainability and potential risks if trading sizes decrease.

summary

- HyperLeeliquid soon became the pioneering pioneering urgent futures platform, dealing with up to $ 30 billion in daily deals.

- His self -funded lean team built a quick -focused Blockchain focus on implementation with the incentives for sharing fees that attract traders and developers.

- Despite rapid growth, the risks such as the audit focus, transparency gaps, and dependence on high trading sizes leave their future inaccurate.

Within a little more than a year, hyperlieliquid has grown to the dominant player in the permanent, decentralized future contracts, with Redstone Appreciation It controls about 80 % of the market, the trading of sizes on an equal footing with large central stock exchanges, and new concerns about the period in which this concentrated activity can continue.

At its peak, the platform was treated up to $ 30 billion in daily deals. This teacher has only reached a few decentralized stock exchanges, although it is run by the Lean team from only 11 people.

Jeff Yan, a graduate of the former Hudson River and Harvard graduate, chose from the beginning to avoid investment capital, a decision, along with timing, which gave excessive liquid to open it faster than competitors.

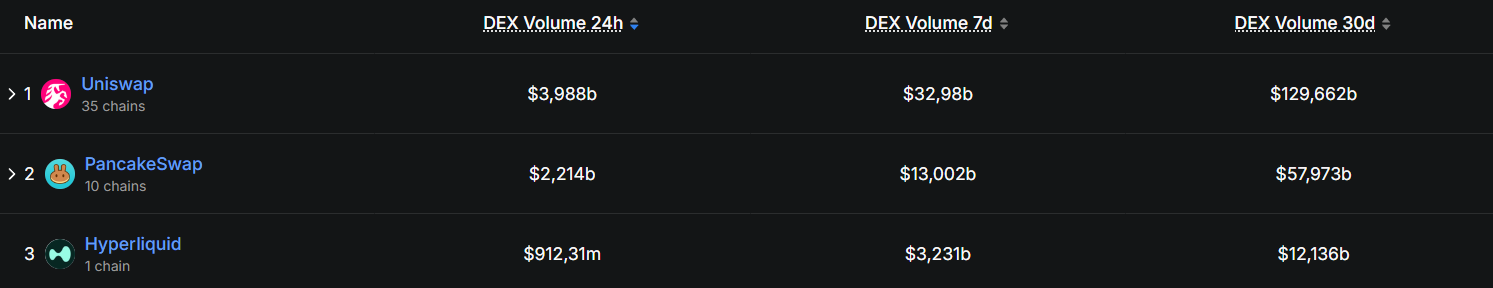

At the beginning of the year 2024, Dydx Excination Dydx had approximately 30 % of the trading volume via decentralized stock exchanges. By the end of that year, its share decreased to about 7 %, while its liquid snowsty stabilizer, exceeding 65 %, settled, for each coinecko’s Data.

It seems that a large portion of hyperlessleber growth is associated with implementation. One click for trade, zero gas fees, and ending sub -requests make it closer to the central stock exchange than most Dexs, which helped attract both traders in the field of retail and professional.

“It was built by a meager team, self -funded that refuses to accept the money of VC investors. They have proven that technical excellence and economics in the first society can outperform the well -funded competitors.”

Redston

The platform works on its Blockchain with Hyperbft, a system of consensus designed to process hundreds of thousands of requests per second with stability as a second end. By focusing first on speed and reliability before the expansion of infrastructure, Hyperliviled has acquired credibility among merchants faster than most of their peers.

Incentives and revenues

The statute is divided into trading fees with its community. People who include new website markets can keep up with up to half of the fees generated by these deals. The developers who build user facades earn a share that can exceed even the protocol. Those who launch permanent markets share their fees with the investors who share them behind them.

This preparation prompted external developers to build on the platform without the need to grant or subsidies. They have already created tools to fill gaps such as allowing traders to use one balance through different positions or borrow for their assets. The result is an increasing ecosystem that is unable to compete with the rival.

Defillalama data He appears Excessive liquid ranks third among decentralized stock exchanges according to the volume of weekly trading, generating more than $ 12 billion, behind pies only and UISWAP. This increase has helped produce annual revenues of more than one billion dollars, translating an estimated 102.4 million dollars per employee.

As mentioned earlier by Crypto.News, this number exceeds $ 93 million, only at $ 37.6 million, NVIDIA at $ 3.6 million, and Cursor at $ 3.3 million.

Next risks

A Common report From Oak Research and GL Capital it is noted that despite the rapid growth of liquid, “it is still necessary to fulfill several major landmarks to check the thesis (evaluation).”

“Centralism is still a concern, as it can deter a lack of transparency at the base of the blade base only from the third party developers. While full control over the infrastructure is a strong model, it also offers the platform to weaknesses, as shown by the HLP incident.”

Oak and capital research

The platform’s dependence on the continuous trading volume increases the inclusion of risk. The prolonged bear market can temporarily weaken the returns and challenge the symbolic purchase system that supports a lot of the ecosystems of noise.

From the evaluation perspective, analysts describe the opportunity as “asymmetric risk/reward”, where the fair value of Hype is estimated at 32 and 49 dollars under conservative assumptions, or about 86 % of the upper part of this range, since the uproar is trading at $ 42.

Excessive liquid has shown quickly, but he still faces multiple structural and market risks. The focus of the auditor, the gaps of transparency, the dependence on high trading volumes, and the implementation -based growth, all means that the results remain sensitive to both internal decisions and the external market conditions.

https://crypto.news/app/uploads/2025/01/crypto-news-Hyperliquid-option04.webp

2025-08-23 16:30:00