Digital asset flows up to $ 3.7 billion: Coinshares star-news.press/wp

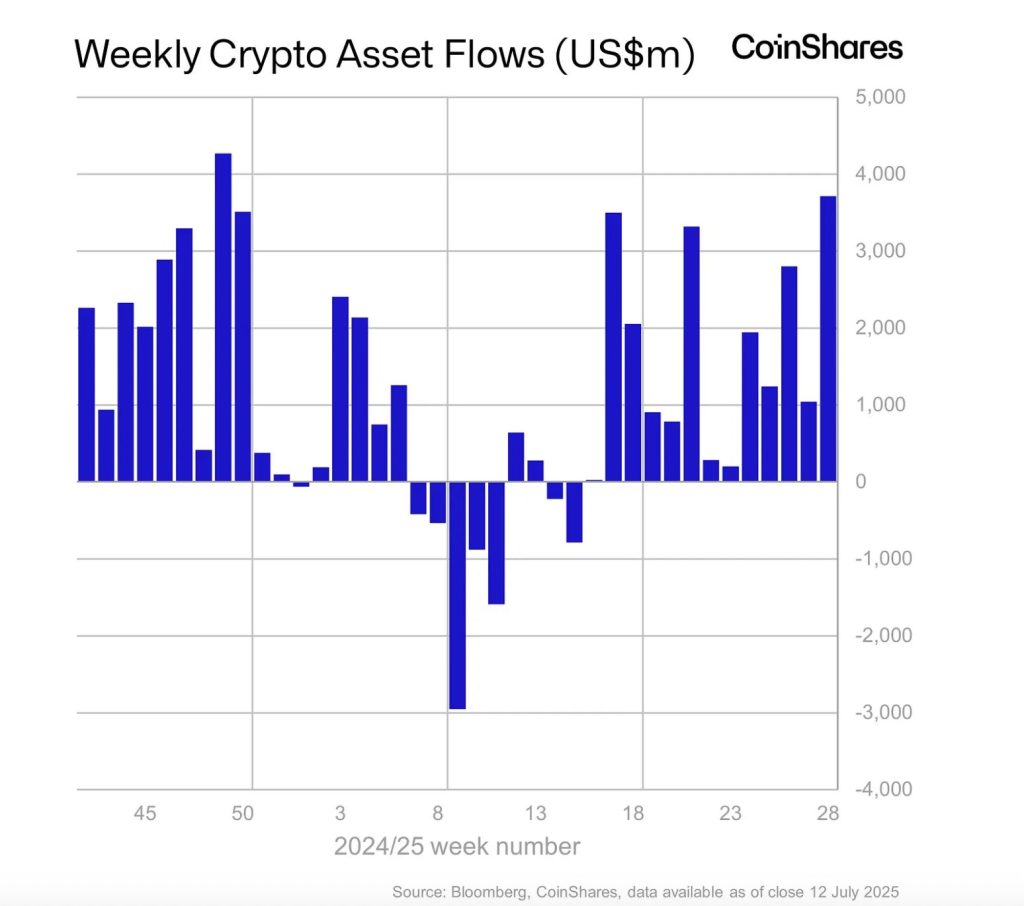

Digital investment products recorded 3.7 billion US dollars in flows last week, which represents the second largest week in history, according to Coinshares James Butterfill analyst.

in Blog post The analyst has reported that the increase in capital led to the total assets under management (AUM) through the products circulating in the exchange of encryption (ETPS) to the highest level ever of $ 211 billion.

Trading activity is also intensified, as ETP storage units reach 29 billion US dollars – the weekly average of the year lasts.

Butterfill notes that July 10 alone witnessed the third largest daily flow, which indicates the intense institutional appetite and the promotion of the upscale feelings that maintained 13 consecutive weeks of net flow.

Bitcoin and Ethereum lead the charge

Bitcoin is still the preferred dominant origin, attracting $ 2.7 billion in flows, raising AUM to 179.5 billion US dollars. This landmark means that Bitcoin Etps now represents 54 % of the value held in the products circulated in gold exchange, which confirms the position of the increasing assets as digital gold.

Despite the assembly, the short bitcoin products recorded a little activity, indicating a prevailing bias. Ethereum also occupied newspaper addresses, obtaining the twelfth week of positive flows.

With 990 million US dollars added last week alone-the fourth highest weekly number on the record-EREREUM’s flows for 12 weeks are now 19.5 % of AUM, as it exceeded 9.8 % of bitcoin during the same period.

According to Butterfill, this indicates the increasing condemnation of the investor in the basics of ETHEREUM in the long run.

Regional difference and Altcoin trends

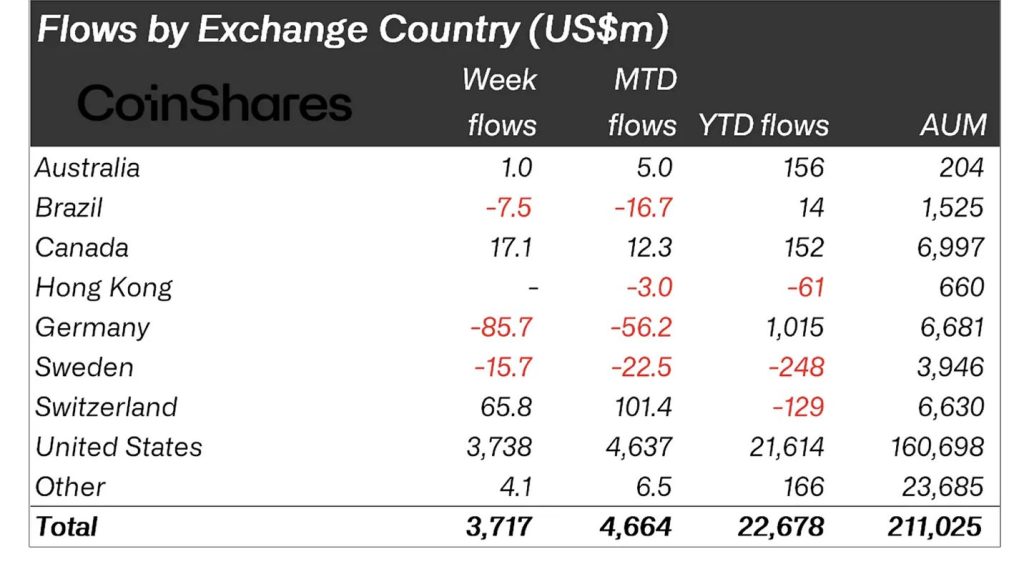

At the regional level, the United States dominates flows with a weekly flow of $ 3.7 billion.

Meanwhile, Germany has witnessed remarkable outfits of $ 85.7 million, noting a possible regional profit or changing organizational feelings. Switzerland and Canada imposed the trend, and published moderate flows of $ 65.8 million and $ 17.1 million, respectively.

From Altcoins, Solana has emerged with $ 92.6 million in flows, strengthening its location as preferred 1 stakes outside ETHEREUM. On the contrary, XRP has suffered from the largest weekly flows at $ 104 million, hinting the investor’s confidence or reactionary moves after the recent price procedures.

Butterfill emphasized that although some mixed Altcoin performance, the continuous capital flow across the broader market is a strong indication of the renewal of institutional participation and retail in the digital assets sector.

https://cimg.co/wp-content/uploads/2025/03/17151512/1742224511-image-1742215437023_optimized.webp

2025-07-14 10:26:00