A 50 % decrease in risk, despite the purchase of whales star-news.press/wp

After a monthly increase of 300 %, the vine price is now facing the harshest check yet. The distinctive symbol has decreased by more than 24 % in the past 24 hours, as it has decreased to $ 0.117, although whales continued to collect coins while decline.

The difference between the confidence of the whales and the behavior of retail, which is associated with the weak flow of money and the preparation of a fragile technician, indicates that this gathering may not have enough fuel to push up to any time soon.

Whales accumulate as retailers to go out

The data on the series from Nansen shows that the 100 best addresses are added by 3.27 % more than vine in the last day, with whale wallets increasing by 2.22 %. This type of purchase usually hints to the increasing condemnation of the big players. But the image is not completely optimistic.

The exchange balances jumped by 3.03 % in the same period, which means that retail holders send symbols to the central stock exchanges, they are likely to prepare for sale to strength.

This division in behavior has left the deviant Vine’s arrangement. Whales provide some support from the purchase side, but the lack of the broader participation has already started eating in momentum. When the retail sale flows while the large portfolios try to decrease, the market lock can become unstable.

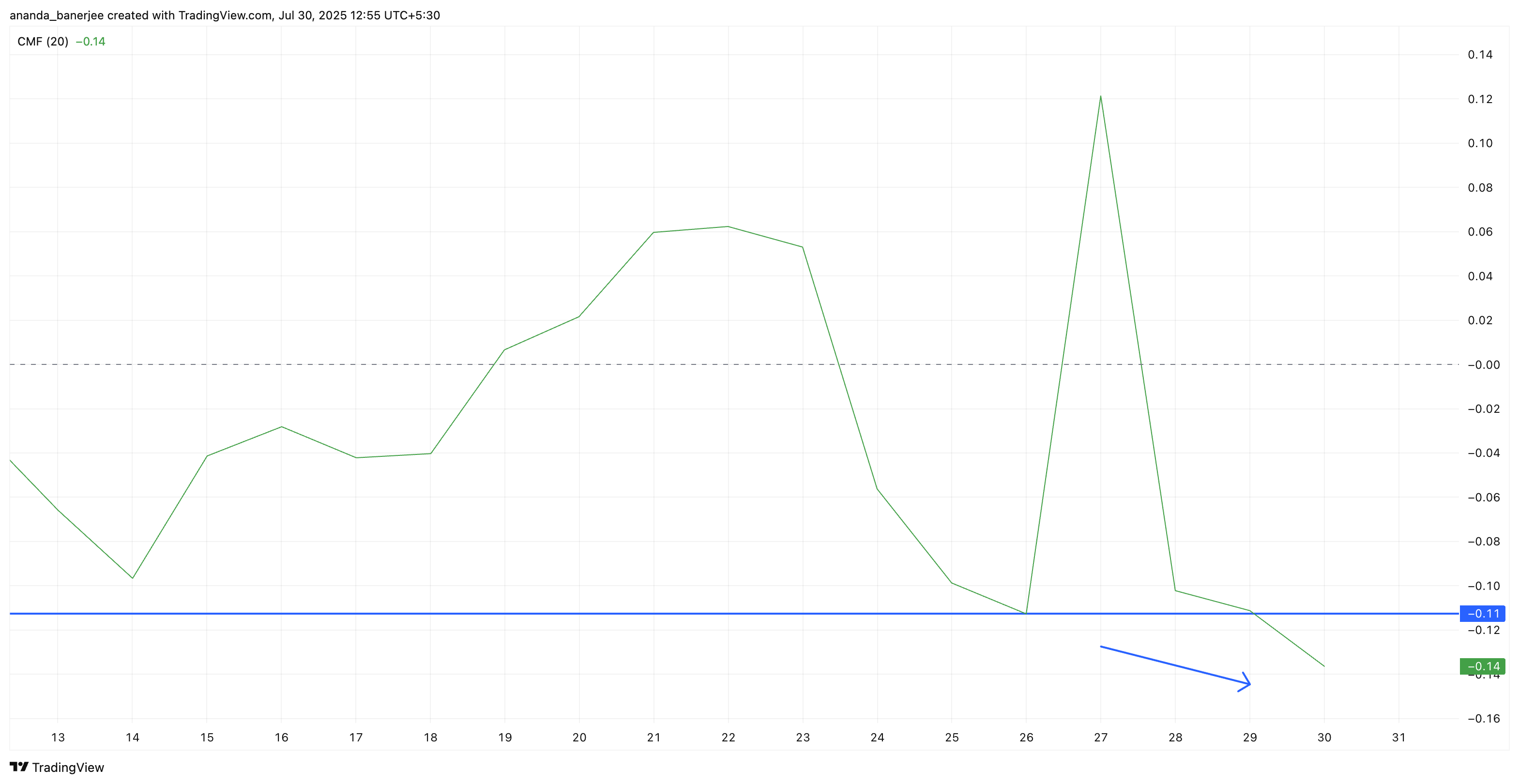

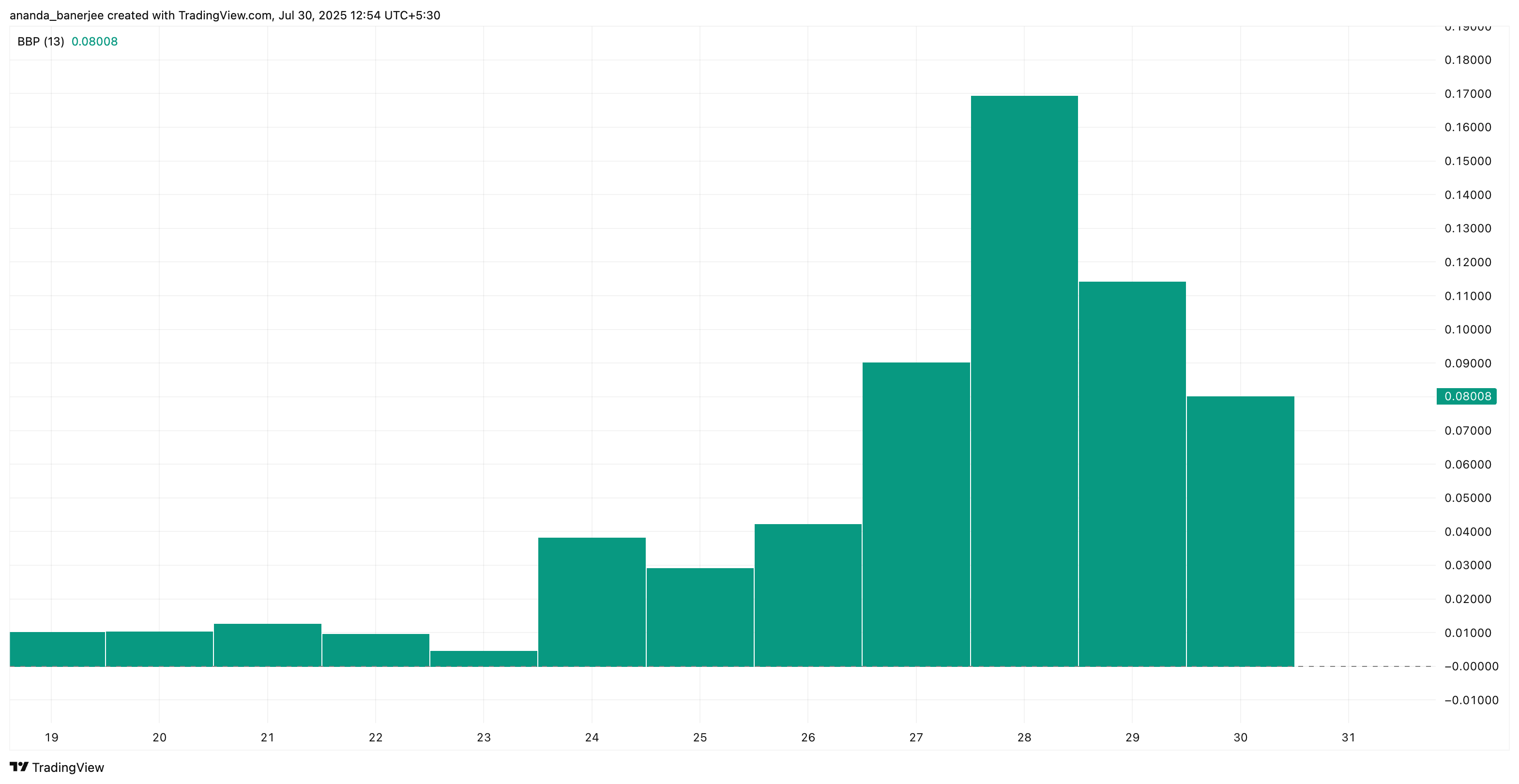

Draining the flow of money with the fading momentum fading

The flow of Chaikin (CMF), which tracks whether the capital enters or leaves the market, has decreased sharply to -0.14, even less than levels before the high price of this month begins. This indicates the tidal in the sale of the superiority of the pockets of the accumulation of the whale.

Besides, the PULL Bear Power (BBP), which is a measure of purchase against the power of sale, has significantly cools since July 28, indicating that the upscale momentum no longer builds as before.

