NASDAQ is listed in the ethzilla menu buying more ETHEREUM, despite the collapse of the stock price star-news.press/wp

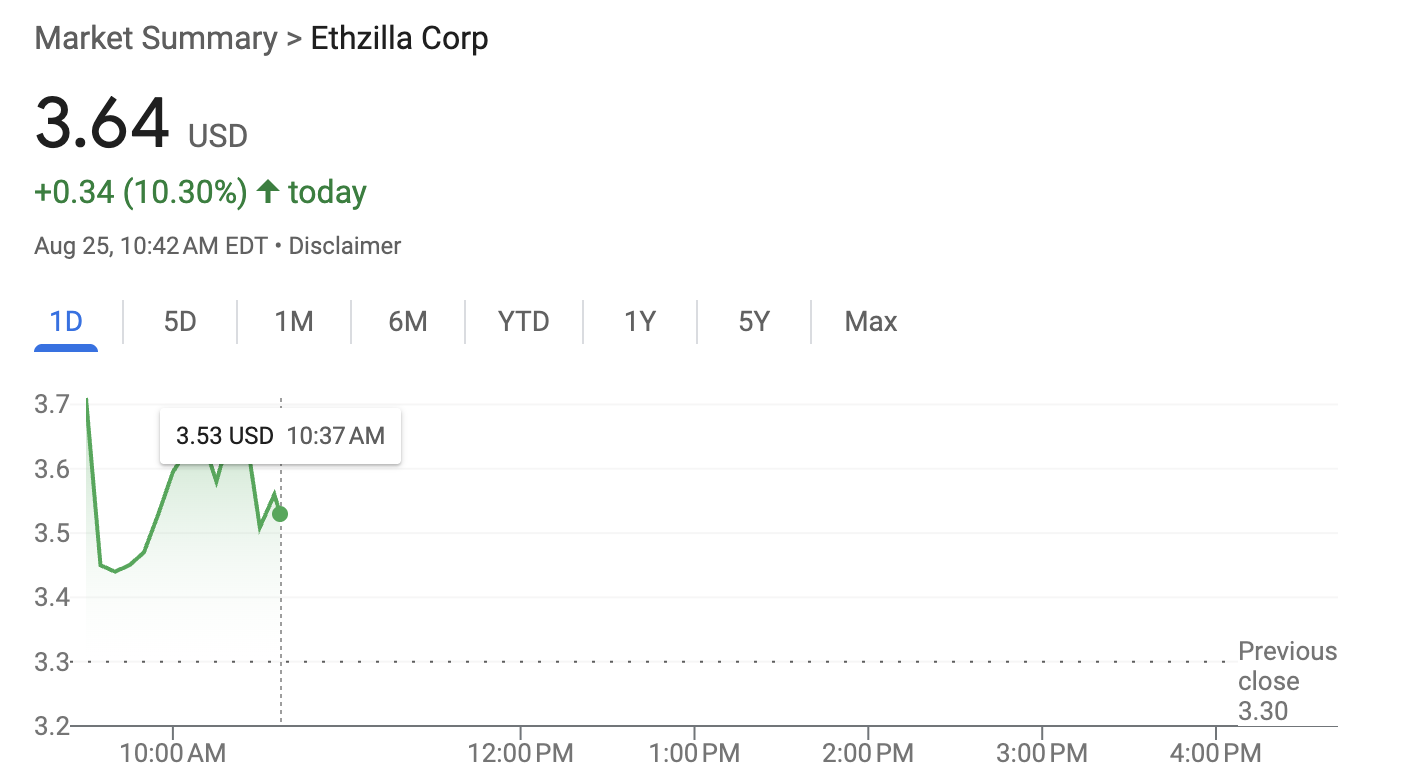

ETHZILLA, an ETHEREUM Company, announced the return of the shares of $ 250 million after the company’s shares decreased by 30 % last week. This causes a summary bounce, relieving stock relief fears.

However, this type of move will not be able to buy the following ETHEREUM. Ethzilla has about $ 489 million of ETH, and it represents a modern acquisition, but it needs to continue to build this stock.

Ethzilla Ethereum plan

Ethereum has been in good condition in recent times, as it reached the highest level ever last Friday, and companies investing a lot to operate this trend. The distinctive symbol receives a lot of institutional confidence, and one of the recent developments shows this.

Despite Etzella’s shares drunk After the last ethereum purchasing process, you are preparing to do so once again:

“In Ethzilla, we continue to spread the capital to accelerate our ETHEREUM strategy with a standard discipline and speed. Since we continue to expand our ETH reserves and follow up on the chances of distinctive return, we believe that the aggressive stock -sharing program at the current stock price is divided into maximizing our commitment.”

Specifically, the company re -purchases the shares of $ 250 million to stabilize their evaluation. Despite the strong performance of Ethereum, stock reduction fears have benefited from Etzella investors’ confidence.

Last week, the company planned to provide 74.8 million shares to finance ETH purchases, which represents 46 % in the total number of shares.

In other words, reduce participation means that the Etzella stock campaign may lose money, even if Ethereum continues to rise.

To treat this, the $ 250 million re -purchase plan helped the company stabilize moments, and opened the door for future acquisitions:

Decrease

second Documents Regarding this purchase, it reveals that Ethzilla currently possesses about $ 489 million of ETHEREUM, making it a great special holder.

This is much higher than the company I mentioned Property last week, so she recently bought.

However, the $ 250 million re -purchase will also reduce purchase capabilities. Ethzilla attracted corporate investments, but stock sales are their main car to buy ETH.

These purchases, in turn, are the only way that a future value can prepare for potential investors.

There is an inherent contradiction here. If this trade collapses due to the decrease in the returns, it may cause serious problems.

The re -purchases may bring temporary stability, but they cannot run real growth.

The tremendous cabinet can provide a negative income, but Vitalik Buterin warned that this may not be sustainable either.

In other words, Etzella may now be discovered in a pickle similar to the strategy.

Last week, Silor claimed that it would start selling shares for reasons other than getting BTC. This prompted a little violent reaction and fears that the company is losing its momentum.

ETHZILLA’s new purchase program is not related to ETHEREUM, though this It has not been verified Social media Rumors Claiming that she bought $ 35.2 million from ETH today.

Between this alleged acquisition and the purchase of last week, the company has some strength. However, it always needs to maintain movement.

Otherwise, the DAT strategy inherent risks can explode in the face of ethzilla.

NASDAQ Ethzilla in NASDAQ purchases more ETHEREUM, despite the appearance of the stock price collapse first on Beincrypto.

[og_img]

2025-08-25 15:53:00