Confuseds about instability with Eltium, as the encryption market cover takes stumbling star-news.press/wp

The cryptocurrency market fell by about 4 % on Monday, which increased their interest in an increase in ETHEREUM (ETHEM). Data on the series show that 1.18 million ETH is in the waiting menu, which is the largest accumulation in months.

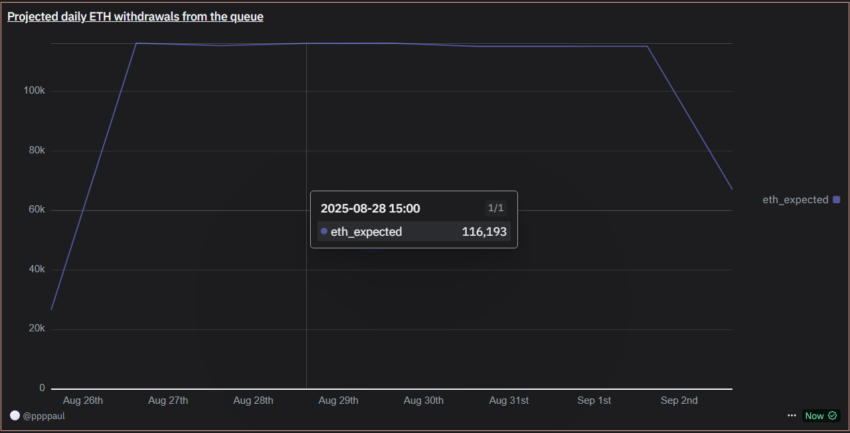

Highlight the delay pressure on the ethereum network. Usually, instability does not take three to five days. Next applicants face up to 40 days.

ETH does not increase the increase in the sale pressure

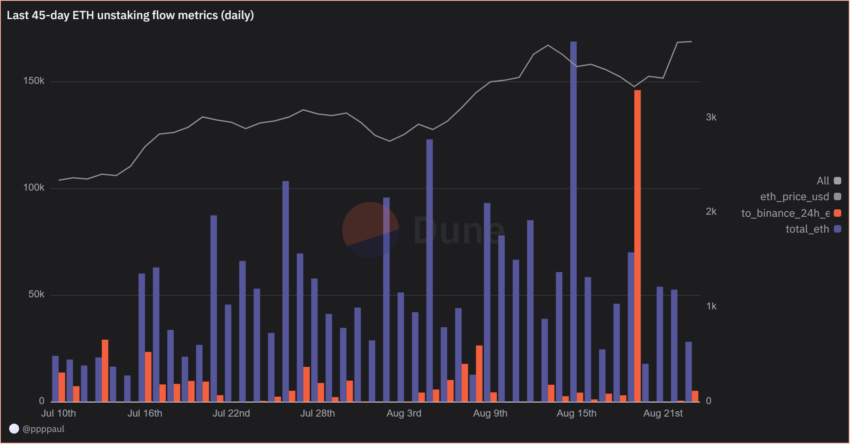

Instability does not mean selling automatically. Many ETH holders may keep, waiting for prices or Defi opportunities. Data from sand dune analyzes indicate that there is no strong connection between the unstable size and the ETH price over the past 45 days.

However, when pulled, the ETH moves to exchanges, and often follows the low prices.

On August 19, the large flows of Binance coincided with the ETH decrease by 5 %. On the same day, the Nasdaq Stock Exchange decreased by 1.46 % on fears of the delay in reducing federal reserves.

According to the series DataNearly 115,000 ETH will come out of those who want daily this week. At current prices, approximately $ 4,600, which is equal to $ 529 million for trading every day.

The volume adds uncertainty as the markets remain sensitive to the total economic transformations. A mixture of heavy news and negative news can drive sharp price fluctuations.

. Source: sand dune analysis)

Many market votes argue that the concerns are exaggerated. Some investors compared the situation with Solana, who faced similar concerns after instability related to FTX.

Meanwhile, Cryptoquant data highlighted that the ETH show on the central stock exchanges has decreased to record its lowest levels. It remains only 18.3 million ETH, which reduces immediate sale pressure.

Unstable flows are still large, but the effect depends on the transfers of exchanges and the broader economic conditions. Analysts warn that withdrawals from ETH alone are unlikely to lead to continuous sales without shocks on the external market.

In general, the author unstainably emphasizes the growth of the growing investor, but its impact on the market is still inaccurate.

Although billions in ETH are set for release, global economic flow flows will eventually determine whether the increase is translated into a sale pressure or simply reflects a ripe network.

The Post Bost Over Ethereum is not supported as Crypto Market Cap takes a back stumbling first on Beincrypto.

[og_img]

2025-08-25 19:59:00