Flags of Sol analysis from Chatgpt explosives 210 dollars star-news.press/wp

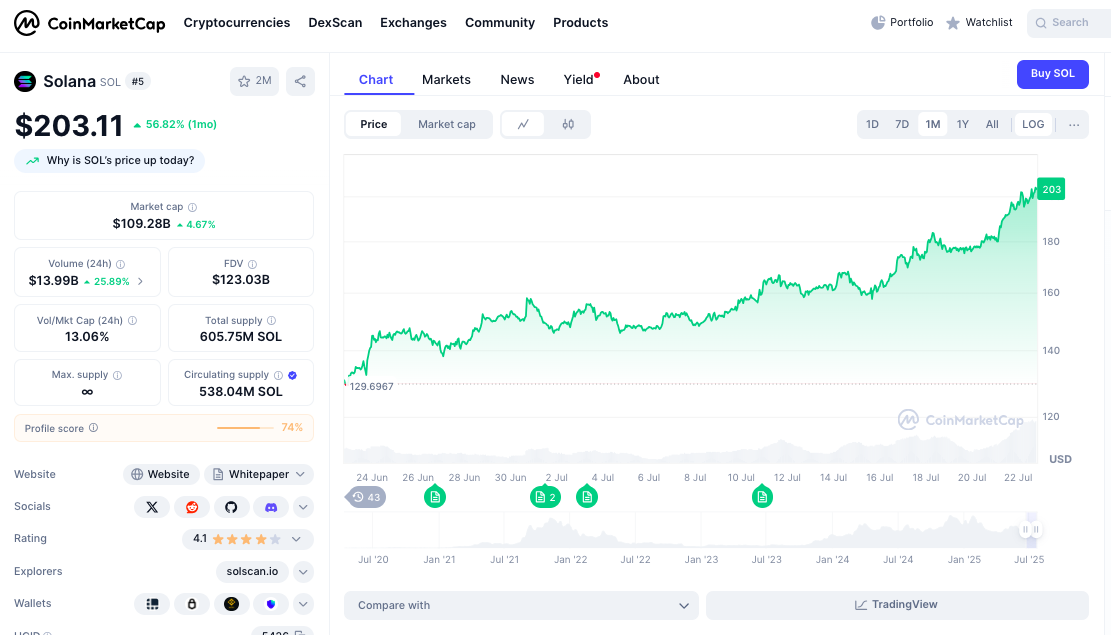

The AI Model from Chatgpt has been treated 42 Live indicators, reveal an exceptional momentum such as Solana Ructas +4.31 % to 204.15 dollars Unusual 26 % A weekly increase driven by the Ministry of Treasury Companies.

Teller It is traded with the extremist relativity index from 82.22 During the key test 210 dollars Resistance, like companies like Defi Development and Sol, and the mining approach $ 100 One billion market market.

The following analysis plans Chatgpt’s 42 Technical indicators in the actual time, the cabinet developments for companies, the expansion of infrastructure, and the institutional adoption to evaluate Sol 90 days The path is amid a historical wave of companies ’adoption and accelerating the maximum momentum towards the highest level ever.

Technical explosion: maximum momentum tests are $ 210 for psychological level

The current Solana price for 204.15 dollars It reflects the explosive daily gains +4.31 %Impressive completion 26 % A weekly increase towards January’s high lands at all.

Huge 11.24 dollars Domain inside the day represents 5.5 % From the current price, indicating the convergence of institutional accumulation and FOMO retail trade during the historical acceleration of companies ’adoption.

RSI in the maximum 82.22 The level displays major warning indicators that require tactical awareness, as the historical analysis shows above the above. 80 Usually, corrections are preceded 10-15 %.

However, the cabinet’s catalyst for companies creates different dynamics from the traditional gatherings that are driven by retail, which may maintain momentum for a long time.

MACD indicators offered exceptionally, with a positive graphic drawing in 6.60, Confirm increase momentum instead of exhaustion.

The group creates a dual scenario where Seoul achieves either a decisive interruption above 210 dollars The psychological level or tests a health decline towards 190 dollars – 195 dollars The level of support before resuming its continuation.

Treasury Nubia: Public companies adopt infrastructure

The cabinet of companies reached an unprecedented range with many public companies at the same time accumulating Sol to diversify the public budget.

The Defi Development has been collected approximately 1 million Sol symbols estimated at approximately 200 million dollars.

Sol, NextGen Digital and Bit Mining strategies have joined the corporate credit wave, creating sustainable demand dynamics that exceed speculative trading patterns.

The timing of companies adopting coincides with the technical collapse of Solana, creating an ideal storm for the ongoing institutional flows, as it embraces traditional funding infrastructure with high performance.

Unlike FOMO retail cycles, the corporate cabinets adopt a continuous demand to support higher assessment floors.

Infrastructure expansion: Metamask and Nasdaq vision

Transak Integration The Sol Fiat on Metamask Gate is a milestone in access, providing main users directly to Sol through familiar interfaces.

Infrastructure development removes these technical barriers that prevent the adoption of the broader institutional institutions and retail for Solana Ecosystem applications.

Jito Labs’s suggestion to convert Solana into the decentralized nasdaq through “through”Bamy“Marketplace shows an ambitious vision to replace the traditional financing infrastructure.

The concept of decentralized exchange lay as a basis for financial markets from the next generation, which requires performance at the institution level.

