The federal reserve is scheduled to leave interest rates without change amid economic uncertainty star-news.press/wp

The Federal Reserve (United States) (United States) will announce the interest rate decision Policy statement was published after the July Policy meeting on Wednesday.

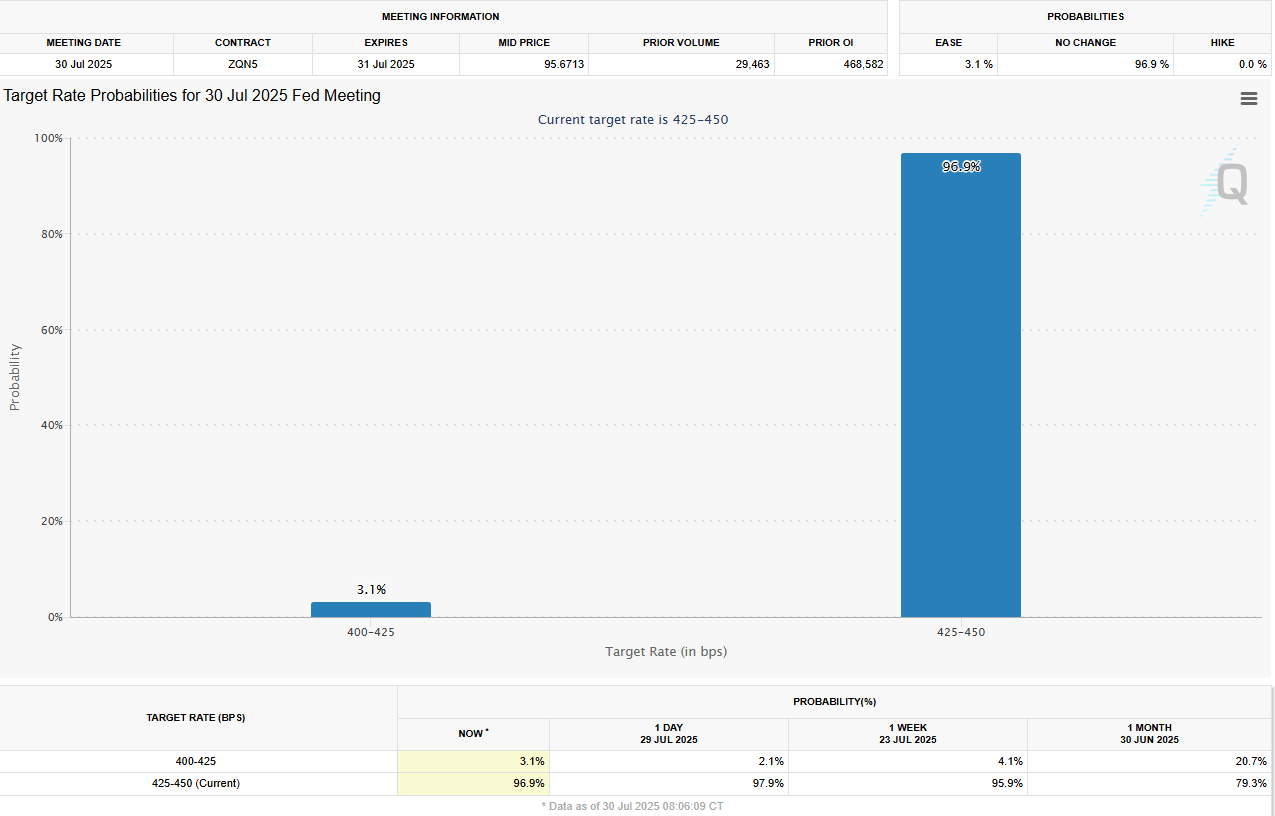

Market participants are widespread that the US Central Bank leaves policy settings unchanged for the fifth consecutive meeting after a 25 -point interest rate (BPS) was reduced to a range of 4.25 % -4.50 % last December.

There is no reduction in the horizon of federalists?

The CME Fedwatch tool shows that investors see almost no opportunity to reduce average in July, while pricing is about 64 % of the possibility of reducing 25 basis points in September. This market site indicates that The US dollar faces a risk in two directions He is heading to the event.

The revised summary of economic expectations (SEP), which was published in June, showed that policy makers’ expectations involve 50 basis points of price cuts in 2025, followed by a reduction of 25 basis points in 2026 and 2027.

Seven of 19 FBI officials did not succeed in the absence of discounts in 2025, two sees one pieces, eight of the expected, and two expectations three discounts this year.

After the June meeting, Federal Reserve Governor Christopher Waller expressed his support to reduce the July rate in its general appearance, on the pretext that they should not wait until the labor market faces trouble before diluting policy.

Likewise, Federal Reserve Governor Michelle Bowman said it was open to reduce prices as soon as the pressure of inflation remains present.

Meanwhile, President Donald Trump has extended his attempts to pressure the US Central Bank to reduce interest rates in July.

While addressing journalists alongside British Prime Minister Kiir Starmer on Monday, Trump repeated that the American economy could be better if the Federal Reserve reduces prices.

“FOMC is expected to maintain its position on policy without changing next week, as the committee maintains rates of 4.25 % -4.50 %,” TD Securities analysts indicated. “We expect Powell to repeat Powell his sick political position that relies on data while maintaining flexibility about the next step for the committee in September. We believe that two opponents, from the conservative Buman Waller, are likely to be at this meeting.”

When will the Federal Reserve announce its interest rate of interest and how can it affect the US/USA dollars?

The Federal Reserve is scheduled to announce the interest rate decision and publish a monetary policy statement on Wednesday at 18:00 GMT. This will follow the press conference of the Slow of the Federal Reserve, Jerome Powell at 18:30 GMT.

In the event that Powell leaves the door open to reduce the rate in September, pointing to the diluted uncertainty after the United States reached commercial deals with some of the main partners, such as the European Union and Japan, the US dollar can be subjected to a renewable sale pressure with an immediate reaction.

Erine Singozer, an analyst at the European session in FxstreeetProvides short -term technical expectations for EUR/USD.

“Technical expectations in the short term indicate the accumulation of a declining momentum. The RSI Index Index (RSI) remains on the daily chart less than 50 and euro/the United States less than the simplely simple moving average (SMA) for the first time since late February.”

On the contrary, the US dollar can collect force against its competitors if Powell repeat the need for a patient approach to give politics, highlight the sticky readiness readings in June and relatively healthy labor market conditions.

In this scenario, investors can refrain from pricing a reduction rate in September and are waiting for new inflation and employment data.

“On the negative side, 1.1440 (Fibonacci 23.6 % of the decline level from February to July) corresponds to the next support level 1.1340 (100 days SMA) and 1.1200 (20 SMA), 1.1830. 1.1900 (fixed level, round level), Singozer said.

The Federal Reserve is scheduled to leave after interest rates unchanged amid economic uncertainty for Beincrypto.

[og_img]

2025-07-30 13:28:00