Ethereum prices are hardly at $ 3,800; Thin supply signals star-news.press/wp

Etherum Price is located at $ 3,677, an increase of about 16.5 % this week. He continues to move to more than $ 3,800, just to get a decline.

With a large, non -supported waiting list hanging in the background and cooling a little momentum, the clear question is whether this door is finally swinging or closed again. Two main standards can help understand what is happening from here.

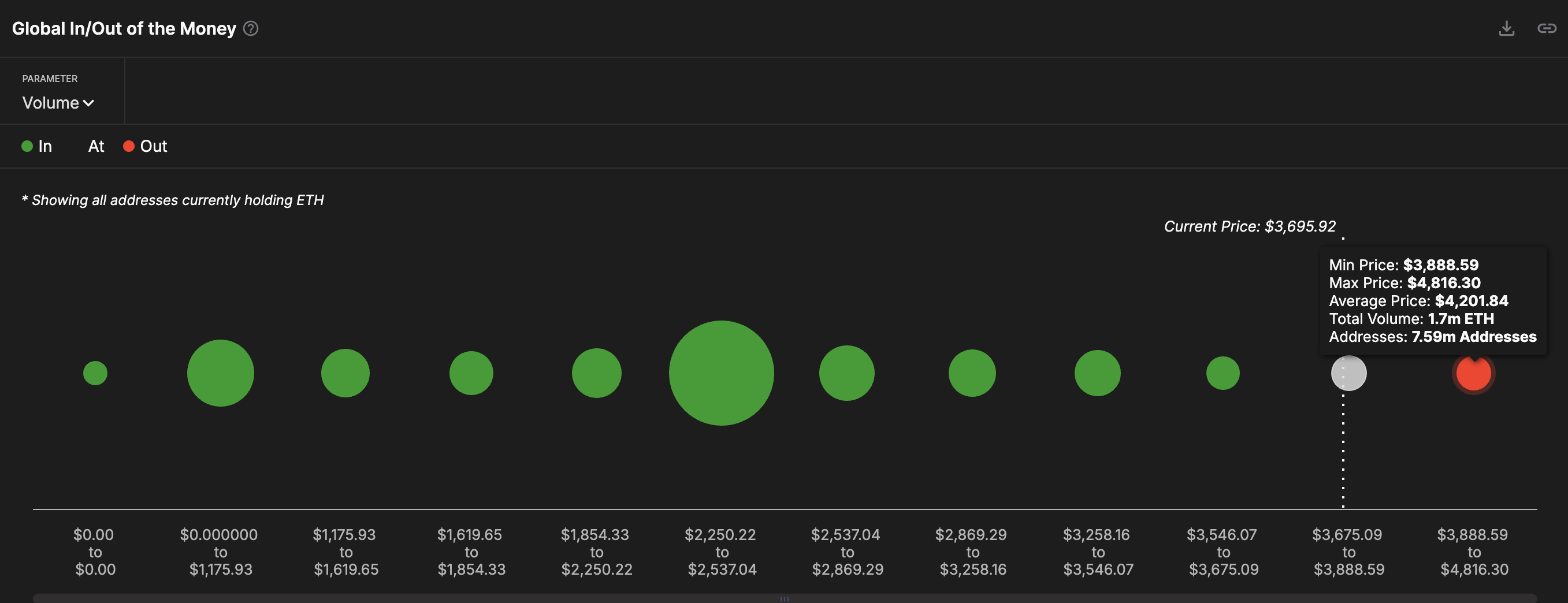

The exchange rate for exchange near its lowest levels

The exchange supplies (ESR) is about 0.145, and is near the lowest level of this year at 0.142. The ratio is used instead of raw exchange balances because it measures the exchanges of exchange against the total rolling ETH, which changes with burning, burns and the lock.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

Only low ESR means a small portion of supply sits on exchanges and is ready for sale. This is the preparation now.

