The analyst warns against the short pressure on the huge bitcoin, here is the reason star-news.press/wp

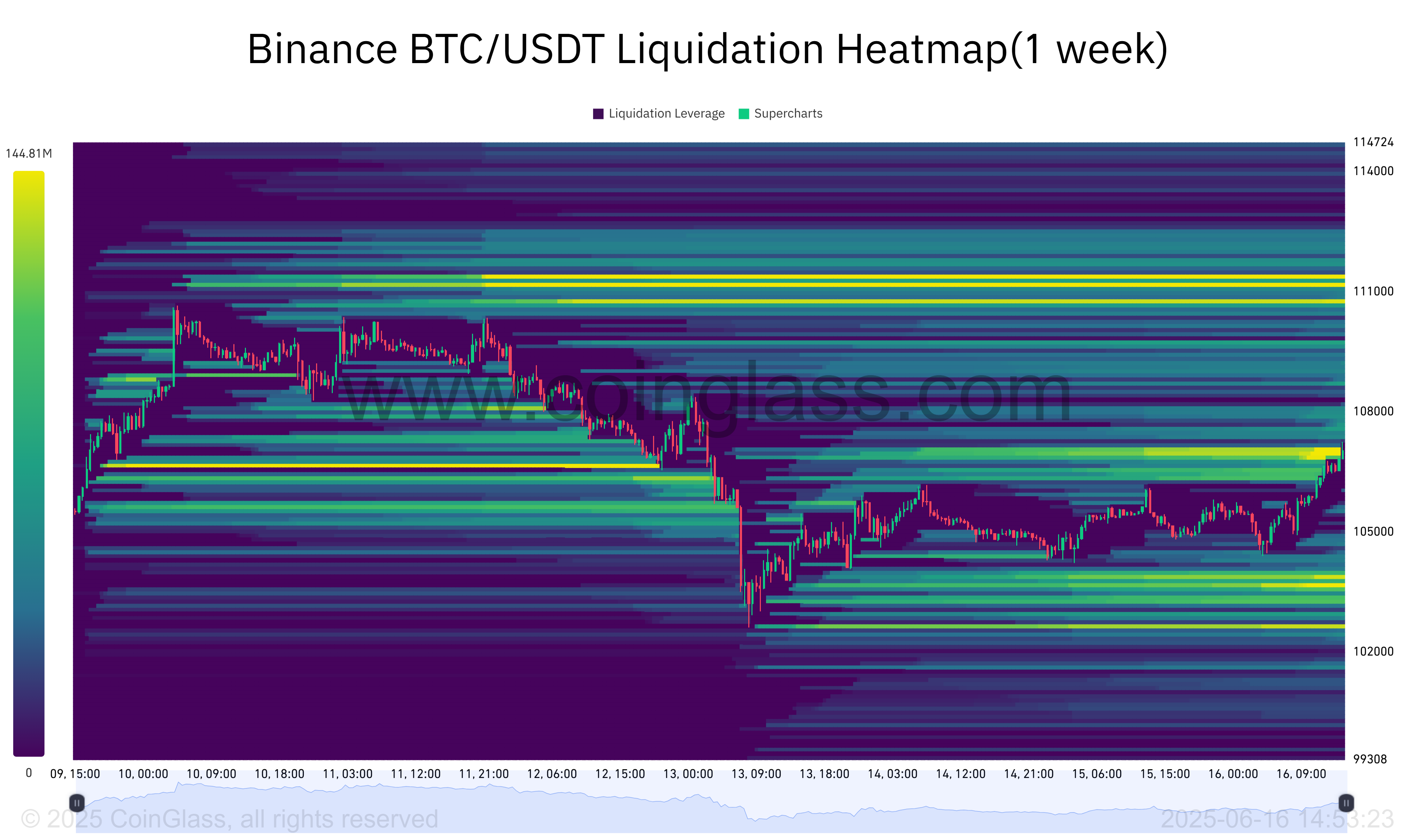

Bitcoin prices in the derivative contracts on Binance are currently about $ 40 to $ 50 of instant prices. This proliferation is much wider than it was in previous market courses, even with bitcoin trading near its highest levels (ATH).

This represents a remarkable deviation from the previous trends and raises questions among investors about what it means in the market environment today.

Why are bitcoin derivatives less than the stain?

During 2021-2022, when derivative prices decreased to less instant prices, they often indicate the bear market. At that time, this type of spread usually comes with declines in sharp prices, which reflects the downward morale and the pressure pressure from merchants.

On the other hand, when derivatives are traded higher than the stain, they usually indicate an upward market. Bitcoin will then continue reaching new levels.

However, the current situation is completely different. Although bitcoin has reached high levels at all, the prices of derivatives drop below the point. This indicates that the new market forces may be playing now.

One of the possible reasons behind this phenomenon is the pressure from the institutional players.

“This institutional hedge, arbitration, or ETF Dynamics,” alphractal, “may reflect I mentioned.

Joao Weeson, founder of Alphractor, added that this position could lead to short pressure. Short pressure occurs when the Bitcoin price suddenly extends, forcing the exposed sellers to buy BTC again to cover their sites. Their urgent purchase increases the demand for the market.

“If the permanent difference in the price in Binance becomes positive again, this is a sign that the price is about to explode. Until this happens, we can say that many institutions are actually putting pressure through short pants, which may be good for possible short pressure because they contradict Make up.

Crypto Rover predicts the presence of short -pressure bitcoin

In his last video analysis, Crypto Rover also Assure The biggest pressure on the bitcoin is about to reveal.

According to his Bitcoin sensitive area lies about 110,000 dollars – $ 111,000. This is where a large amount of liquidity is concentrated. If the price of bitcoin crosses this area, many short centers will be filtered. This can lead to a new wave of explosive bullish momentum.

“So it is very important to separate above this high here. Whenever we do it, we will probably move quickly … I see large sums of liquidity that now accumulates about $ 110,000 – $ 111,000. Propagate.

The clarification of Joao Wesons and Crypto Rover’s predictions indicates that the spread of the current price can be a bullish sign for Bitcoin. However, this view differs from historical patterns.

It indicates that the market is entering a new unprecedented stage. This shift holds short and long -term expectations, making price movements more difficult to predict than ever.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/05/crypto-whale-short.png

2025-06-16 10:30:00