Power Crypto Etf Entflows Investors as ETH takes the spotlight star-news.press/wp

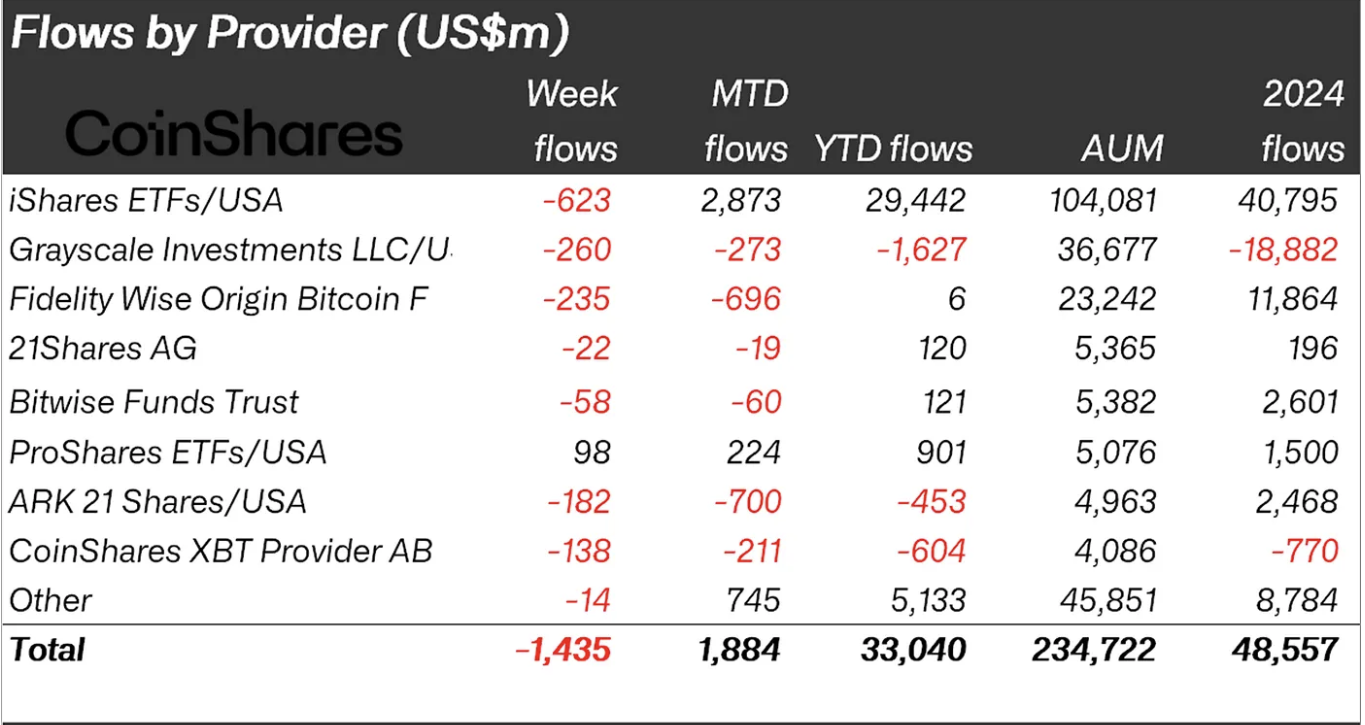

Coinshares has released a report on weekly digital asset investments and analyzing extensive output in the ETF encryption market. In total, Crypto Investment Products witnessed $ 1.43 billion in external flows last week.

Decreased hopes for low interest rates were working with a lot of pessimism, but there was something of return. However, the situation is volatile, and it is not clear what will happen after that.

Crypto ETF flows last week

Crypto ETF has invested the world’s investment since early 2024, but a modern style of external flows makes investors tense. Shortly after exceeding ETH ETF Bitcoin’s flows, the entire class began to spread heavy losses.

Coinshares issued a report In this direction for better analysis:

Basically, the report assumes that Haboodi hopes to reduce the interest rate in the United States stimulated these external flows ETF, and the unexpected reconciliation efforts of Jerome Powell were created during his speech in Jackson, the hole of some hostile momentum. A closer analysis provides both funds and symbols.

The importance of institutional investors

For example, Ethereum was more sensitive than Bitcoin for these fluctuations, which reflects its position as a hot commodity among institutional investors.

During August 2025, ETH BTC flows exceeded $ 1.5 billion, which is a truly unexpected transformation. In other words, ETHEREUM’s new investment novels have a real impact.

Nowadays, institutional investors appear to be the main driver on the market here. Independent data from other ETF analysts supports this hypothesis:

Coinshares looked at all the investment of digital asset funds, not only the traded investment funds, so the external flow data has a few interesting tales.

For example, the performance of XRP and Solana was better than Bitcoin and Ethereum in this sector, but the investment funds circulated in the investment funds circulated for them did not win approval.

In other words, investment in the DAAD (DAT) cabinet (DAT) may constitute some of this group.

To be clear, though, this sector is particularly vulnerable to macroeconomic factors.

Despite the huge DAT flows this month, investor fears and shares reliefs caused major problems for many major companies. Even the strategy, a pioneer in the clear market, faced some major warning signals.

All this means that the current situation is somewhat fluctuating.

It is difficult to extrapolate this data for a prediction procedure in the future, but it seems that one thing is clear. The new ethereum prominence is very clear, and it may have significant effects on Altcoins.

Post -institutional investors, as ETH takes the lights first appeared on Beincrypto.

[og_img]

2025-08-25 23:25:00