The last decline of ETHEREUM, by 13 % of the last levels, represents its first weekly loss in more than a month, breaking the fixed upward trend that witnessed the test of multiple weeks. The correction, which led to prices to less than $ 3,400, sparked a discussion: Is this a temporary stop before collapse, or the beginning of a deeper decline?

Wonderful analgesics appeared: it was purchased as a whale $ 300 million from ETHThis indicates that they believe this decrease is temporary.

The data on the series from Arkham Intelligence shows that the massive purchase process occurred with the low prices-a “DIP” strategy of a high-support entity. This is, as the broader market is reeling from macro stress: strong American salary data and non -farm, which raised a feeling of risks.

- ETH price decreased: -13 % of the July rise

- Pisces buy: $ 300 million in ETH

- The maximum market: 422 billion dollars

- Trading: 28.8 billion dollars (24 hours)

This difference between price work and whale behavior indicates a possible reflection. While many merchants come out of fear, aggressive accumulation indicates medium -long recovery forecasts. It also comes because Ethereum is one of the institutional assets associated with the upcoming ETF permits and promotions on the chain.

ETHEREUM (ETH) prices test the critical areas

ETHEREMM prediction turns up as ETH tries to recover from $ 3,374 – its lowest level since early July. The price tests 0.236 FIB at $ 3,491, a level of support and resistance before.

A clean break above this may lead to 3,564 dollars (38.2 % of FIB) and $ 3,623 (50 %), with a final recovery at $ 3681 (61.8 %), which is also 50-Batt SMA at $ 3,711.

The momentum is still weak. RSI is 4 hours in 39 years, just less than the neutral area. Without a difference in the rise or confirmation of size, the price may stop when resistance.

The reflection candle (updated immersion) will add $ 3564 to the recovery. But rejection of $ 3,491, or $ 3564 will be landfill and ETH can pull to $ 3,374 or even $ 3,267.

Ethereum Trade Outlook: Watch the penetration of $ 3564

if Eth is broken over $ 3564 With bullish size and candlestick, merchants can target $ 3,681 and $ 3,765. This is Fibonacci and historical resistance, which is a high probability.

Trade levels:

- entrance: Above 3565 dollars

- Stop: Less than 3,480 dollars

- Goals: $ 3,681 / 3,765 dollars

- Ability: 3,491 dollars failed

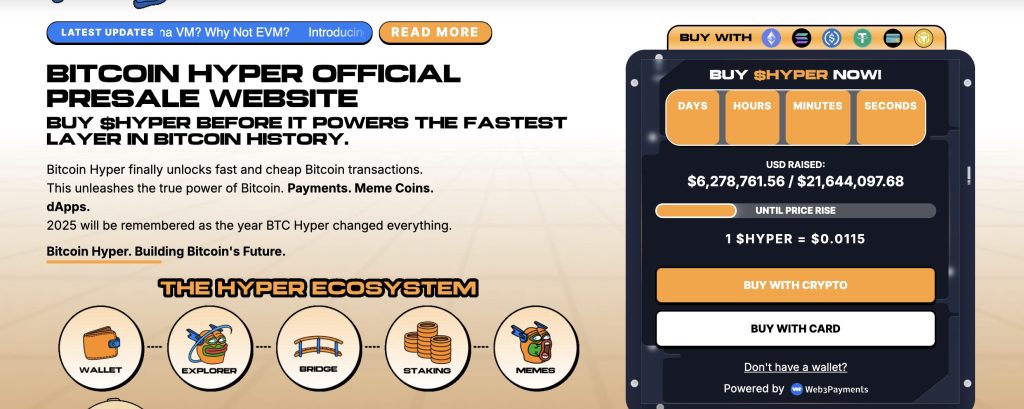

Bitcoin Hyper Presale more than 6.2 million dollars with a approaching price

Bitcoin Hyper ($ hyper), the first layer of BTC-Nation 2 supported by Solana Virtual Machine (SVM), collected more than $ 6.2 million in a period of between them, with 6,278,761 dollars out of 21,644,097 dollars. The distinctive symbol is priced at $ 0.0115, where the next price layer is expected to be announced soon.

It is designed to integrate Bitcoin quickly Solana, Bitcoin Hyper enables fast -cost smart contracts, DAPS, and create a Mimi currency, all with a smooth BTC Dam. The project is checked by consulting and engineering for expansion, confidence and simplicity.

The Golden Cross was made of the charger and true benefit of the Bitcoin A Contenter 2 of the competitors to watch in 2025. With interest, simplified precedent, and a full expected offering by Q1, Hyper acquires $ serious attraction.

https://cimg.co/wp-content/uploads/2025/07/31120817/1753963696-ethereum-price-prediction.jpg

2025-08-03 21:21:00