Ethereum is approaching $ 4000 – but whale dumping allegations and confidence move uncertainty star-news.press/wp

ETHEREUM (ETH) steadily approaches the psychological level of $ 4,000, but the teacher is still far -reaching as the sale of clouds is upholstered by the upholstery.

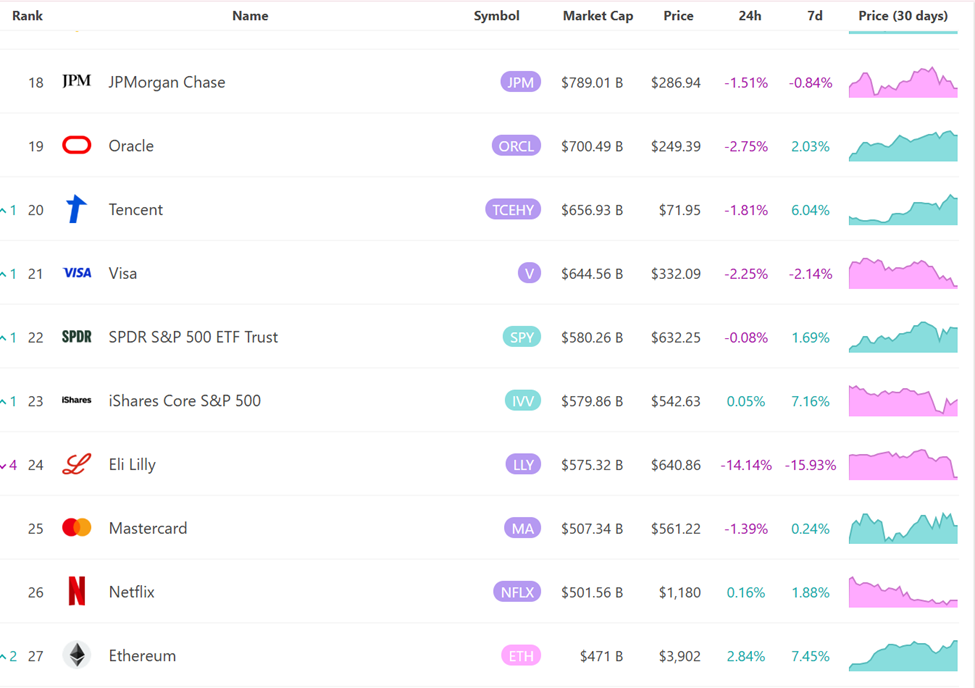

However, the last institutional frenzy of ethereum has prompted ALTCOIN to the maximum scales of the market to 27Y The position between global origins.

Whales sell ethereum to strength – but why now?

The market value of Ethereum increased to 471 billion dollars, as major international companies exceeded the twenty -seventh among all assets.

Meanwhile, in the midst of the mutation, there is another force to pull in the opposite direction. Traders, whales and agents raise red flags about the main sales and manipulation of the alleged market.

This anti -power comes properly when ETH appears ready to restore its highest level ever.

According to analysts and data on the series, whales come out of large sites, with Binance exchange as a joint name.

TED Bidows, an investor and KOL on X (Twitter), claims that Binance treats ETHEREUM price by throwing millions of ETH.

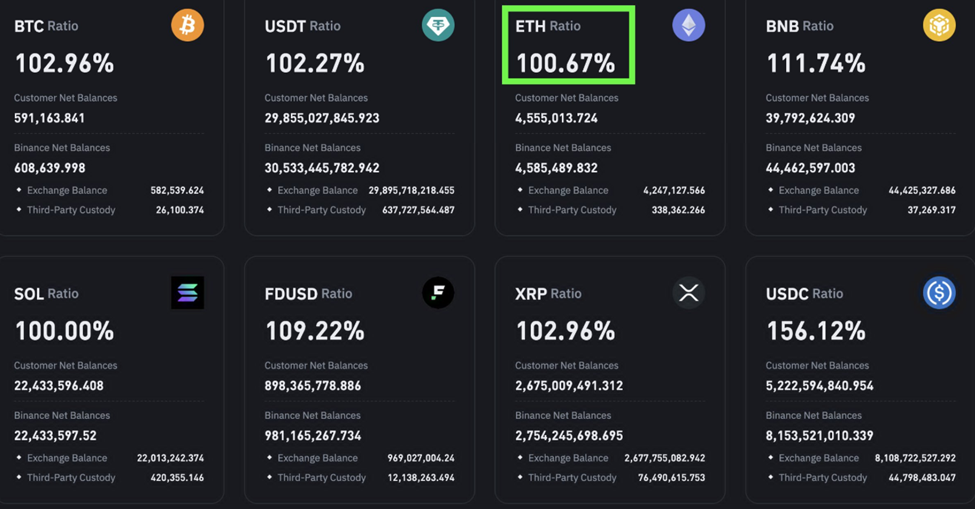

In a follow -up post, TED claims that Binance moves ETH to multiple market making accounts, although no known ETH exceeds customer deposits.

