Ethereum price may decrease soon due to this indicator star-news.press/wp

The Ethereum’s Recovery Rally has stopped over the past few days, with ETH trading side by selling pressure.

The frequency stems from long -term holders (LTHS) who move to insurance profits, which is a historically related trend to the main price repercussions. While this behavior is not new, its appearance aims to more from the negative side.

Sponsored

Sponsored

Sell the main Ethereum holders

NUPL LTH reveals that each time the indicator crosses a 0.65 sign, struggling with ETHEREUM prices.

This is because profit levels reach a satiety point where experienced investors prefer to sell instead of keeping it, which leads to stagnation of prices or corrections.

Currently, Ethereum reflects the same behavior of its previous sessions. With LTHS perception of great profits, the sales process undermines the escalating ETH path. Buyers hesitate to absorb the sale pressure, leaving ETH vulnerable to extended unification.

Sponsored

Sponsored

Do you want more symbolic ideas like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

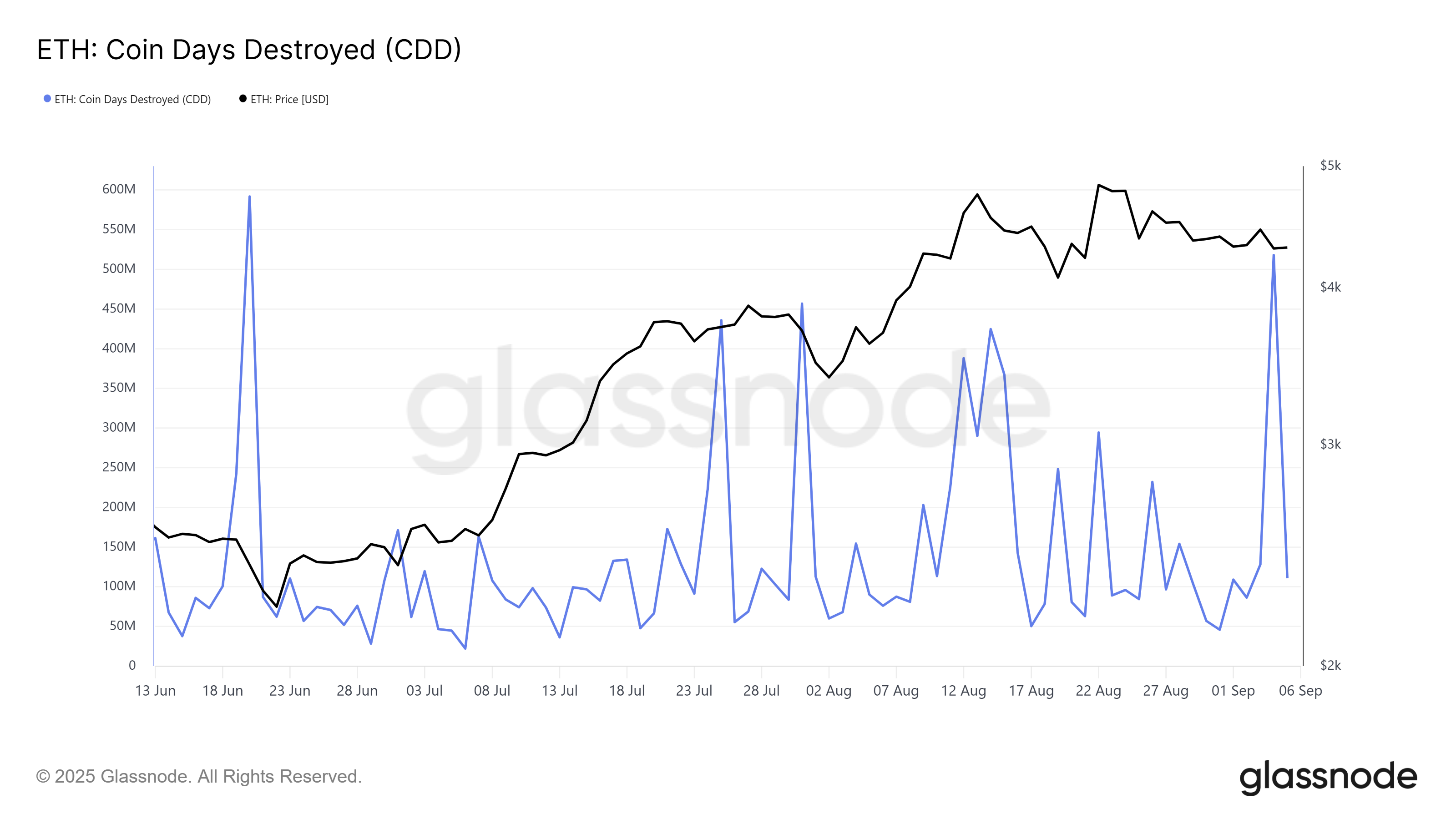

The destroyed currency days scale (CDD) support this trend, indicating that LTHS is filtering with possessions. Within the past 24 hours, CDD recorded its sharp height within two months, with a highlight of the increase in the sale.

