Founding investors invest Ethereum with nearly 900 million dollars in new purchases star-news.press/wp

Many of the main institutional investors take over the recent decline in the ETHEREUM price to expand their holdings, indicating a focus on long -term exposure instead of short -term gains.

This activity indicates that institutions determine the long -term exposure mode rather than short -term gains.

Moral edges on the market in Ethereum after Bitcoin with the growth of accumulation

Lookonchain’s Blockchain analyzes reveal that one unnamed institution created three new governors last week. The company also withdrew 92,899 ETH, at a value of $ 412 million, from Kaken.

Market analysts usually explain withdrawals such as upscale signal, indicating that investors transport coins to the self -body with a long -term reservation strategy.

Meanwhile, Defi Venture World Liberty, Donald Trump, joined the purchase spree.

Data on the series show that the company spent $ 8.6 million to buy 1911 ETH with about $ 4,500 each. Meanwhile, the company allocated another $ 10 million to gain 84.5 wrapped bitcoin (WBTC) for $ 118,343 per currency.

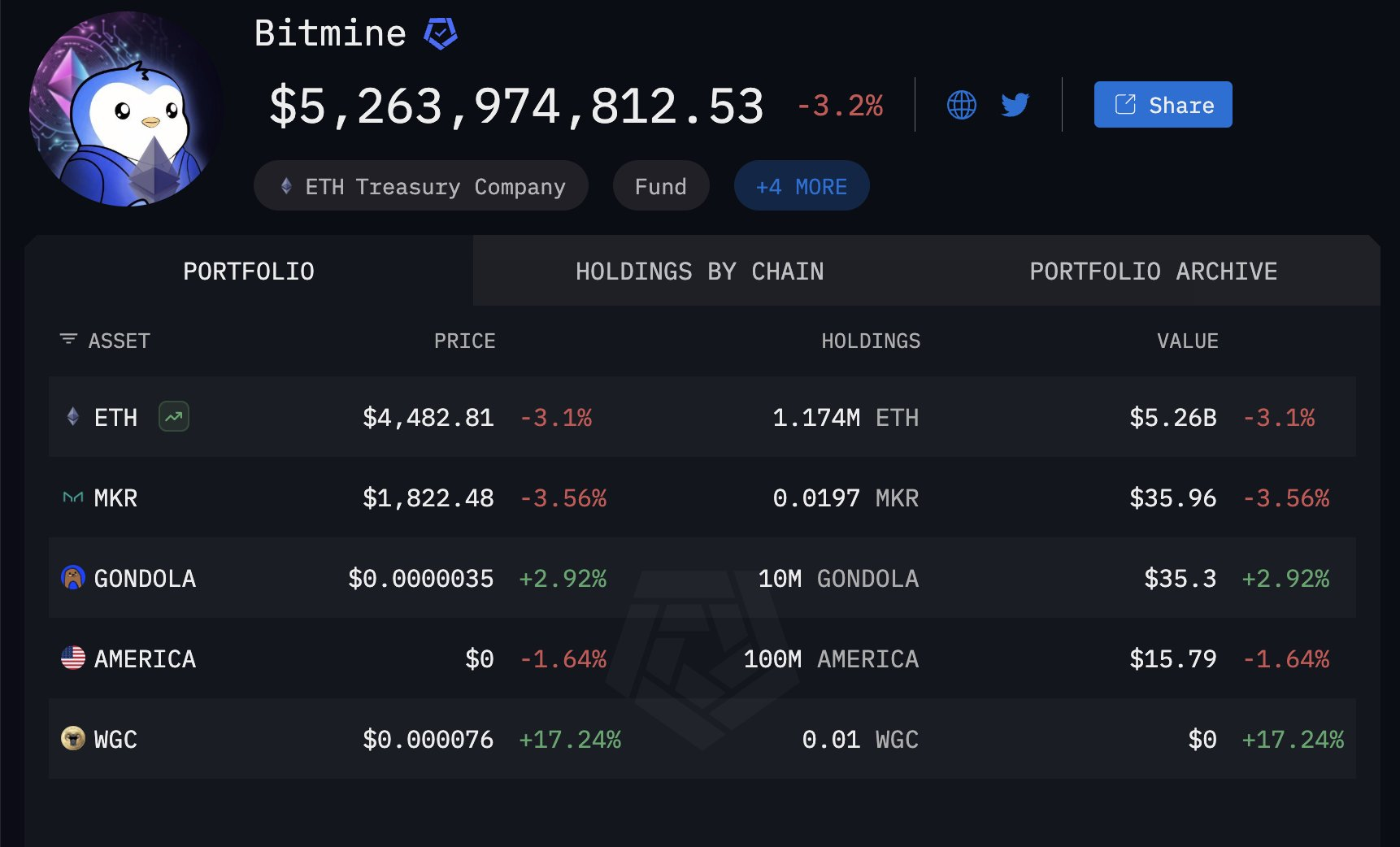

In addition, BitMine, which focuses on Ethereum, has installed a more important individual step during this period. Lookonchain reported that the company added 106,485 ETH to its public budget at a cost of $ 470 million.

This reaches the ETHEREUM Treasury in BitMine to 1.17 million ETH, which is now estimated at about $ 5.3 billion. The company Tom Lee is the largest company holder in Ethereum Reserve.

These institutional moves follow the last ethereum correction after weeks of the upscale momentum that has almost brought ETH to its highest level ever.

Market analysts note that the timing and size of these institutional purchases indicates the calculated accumulation strategy rather than speculative trading.

It is worth noting that the institutional appetite is driven by increasing exposure to ETF and the rise of treasury companies. These entities collected more than 10 million ETH, or about 40 billion dollars, of digital assets.

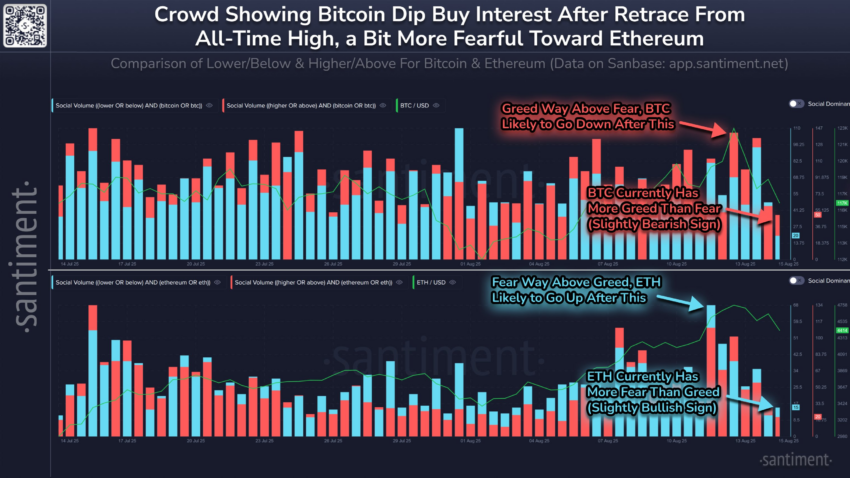

Given, the Blockchain analysis platform indicates that Ethereum currently maintains a modest feature in the short term on Bitcoin in the market morale.

Santimi’s analysis shows that bitcoin pools often generate noise on social media. On the contrary, the coherent ETHEREUM performance has attracted during the past three months.

According to the company, this disciplined approach indicates that institutions are placed for continuous growth. It also enhances the role of Ethereum as a pioneering Macro play in the digital asset market over the next decade

Post -ETHEREUM Investors Invest approximately $ 900 million in new purchases on Beincrypto.

[og_img]

2025-08-16 15:36:00