Syrup, 1.85 million dollars of profits obtained – however, 85 % of the bulls are strong: why? star-news.press/wp

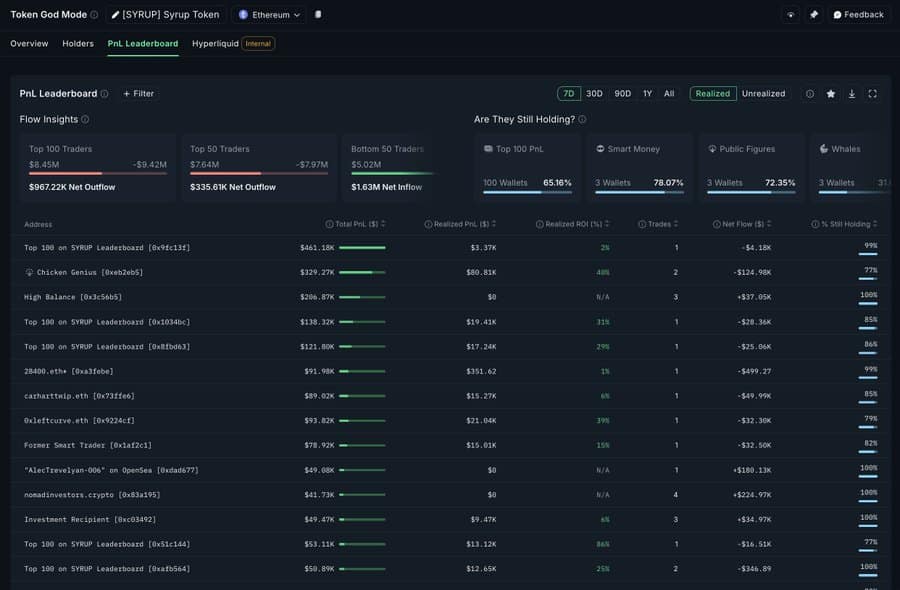

- Senior drink holders made $ 1.85 million; 65 % are still a contract.

- Other participants in the market – led by Binance traders – continued to empty altcoin, which increased the declining pressure.

Maple financing (syrup) decreased by 3.25 % on June 28, reducing sharp gains of 6.17 % the day before.

The market condition analysis indicates that achieving a long -term pregnancy profit is a major reason behind the sale. According to Ampcrypto analysis, Binance sellers seem to lead this wave of retreat.

Smart money makes it out

Of course, when prices rise quickly, the first buyers often sell first. This is exactly what he played.

according to NansonThe highest drink holders – who entered early – have achieved more than $ 1.85 million in profits this week.

Source: Nansen

About 65 % of the best 100 wallets are still carrying the distinctive symbol, but external flows gain a pace.

In fact, the first three governor alone received more than 911 thousand dollars. What is more? 78 % of these titles are marked as “smart money” – the well -known bodies for high purchase and low sale.

Usually, strong Holding behavior may inspire market confidence and persuade others to buy.

However, the current trend indicates the opposite, as many of these investors continue to sell, perhaps because of previous sale patterns.

Binance traders lead the pressure

Data from the Binance Derivatives market showed that traders on the platform are leading a lot of sale pressure.

according to CoinglassA long/short percentage hovering near 0.47, indicating heavy sale. Less than 1 usually indicates the sale of hegemony, and the lower the number from 1, the stronger the homosexuality.

Source: Coinglass

The effect of Binance merchants is important, as they control a large part of the open interest (OI), the trading size, and the number of trade.

On June 28, both OI and the total trading volume decreased, probably due to the influence of the Binance Market. The volume of 451.63 million dollars decreased to 242.31 million dollars, while the open interest decreased by 10.16 % to 71.75 million dollars.

Source: Coinglass

If the sale continues, this may lead to low liquidity flows, which limits the discovery of prices as merchants move away from speculation.

The sale of the immediate market adds to the drinking crisis

The immediate market, or the unregistered trading environment, has also witnessed an increase in the sale activity, which enhances the dumping market tilt.

For all Coinglass, $ 2.9 million of drink was unloaded via SPOCT Exchange Netflows on June 28.

The size confirmed on Coinmarketcap this pattern, which reduced $ 118 million on June 26 to $ 77 million on June 29.

Source: CoinmarketCap

Despite this, data from Coinmarketcap’s The societal feelings plan reveals that all participants do not expect more decrease.

On June 28, societal morale remained ascending, with 85 % expected to increase prices.

If these Saudis investors continue to intervene, the drink may avoid deeper losses or even a strong recovery.

https://ambcrypto.com/wp-content/uploads/2025/06/Abdul_20250628_141404_0000-1000×600.webp

2025-06-29 08:00:00