This activity often indicates more risks of the downside. LTH sale at high levels indicates a lack of confidence in immediate recovery. What is not met by strong flows from other investor groups, the total momentum of ETH suggests a cooling period.

ETH price remains stagnant

Sponsored

Sponsored

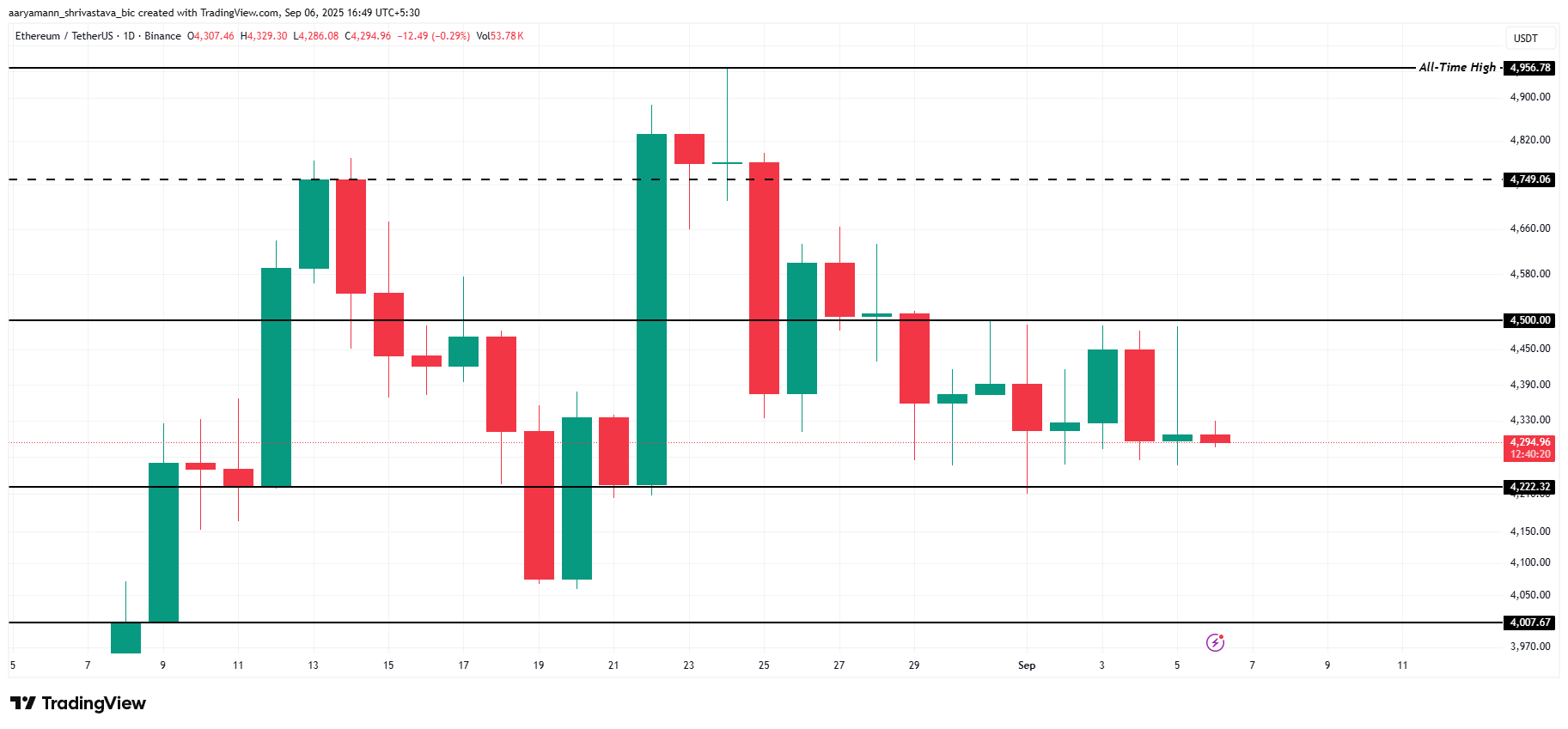

The ETHEREUM price is currently $ 4,294 and holds the highest support level of $ 4222. The challenge remains a frequent ETH failure in a breach of $ 4,500 over the past few days, which is the ceiling that is now working as a critical resistance barrier for Altcoin.

This indicates that ETH may remain in the short term. With LTHS reservation profits, the potential of the upward trend is crowned, leaving ETH swinging between $ 4,222 and $ 4,500 until market conditions improve or absorb the demand for continuous sale pressure.

If other investors intervene to buy ETH, it is unloaded by LTHS, so it is still possible to recover. A successful breach and face of $ 4,500 in support would open the ETH path to re -test $ 4,749.

This would represent a possible appeal for its broader upward path.

https://beincrypto.com/wp-content/uploads/2025/03/bic_ethereum_5-covers_coins_neutral.png

2025-09-06 12:27:00