According to the scheme, the highest levels of local ESR came before ETHEREUM prices withdrew. Therefore, ESR levels decreased.

If ESR rises during price slippage, this usually means that overcoming tools or adult pregnant women transport coins to exchanges, and the decrease can follow.

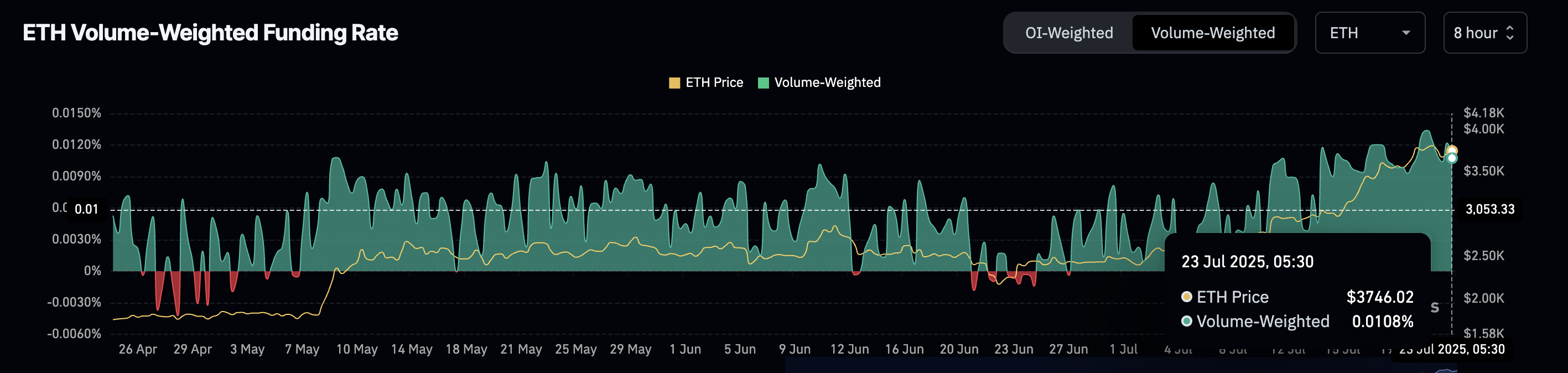

Funding and open interest

The open interest is about $ 55.9 billion, so many future situations are open. The financing rate is approaching 0.01 %, and it is still positive but it is less than modern nails (anything may exceed 0.02 % worrying because this may mean a long crane).

The current market structure means that traders tend for a long time (they expect prices to rise), however they do not pay a heavy bonus to stay there. This says that the leverage exists without being extreme. This is a healthy scenario, and it seems that the ETH price is moved by a spot.

Funding is the fees that each other pays and the short strictures to maintain permanent prices near the stain. Open benefit is the total value of all open contracts.