These readings indicate that the explosive range of Fine may be more move than the noise than sustainable support. With the failure of fresh money to enter the market and sellers control, the distinctive symbol shows signs of fatigue, leaving the virgin price movement vulnerable to the most obvious movements.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

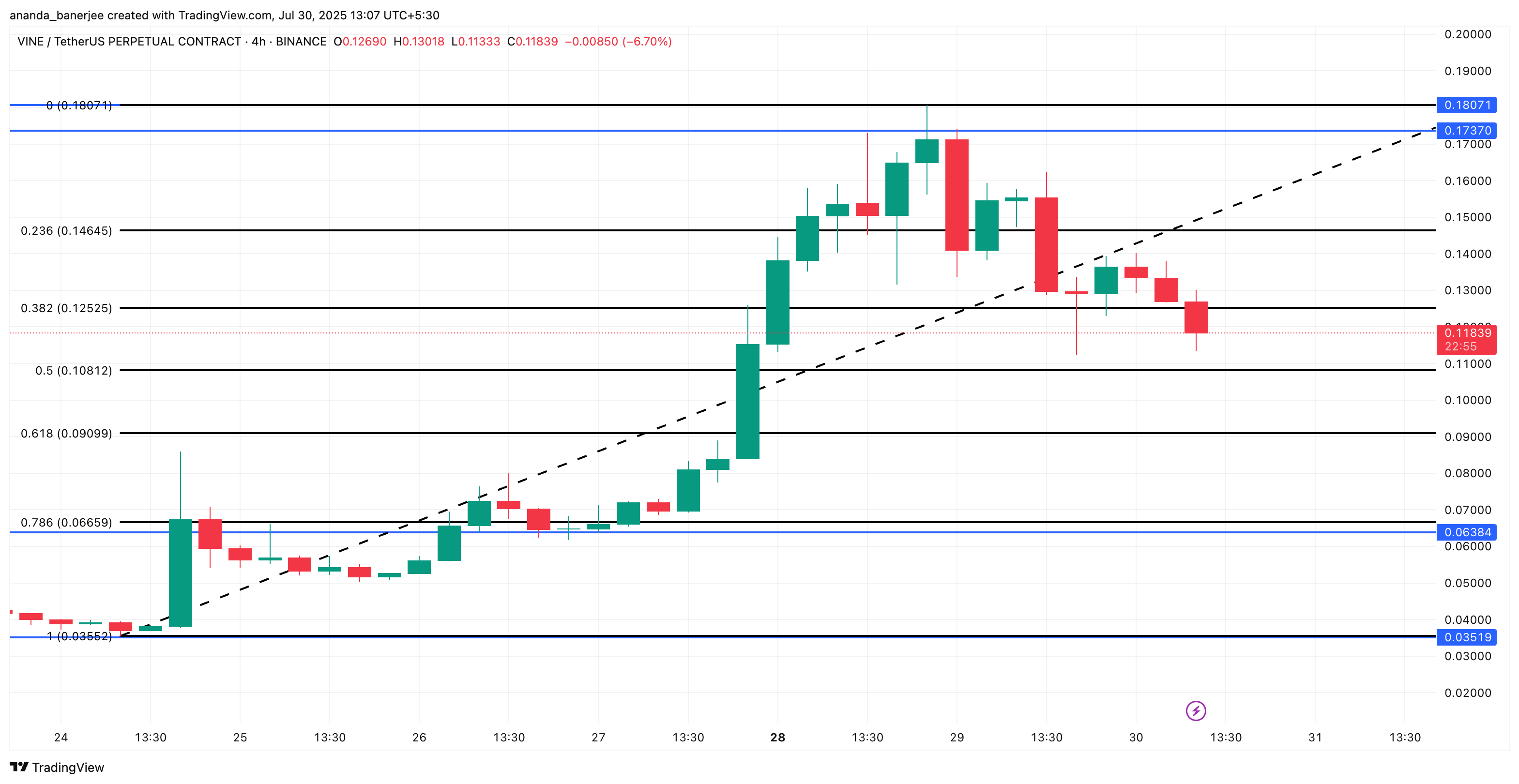

Flags preparing the price of vine support and the risks of the severe passive side

The VINE diagram gives 4 hours a clearer view of short -term fluctuations, and the image is not encouraging. The price of the distinctive symbol constitutes an ascending wedge, a pattern that often indicates a declining reflection.

The price of the vine is now clinging to its support at $ 0.1129. The collapse here opens the path towards the following main support is about $ 0.063, or approximately 50 % of the current levels.

Highlighting Fibonacci levels in the same time frame where bulls need to intervene to change the story. The move back above $ 0.1465 can nullify this landfill and revive upward momentum.

Until then, the lower resistance path looks less, with the whale purchased alone unlikely to stop more corrections.

Post -vine risk a 50 % decrease, although whales that buy decline first appeared on Beincrypto.

[og_img]

2025-07-30 17:30:00