SEC Greenlights Spot XRP and Altcoin Etf – then freezes it star-news.press/wp

On July 22, the US Securities and Stock Exchange Committee (SEC) granted accelerating approval of NYSE Arca to insert the Crypto InDENT 10 BitWise 10, a multi -asset product that includes its XRP, Solana, Cardano and seven other digital assets alongside Bitcoin and Eter. The matter, which was published as version No. 34-103531, concluded that the proposal “is in line with Article 6 (B) (5) of the exchange law” because it was designed “to prevent acts, fraudulent practices and manipulation, to enhance the principles of fair and equitable trade, (and) to protect interest and public attention.

Another spot xrp etf hanging

BitWise’s confidence is already trading on the BitW tablet, but the conversion to a trading box for exchange would have moved the car to a national exchange for the first time. SEC order the latest mix of assets in the box: 78.72 percent of Bitcoin, 11.10 percent of the ether and 4.97 percent of XRP, with the spread of the remaining customization via Solana, Cardano, SUI, ChainLink, Avalanche, Litecoin and Polkadot. Although the weights are subject to the monthly balance, the committee asked that at least 85 percent of the portfolio in assets already supports other products accredited from the SEC exchange, which effectively determines the compact share of Altcoins with a 15 percent smaller.

Immediately after the division of trading and markets, he issued his authorized approval, the secretary of the secretary of the committee intervened. In a brief message indicating 431 of the rules of practice in the Securities and Stock Exchange, the most dangerous assistant secretary Sherry R. Haywood New York Arca that “the committee will review the delegated procedure” and that “according to Article 431 (A), the July 22 order remains until the committee’s orders otherwise. The survival of the transfer process and leave the current bit.

Drawing procedural injury is immediate reactions from ETF specialists to Bloomberg James Sivart analyst books“We have the approval of the BitWise 10 – BITW – but exactly like GDLC from Grayscale earlier this month, BitWise has either by commissioners or multiple people. This means that it cannot actually convert it to ETF … until now.” Analyst Nate Girassy’s colleague described the episode as a “strange situation”, on the pretext that both BitWise and Grayscale should be allowed to convert/UPLIST as soon as possible.

The residence mechanism reflects the committee’s treatment for Grayscale Digital Cap ETF earlier in July, confirming the internal divisions of the speedy expansion of US Crypto-EETF offers that exceed one asset products. Since the rule of Al -Qaeda is 431 appreciation and open, there is no legal deadline for the committee to raise the temporary suspension or issue a final ruling. Historically, reviews can take anywhere from a few weeks to several months; During that window, the approval order does not carry any legal effect.

Related reading: Investor analyst XRP warns around banks, which is the reason

Participants in the market are installed on two questions. First, whether the XRP insert – a long point in the SEC Employment Employment Employment Table – has affected one or more of the commissioners to request an additional audit. Second, whether the committee will use the review to impose new conditions on the investment funds circulating in multiple assets, such as custody standards, prices or more strict monitoring.

Although the residence has no immediate impact on BitW shareholders, BitWise has argued that ETF included on the New York Stock Exchange will tighten labor differences, removing distinct preferences and expanding distribution through brokerage platforms that refuse to deal with OTC products. In its introduction, the company also claimed that trading in the organization “will enhance transparency and protect investors” by subjecting shares to the unified strip and the framework of reporting the stock exchange law.

Currently, the fate of the fund stabilizes with a commission that clearly struggles with the speed at which the American market opens for a varied exposure to encryption. Until the review emerges, investors who are eager for a bitcoin, ether, XRP, and other large universities will have to continue to rely on OTC boxes that lack the structural guarantees of ETF.

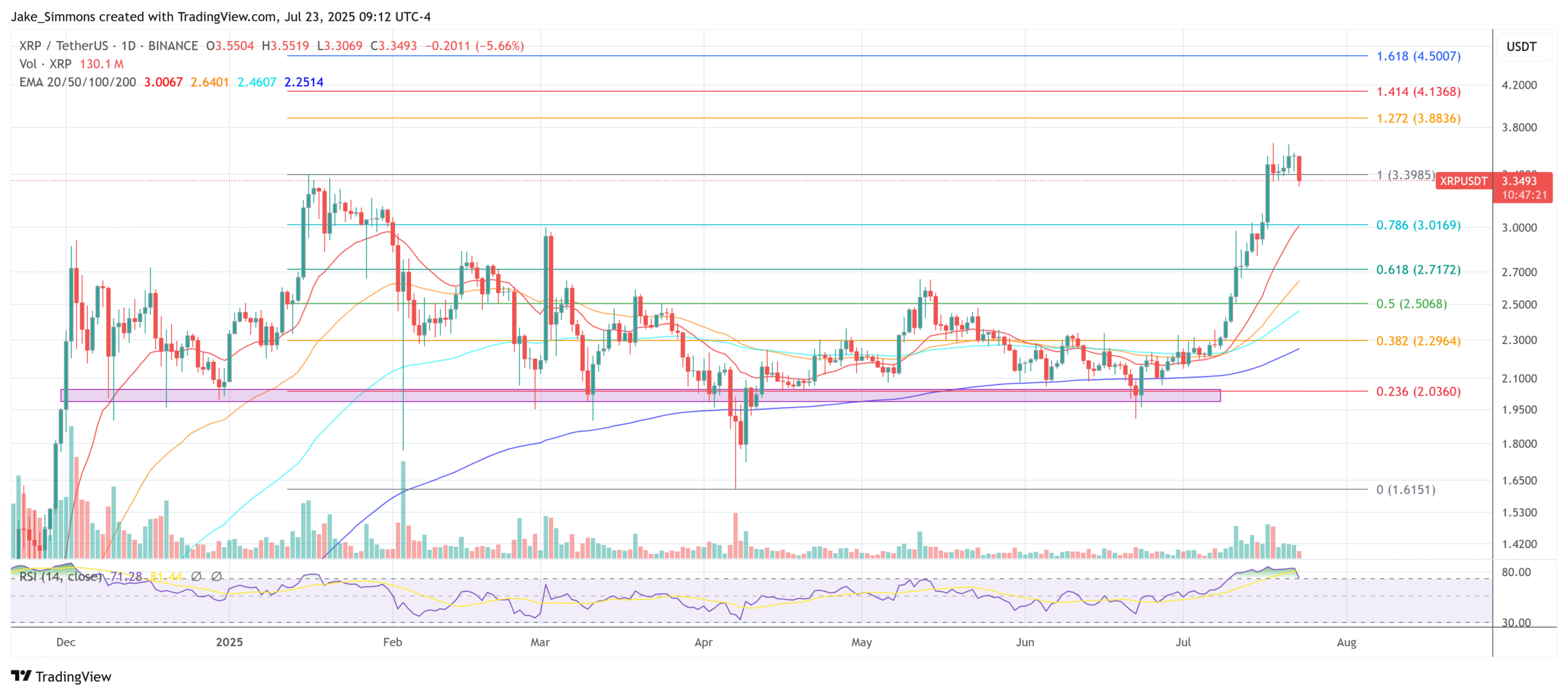

At the time of the press, XRP was traded at $ 3.349.

Distinctive image created with Dall.e, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/07/XRPUSDT_2025-07-23_15-12-41.png

2025-07-24 04:00:00