Historical context: approaching the lands of January

Soul’s increase towards 204 dollars It is close to a major psychological area, near the highest level in January 295.83 dollars.

the 31 % The opponent provides the ATH dynamics of risk bonus, while the current momentum indicates the possibility of the highest new standard during the acceleration of companies ’acceleration.

the 109 % Healing from April 95.26 dollars The lowest levels showing strong institutional flexibility and confidence building throughout the correction cycle.

Support and Resistance: EMA is a force that verifies the location of companies

Immediate support appears at the lowest level today 193.75 dollarsEnhanced with myself support in 190.00 dollars – 195.00 dollars.

Ema mode, with prices 21-27 % Above all, the main averages of movement emphasize the success of companies’ accumulation and check the power of unusual trend.

The main support extends through 20 days EMA in 170.71 dollars And the EMA group in 158.51 – 161.23 dollarsProviding multiple safety networks during any correction periods.

This support structure appeals to the management of the tank risk of companies, and requires protection on the negative side specified during the stages of institutional accumulation.

The main resistance begins at the height of the day 204.99 dollarsFollowed by psychological resistance in 210.00 dollars – 215.00 dollars.

Fractures above this area, despite the extremist RSI, indicates a continuing momentum towards extreme resistance in $ 253.00 – $ 260.00, It represents a way to the highest new level ever.

Market standards: The historical volume verifies the health of companies

Solana maintains 108.59 billion dollars Market value with exceptional 24 hours Trading 14.36 billion dollarsHe represents enormous 38.29 % leap.

Caping the sound to the market from 13.17 % It refers to the participation of intensive companies and institutionalism, and verifying the validity of the collapse.

The sound pattern supports this continuous momentum instead of fatigue, although the extremist RSI requires artistic monitoring.

Market dominance 2.75 % With supplies circulating from 538.04 million Sol provides the features that it controls and which appeals to the cabinet strategies for companies, while maintaining adequate liquidity for continuous institutional participation during appreciation courses.

Moon data reveals an exceptional community participation with access to Altrank 33Noting the strong social performance between the main cryptocurrencies.

the 82 % Positive feelings with 41.45 million The total links shows the ability of Sol to attract tremendous attention during periods of adoption of companies.

Social dominance 9.2 % with 160.32k Reminded and 35.37k Creators are verifying the interest of the community on the adoption of the Ministry of Treasury for companies and infrastructure development.

Modern topics focused on price goals $ 250-400 dollars Institutional verification, instead of speculative trading.

The resonance of the Treasury Ministry’s account of companies is strongly frequent with members of society who are looking for basic value drivers who go beyond trading speculation, which indicates maturity towards an investment thesis focused on benefit that supports continuous institutional sites.

Sol price expectations for 90 days

The Ministry of Treasury accelerating companies (bull issue – 45 % probability)

The continued adoption of the corporate treasury, along with successful 210 dollars The outbreak, the estimate can be pushed towards 250 – 280 dollarsHe represents A2-32 % upside down.

This scenario requires sustainable institutional location and infrastructure development while confirming the size above the current levels.

The technical goals include $ 220and $ 240And $ 270 Based on the momentum of the adoption of companies and historical resistance patterns.

The expansion of the infrastructure and the validity of the cabinet can attract additional institutional capital that seeks high -performance Blockchain exposure.

High purchasing unification (base case – 40 % probability)

A health withdrawal from the levels of extremist relativity index towards 190 dollars – 195 dollars It can extend 2-3 weeks While the location of the companies develops gradually.

This scenario allows the reset of technical indicators while maintaining the momentum of the adoption of companies and ensuring the integrity of the EMA support structure.

Support in the EMA group around it 170 – 180 dollars It is likely to hold during the unification, with the normalization of the size around it 10-12 billion daily.

The risk of technical correction (bear condition – 15 % probability)

Break 190 dollars The support level can lead to a deeper correction, and may reach 170 – 180 dollarsIt represents a 10-14 % The downside.

This scenario will require a wider market weakness or disappointments in adopting companies that affect institutional confidence.

Limit the strong trends of companies and infrastructure development trends from extreme negative side scenarios, with great support from scenarios 170 – 180 dollars Providing the basis for future recovery sessions during continuous institutional verification.

Sol expectations: high -performance infrastructure that meets the transformation of companies

Solana’s current situation reflects the convergence of technological excellence, the authenticity of the cabinet of companies, and the expansion of infrastructure during the optimal institutional adoption conditions.

The 42-metric analysis reveals the presence of Blockchain in a position in a historical turning between experimental technology and corporate infrastructure standard.

The immediate path requires a decisive interruption above 210 dollars Resistance to accelerate momentum towards $ 250 The area, which represents the next main Seoul teacher.

From there, the continuous treasury Ministry’s flows can pay $ 280–$ 294 (Previous ATH) as Fomo is accelerated.

However, failure to withstand the above $ 200 Support will lead to good health 10-15 % revision 170 – 180 dollars The scope, and create an opportunity to re -enter the optimal entry before it pushes the next adoption wave to the company Sol towards new levels at all above $ 300.

https://cimg.co/wp-content/uploads/2025/07/22205953/1753217992-chatgpt-image-jul-22-2025-03_58_49-pm_optimized.jpg

2025-07-22 21:00:00