When people learn that I help expand European scaleups to African markets, the response is often a mixture of curiosity and skepticism. One of the first questions is whether this type of expansion is at risk of recurring colon ponytime. It is a fair concern and a one that claims to be thoughtful reflection. However, the reality on the ground is more complicated. European startups are already creating meaningful activities across the continent, solving real problems and having a true impact.

When European founders think about international expansion, they usually follow good Trodden paths. Spanish Startups look at Latin America, UK companies cross the Atlantic, and the Germans aim to capture the “Dutch”. Italian founders are mostly missing abroad – really, why leave Dolls? (Being Belgium-Italian I have been allowed to joke!)

But what will happen to Africa? Although the German VC and Startup scene have been silently winter in Johannesburg for years, most European startups have not considered the continent as seriously for strategic expansion. It represents a missed opportunity.

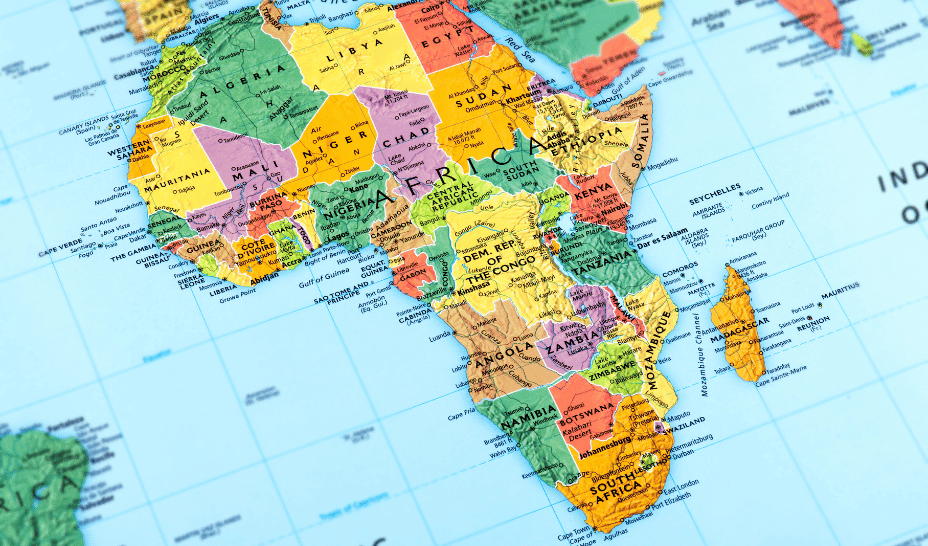

Opportunity to a $ 2.8 trillion lipping

The combined GDP of Africa stands at $ 2.5 trillion in 2021, which presents the economic output of 1.5 billion people. “Big Five” – South Africa, Egypt, Algeria, Nigeria and Ethiopia – Half of the entire GDP of Africa provides European startups enough strategic entrance points.

It is the possibility of technical lipphroogging that makes Africa especially mandatory. As part of the management team behind the shame of Southeast Asia in the 21st, I have directly witnessed how the trade jumped directly from offline to mobile-farthest, the desktop episode was completely avoided. Africa is feeling the same transformation across multiple sectors.

If you want to understand Africa’s digital lipphorging, just look at mobile meaning. M-Pesa, which was launched in Kenya in 2007, has now removed more than half of the country’s GDP in Africa, your phone is really your wallet. By 2021, Sub-Saharan Africa operates 64% of mobile money transactions worldwide, $ 490 billion in total. For any fintech – think Revlut, now looking at South Africa – a partnership with mobile operators such as Airtel, Kamala Money and MTN is necessary to plug the financial ecosystem of the continent.

The renewable energy sector offers another lipphroogging opportunity. Africa has the richest solar resources in the world, but it has only installed 19 GHz solar power, or less than 1% of the world. International Energy Agency Projects can become the largest power source of Africa by 2040 by 2040. And Spain still investigates the cause of its recent blackout, the decentralized, off-or mini-grid solar change has begun to look especially attractive.