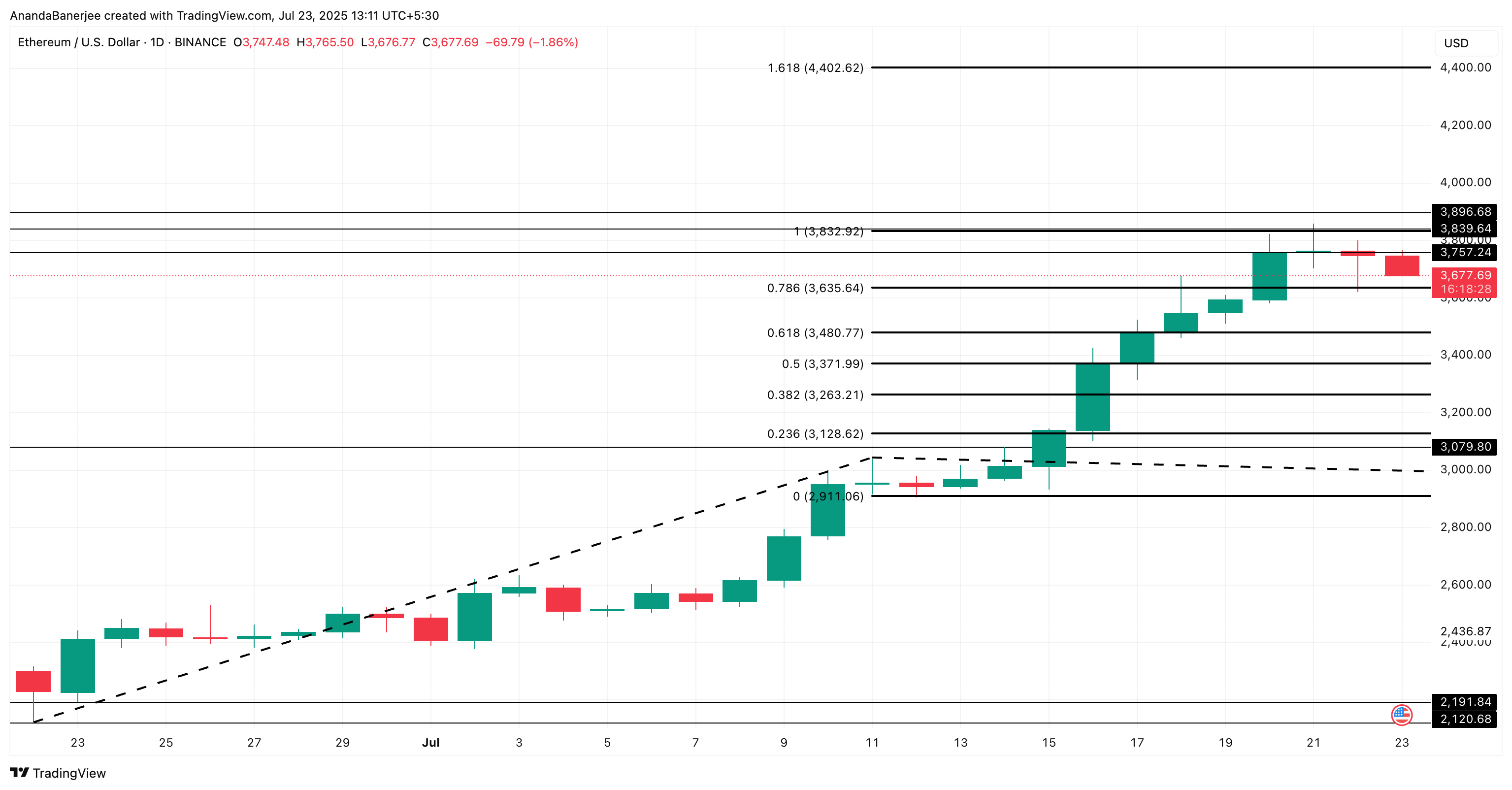

ETHEREUM (ETH) price is to overcome the main levels

ETH is trading within the main ranges of $ 3,832 and $ 3,635 (FIB level 0.786). As the upper level (resistance) also suggests, the real mass is located above the “$ 3800” door. However, just a breach of resistance of $ 3,832 as earlier may not help.

There is a standing group of more than $ 3,888, which also needs to be breached. This group is likely to explain why fast movements fade over $ 3,800; Many governor is close to breaking there and selling it to strength.

A daily closure above $ 3,896 will open the doors to 4,402 dollars (an extension of 1.618). If ETH declares again, $ 3,635 is the first support, then $ 3,480. The decrease under these levels, along with an ESR, will weaken the bullish setting quickly.

Fibonacci levels, science, common interaction areas. The money map that is purchased in many portfolios shows; These areas often act as a real resistance or support, which leads to the verification of FIB levels.

However, the entire oud hypothesis may be nullified in the short term if the ETH price decreases less than $ 3.128 or the FIB 0.238 extension level.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/07/ethereum-eth-q2-2025.png

2025-07-23 21:30:00