Big Pharma’s betting on GLP-1 is likely to pay off, Deloitte Report star-news.press/wp

In this story

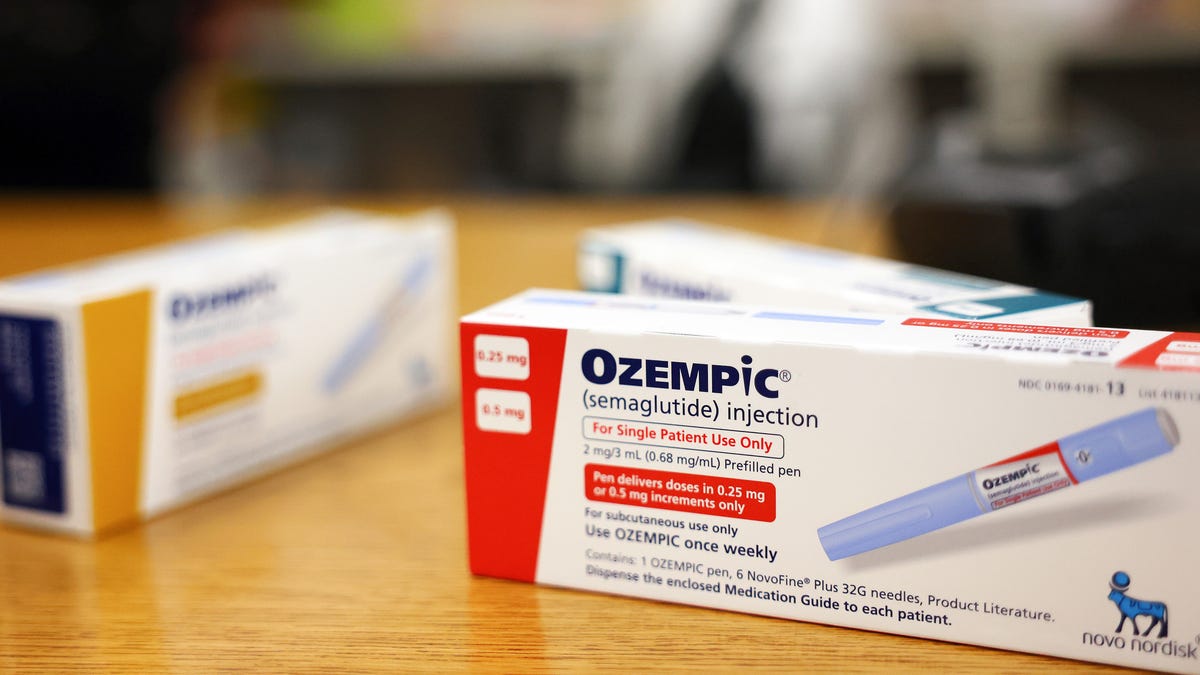

The Great Pharma is expected to see great yields from their investment in the class of drugs known by Novo Nordisk (NGO-2.68%) Popular Diabetes Droga Okempic.

Annual Report of Deloittea, Measurement of return from pharmaceutical innovationThey found that GLP-1 drugs can encourage significant returns to research and development investments that made major drug producers last year. The consulting firm analyzed the projected internal return rate for late-stage pipeline in 20 leading pharmac companies.

On average, these companies predict the peak sale of $ 510 million per asset. But when the GLP-1 is excluded, this figure suddenly falls to $ 370 million. The internal reduction rate for late-stage pipeline assets climbed by 5.9% in 2024, from 4.1% in 2023. – Running in a large part of GLP-1 medications. Without them, the return would fall, died at 3.8% in 2024. and 3.4% in 2023. years.

This is even more given that the report also found that the average cost for the development of the Big Pharma amounted to $ 2.23 billion in 2024. years, more than $ 2.12 billion before.

GLP-1 drugs mimic hormones that regulate blood sugar and comb their appetite, making them very requested to treat the obesity and diabetes of type 2. Demand required Eli Lilly (Lly-1.93%) And Novo Nordisk to become the largest pharmacical companies in the world. Eli Lilly is a cure for weight loss Zepbood generated $ 4.9 billion in the annual incomeWhile the new Nordisk’s companion treatment, Wong, approximately scored $ 8 billion sells.

Wall Street noticed. Since the American food and drug administration (FDA) approved Zepbound in November 2023. year, Eli Lilly rose more than 40%, pushing their market capitalization $ 750 billion. The new Nordisk also saw an even rise, and the stock increases over 76% from the beginning of the house in 2021. years.

With such a massive yield, several companies – including New NordiskEli Lilly, Pfizerand Amgen – Progress GLP-1 drugs for next generation and exploring their potential for new use, such as Treatment of sleep apnea and improving the health of the heart.

2025-03-25 18:26:00