Lesson

Better to understand how European companies are successful in Africa, I have talked to all three Scale-up That has already taken steps. Shows what their experiences work and what they don’t do.

Local market burden: Spotify

In 2021, Spotify became the first technology company in Europe by exceeding $ 1 billion in SAP, proves that European innovation could make the global scale during the locality. Before joining the Elite Club of Tech Giants, it was necessary to prove that it could capture the global finance department with emerging markets. For the customer business directly with the freemium model, I think this is a more important data point in the company’s equity story.

In a conversation, Claudius bowlerSpotify Mena and SSA Managing Director (Sub-Saharan Africa), explaining how the Spotifi strategy of Africa was defined by deep localization instead of rapid expansion. Instead of applying one-size-fit-up techniques, the company studies the reality of different markets from the payment system to the limit of the device before deciding where and how to manage. For example, Spotify has launched a lightweight app created for slow network and entry-level smartphones. The price was determined by providing a monthly subscription below $ 2.50 with alternatives to payment such as M-Pesa Integrated Kenya.

Claudius emphasized that Africa’s mobile-first and rapid digital adoption environment creates fertile fields for hyper-growth, but only companies invest in authentic localization. Success is not just about product features; It demands cultural relevance and adaptation of infrastructure.

Success through partnership: Iburi

Are strong by the same lesson Easter Elana, the chief strategy officer In eburi, an B2B fintech in inter -bound payment and coin management. He emphasized as the root of strategic partnerships and on-ground cooperation and enhancing faith.

Aburi adopted a partnership for entry into Africa, with experts in the continent’s complex controller and local payment experts like Delocal to navigate banking landscapes. This strategy has enabled the solutions to the appropriate inter -border payments for African businesses and SMEs while building relationships with local commercial teams, clients and partners.

Investing for long -term: Gloveo

Early this year, I restored a panel with Tech Africa William BenthalThe Of the gloveo Population directorAnd I knew I would tap him for more insight. William shared how the Spain-born Gloveo made Africa a strategic pillar of its growth. The company is now working in six countries after leaving Ghana in 2021 due to local challenges, Nigeria has emerged as its most committed market.

Glovor B2C platform users enables grocery, retail, electronics and more to order African businesses to produce more than $ 1 billion today. Among these sales, 90% went to SME, showing the impact of the platform on local entrepreneurs and economic growth.

William highlights that Gloveo’s success in Africa is constantly investing, accelerating digitalization from local recruitment and leadership development and reaching the new market across the continent. To support this growth, Glovo recently launched the Africa Graduate Program, providing a one-year, professional development journey to future leaders.

Instead of copying what the three companies have done in Europe, they succeeded in adjusting the local needs. They have created partnerships, adapted their value and developed solutions for African markets.

Technology as a force for the best

When we talk about European expansion in Africa, geographical considerations have become more urgent as the world power is more publicly competed for influence across the continent. The Democratic Republic of Congo (DRC) gives this energy dynamic example. Chinese state -owned companies control 5 percent of the DRC Cobalt output, with new billion dollars from China to the new infrastructure loans in 2021. As a response, DRC is looking for “Better and more diverse investors,” Recently signed a security deal for US minerals. The agreement, such as US-Ukraine One, remains unclear and raises doubts as to whether the Trump administration may be committed to a more complex conflict.

In contrast to inactive relationships, a sustainable method of Africa depends on long-term partnerships, investing in local talent, empowering regional leaders and coherent in African markets adapted business models. With the emphasis on the transfer and authentic cooperation of knowledge, European startups can unlock the potential of the continent and share, create permanent values. If the talent is evenly distributed, startups can provide the knot needed for everyone to reach their full potential.

Africa’s young, digital-first population and jumpphorogging potential proposal opportunities that do not match growing saturated Western markets. The geopolitical tension will increase the importance of the future of both the continents, with the re-shape of global trade relations. There is no question whether this busyness will happen. It’s already underway. The real question is whether it will be communicated in thoughtly and durable.

[publish_date