Wall Street leaders believe that encryption will get 10 % of the post -trade market within 5 years: CITI scanning star-news.press/wp

The Wall Street executive officials expect that digital assets will get 10 % of the post -trade circulation in the market by 2030, which represents about $ 2 trillion in the daily trading volume as the distinctive securities reach a critical adoption point, according to City. Cereal of Securities Services 2025.

The prediction depends on 537 industry leaders over five years of data, as the respondents in North America were the most optimistic, and they expect a 14 % digital rotation rate driven by the last organizational clarity.

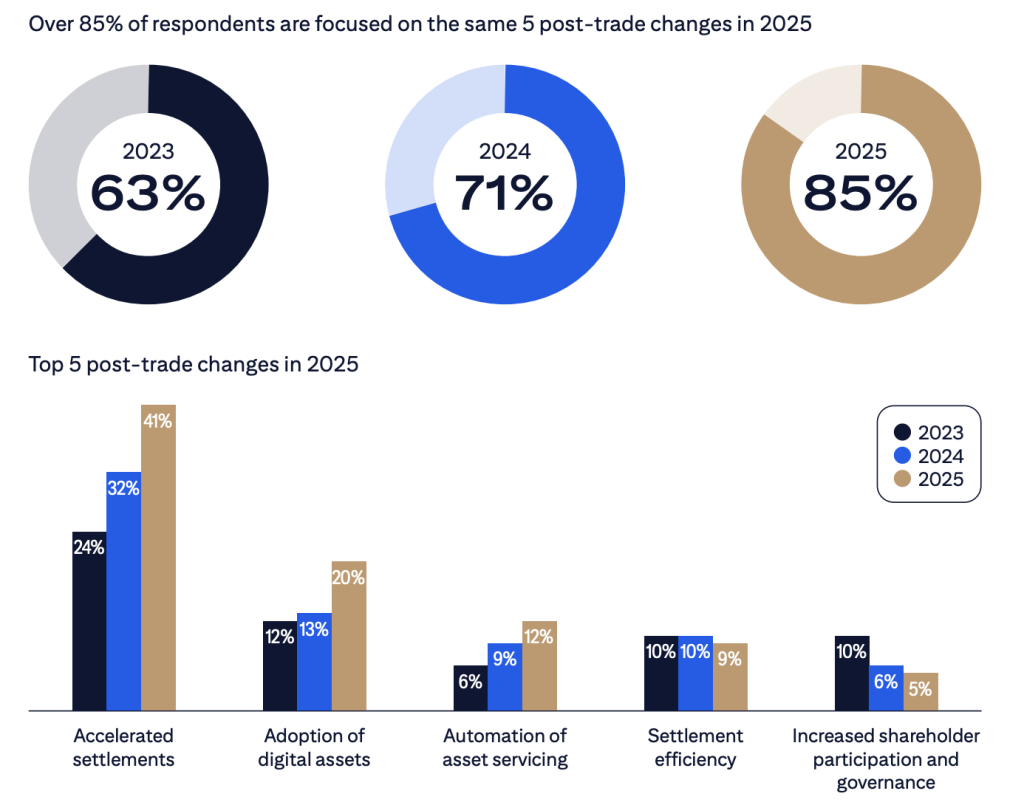

The poll reveals the great hope of the rapid settlement infrastructure, as 85 % of the respondents gave priority to the accelerated settlements, the adoption of digital assets, and automation.

Traditional infrastructure in the financial market, which supports 40 % of the global market value, passes huge transformation programs while facing competition from the zero “Neobrokes” that require access to cryptocurrencies around the clock throughout the week.

Stablecoins has emerged as a critical infrastructure for digital transmission, with the codes of the bank’s export for great growth as the perfect bridge between traditional and traditional financing.

The rapprochement maintains traditional institutions as reliable gates while taking advantage of Defi engines to improve speed and efficiency.

The settlement revolution pays the convergence of Defi-Tradfi

More than 52 % of the respondents expect that the current infrastructure of the financial market will become basic empowerment factors for the digital markets of shares and fixed income.

The wills, as basic network service providers connected to several blockchain tools instead of disrupting them through the technician’s distributed book technology.

The industry has turned the focus from the extensive Blockchain development into specific commercial use with the benefits of clear cost.

Distinctive funds and money are the fastest growing regions, which allows automatic financing operations during the day that replaces manual procedures overnight.

This improvement in speed enhances the efficiency of the public budget, reduces financing costs, and improves liquidity rates.

The adoption of digital funds supports the new ecosystem through various forms, as Stablecoins from the bank provides an ideal balance for automation, organization and benefits through commercial life courses.

The infrastructure provides atomic payment transactions for payment that eliminates the risk of perception, while combining the correspondence and the settlement in one -layer that is programmed.

Stablecoin stability can process transactions 3-5 times faster and 10 times cheaper than fast-based systems.

The Brazilian companies that settle in the euro achieve more than 500 times settlement times, while the costs of transfers decrease from 4 to 13 times through the treatment near the eight.

Traditional settlement systems depend on correspondence banks, the separation of fast messages, and pre -delivery requirements that make $ 27 trillion worldwide in inactivity accounts.

The old structures that were created during the pre -digital ages accumulate from incompetence through many brokers and the processing courses that remove DLT through the unified and settlement correspondence.

Stablecoin growth forecasts industry discussion

Earlier in August, Goldman Sachs expected that USDC would grow from Surk 77 billion dollars between 2024 and 2027, which represents an annual compound annual growth by 40 % as “Stablecoin Gold Rush” is accelerating.

The Investment Bank expects organizational clarity and the integration of the broader digital assets to expand fuel to the current market evaluation of $ 271 billion.

Treasury Secretary Scott Besent Wall Street in particular that Stablecoins is supported by US dollar and treasury could become a major source of demand for government bonds.

The Genius Act framework requires individual reserves in liquid assets, which may create billions of dollars for US debt markets.

However, industry expectations vary greatly. JPMorgan expects conservative growth to $ 500 billion by 2028, citing the prevailing adoption behind the encryption trade.

The bank estimates that only 6 % of the Stablecoin request comes from the actual payment activity, which questions the expansion scenarios.

Before this poll, CITI previously highlighted the institutional contradiction as the bank explores Stablecoin with a warning of risks similar to those in the 1980s, including the deposit trip.

CEO Jane Fraser confirmed her plans to issue Citi Stablecoin, while analyst Ronit Ghose compared the potential disturbance of the money market makers draining $ 32 billion from banks between 1981 and 1982.

Recently, Nobel Prize -winning economist Jin Terrol has warned that the weak supervision of Stablecoins may lead to government rescue operations during financial crises.

He warned that the reserve wallet losses could provoke the distinctive code, forcing the intervention to protect retail investors who look at Stablecoins as “completely safe deposits.”

Former China Governor Chu Xiaoshuan has also identified the risks of regular amplification, exceeding the specified reserves by lending to deposit and fimented financing.

Support, recent investment analysis Suggest Annual risk estimates of 3.3-3.9 % for the main stablecoins, which are almost one in three of the crisis over a decade of time.

Look forward, the current Stablecoin market grows, with a $ 284 billion capital with 22 consecutive months of growth, while weekly expansion rates are moderate from 4 to 8 billion dollars to current levels of $ 1.1 billion.

https://cimg.co/wp-content/uploads/2025/09/03092624/1756891583-image-1756891524542_optimized.jpg

2025-09-03 10:41:00