Analysts say that infiltrators get rid of mixers for bridges in the play washing rapidly star-news.press/wp

The bridges through the series exceeded traditional mixers as a basic tool for laundering stolen encryption in early 2025, with more than $ 1.5 billion of penetrated funds. It made it its speed, liquidity and its lighter organizational scrutiny more attractive than mixers such as Tornado Cash to thwart the assets of assets.

summary

- The encoding penetration in the first half of 2025 achieved unprecedented levels, stolen more than $ 3 billion in 119 accidents, already 50 % higher than 2024.

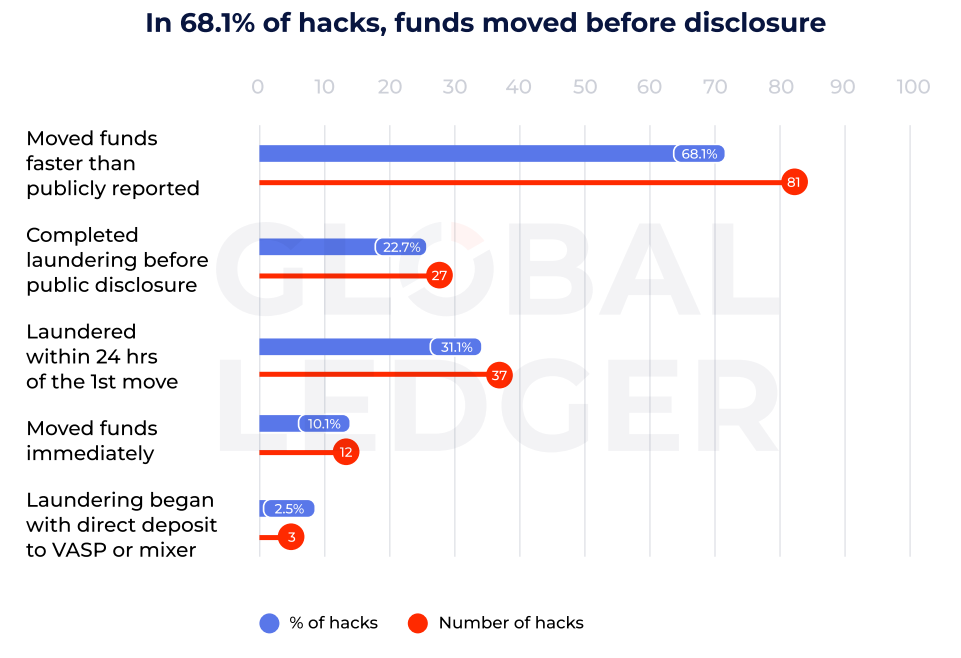

- The infiltrators move the money faster than ever, and often wash the assets through the bridges across the chain instead of mixers, with some thefts that completely block them in minutes before any general disclosure.

- Central stock exchanges remain the basic cash points, while recovery efforts are limited, leaving most stolen money either washing them quickly or lying down waiting for future movement.

The first half of 2025 is one of the most destructive periods in the history of cryptocurrencies. According to a recent report issued by Global Ledger Shared with Crypto.News, more than $ 3 billion has been stolen in 119 separate accidents, a number that already exceeds total losses for all 2024 by more than 50 %.

However, the huge size of the attacks is not the only alarm bell. Analysts say that the speed with which infiltrators move moved stolen money – often before the theft is publicly known – has mainly changed the scene of encryption crimes.

“The attackers move faster, and they are often laundering before the accident publicly,” the report says. In one cases, it took the fastest movement of the money that was penetrated only four seconds, which effectively gave the attackers the beginning of the measured head in the flash of the eye. This speed is severely limited to the ability of current alert systems and organizers to intervene before money disappears.

By destroying time tables, analysts have set main patterns in how to process stolen assets: how quickly they move, the duration of their survival in inactivity, and any parts of the most exploitable ecosystems system.

“Knowing these timing patterns can help discover the suspicious activity urgently and reduce the window of the attackers who have money laundering. It is not only related to the response, but rather to expect the next step.”

Ledger Global

Outpace bridges as washing tools

Perhaps the most important result is the methods used by infiltrators to hide the origin of stolen encryption. It seems that the crosses of the crossed chain-also known as cross bridges-have become the preferred way to wash stolen encryption.

In the first half of 2025, more than $ 1.5 billion was directed, or 50.1 % of all penetrated assets, through bridges. This dwarves are $ 339 million – about 11 % – sent to encryption mixers, which are still being used in about half of the hacking.

As Global Ledger is noted, the functions of crossed chain protocols “are highly used by illegal actors, making it an essential tool for receiving stolen money.” The report indicates that bridges go beyond mixers as a favorite washing tool “that is likely to be due to their speed, liquidity and less organizational audit.”

Mixers like Tornado Cash, who defended money by mixing them with others to break the tracking, was once the standard for washing stolen sheets in the breaches. It seems that bridges, which allow rapid transfer of assets between different Blockchain networks, now provide a faster movement and access to multiple liquidity pools, making it easier for infiltrators to transfer large sums quickly and complicate tracking efforts by applying the law.

The exchange of encryption remains the main cash points

Another field of insight is related to the ultimately stolen money. Analysts say nearly 15 % of the assets that have been hacked-453 million dollars-flowed into central stock exchanges, which “is very likely to be used for more money.” On the other hand, decentralized financing platforms received about a third of this amount, about $ 170 million or 5.6 %.

Despite the rapid growth of the use of Defi and the closed total value, the report confirms that the central platforms remain the primary slope of laundering stolen money, which indicates that, despite all their promise, Defi protocols did not replace traditional stock exchanges after destinations are directed to infiltrators who seek to convert encouragement to two or less assets.

The report also draws a realistic picture of recovery efforts. Of the total stolen amount, approximately 13 % – 379 million dollars – most likely due to coordinated implementation procedures or security measures. Meanwhile, only a small part, 4.6 % – about $ 140 million – voluntarily.

As Global Ledger says, enforcement efforts have some effect, “But voluntary returns are still rare,” with a focus that “most recovery still depends on rapid intervention, not good intentions.”

Only a matter of time

Fast food is the disturbing speed that attackers work. The money was washed from approximately one out of every four penetrations before any general disclosure, with the window closed to apply the law to track or freeze assets. It was the fastest full washing process – from theft to the last deposit – just two minutes and 57 seconds, barely enough time.

“The speed has become a new dangerous weapon,” the report warns, noting that the fastest stolen money movement was “more than 75 times faster than the alert system.” Once the money begins to move, the corridor can cool in hours or even minutes. The attackers clearly take advantage of the narrow response window: in more than 30 % of cases, unlawful actors have completed washing within a day of the first wallet movement.

At the time of the report research, it remained $ 1.6 billion – or 53.6 % of the total losses – unproductive, which means that these money either did not move or stop its movement. The report indicates that some of this amount “is still likely to be washed, as attackers may wait for the heat to die.”

https://crypto.news/app/uploads/2025/01/crypto-news-hack-scam-option04.webp

2025-08-01 11:55:00