“I hate to say that, but Binance treats ETH and the entire altcoin market … How can they transfer a lot of ETHEREUM to these accounts when they do not have an additional ETH, just customer money?” he books.

These assurances indicate that organized sale pressure may be undermining institutional demand. Meanwhile, Binance did not immediately respond to Beincrypto’s request for comment.

The stock exchange publicly did not respond to allegations at the time of the press.

The main events of the series support these concerns, and are unfolded with the climbing of the last ETHEREUM.

One title, 0x219 … C3C4F, sold 3000 ETH at a value Reveal The wallet has accumulated ETH at a rate of $ 3500 on average and endured 70 % of clouds before leaving $ 1.24 million.

Another whale, sleeping for eight months, deposited 1,383 ETH codes in Mexc, and a shortcut of $ 4.32 million. The title still holds 1,384 ETH code worth $ 5.39 million.

This highlights a wider style of profit now after the ETHEREUM price approaches a critical psychological level.

Not everyone buys the theory of manipulation

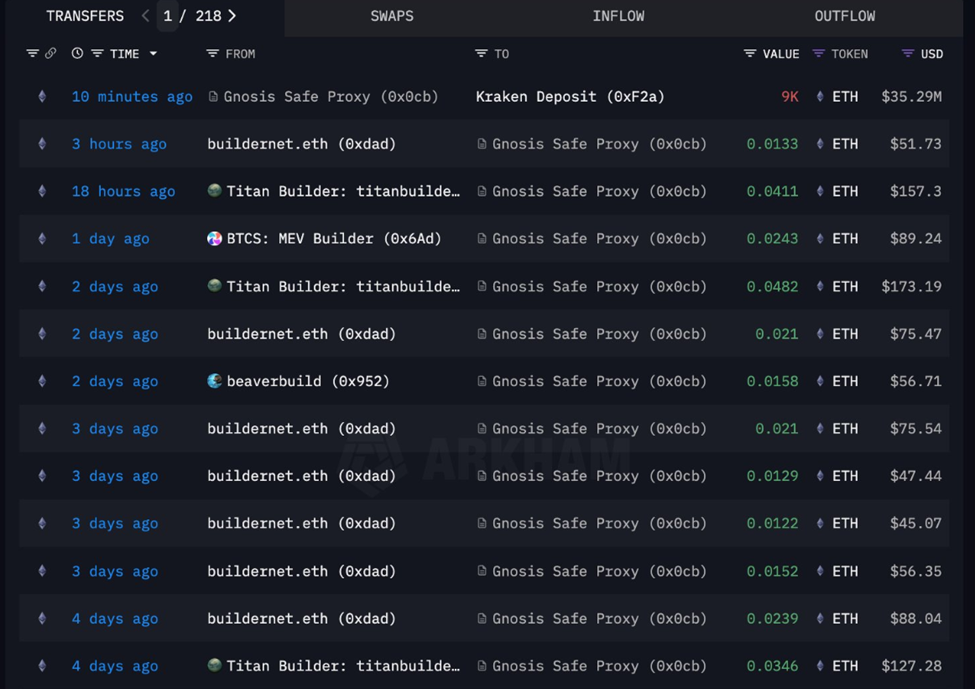

Nevertheless, the largest multi -signed red mark (0x0CB … E07E4) that recently deposited 9000 ETH, is about $ 35 million, to Kaken Exchange.

According to what was reported, the title is linked to a high -frequency block builder and the builder of Titan. According to the analyst, it still holds more than 18,000 ETH, at a value of more than $ 70 million, with most of them still are different.

Analysts suggest the series that this is not a coincidence, as the wave of sale is likely to reflect advanced players coming out of liquidity. If this is true, they may use CEXS (central exchanges) like Binance and Kaken as an exit slope.

One whale dealer It is said The fourth fourth swing trade concluded after the 5000 ETH was emptied at $ 3,895, at a value of $ 19.47 million.

It is not clear whether these profits have been booked in anticipation of a decline or as part of the larger market coordination.

While Ethereum technical technologies are still strong and institutional demand rises, the coordinated sale is now absent from the gathering.

As of writing these lines, Ethereum was trading for $ 3,906. But the big question is whether the price has been kept exactly as it approaches the people of $ 4,000.

Beyond ethereum is approaching $ 4000 – but the allegations of whale and construction were uncertain for the first time on Beincrypto.

[og_img]

2025-08-08 12:46:00