Ripple chooses 43 trillion Titan for Stablecoin Reserves | News of the United States star-news.press/wp

Welcome to Mooring Crypto News – the main blaming of the most important developments in encryption for next day.

Drink coffee and settled to catch up on the big Ripple step. This is the main encryption player with the headlines with the Wall Street alliance, which can reshape the future of digital financing.

Crypto News of the Day: Ripple chooses the giant Wall Street to protect RLUSD reserves

Ripple selects New York Mellon Corporation (BNY Mellon) as the primary guardian of RLUSD reserves. This step is designed to expand digital financing at the institution level.

BNY, with more than $ 43 trillion in assets below SponsorshipRipple will also provide banking services to support RLUSD operations.

While the news broke out on July 9, the deal occurred on July 1, reflecting the Ripple ambition to fed the traditional financing (Trafi) and Blockchain Innovation.

RLUSD is the dollar -backed Stablecooin, which was approved in December. It is issued under the New York Financial Services Charter (NYDFS), which was developed as an institutional class designed for interest, not speculation.

Ripple described the partnership as “a joint commitment to building the infrastructure for the future of financing.”

Cooperation comes at a time when Ripple increases its organizational imprint in the United States, including its latest application to obtain a national banking license supervised by the Currency Observer Office (OCC).

“BNY gathered a clear custody experience and a strong commitment to financial innovation in this rapid variable scene. Their approach to thinking forward makes them the perfect partner for Ripple and RLUSD,” Read Excerpt in this announcement, which was martyred by Jack McDonald, from Stablecoins.

RLUSD 1: 1 is supported by high -quality liquid assets, including cash, rewards, and US cabinet. In the recently, the United States Check News, Bitcoin Maxi Max Keizer highlighted the use of the American Treasury between Stablecoin.

At the same time, the RLUSD design is characterized by strict reserve management, independent reviews, clear recovery rights and full asset separation, which meets the expectations of user and institutional organizers alike.

Besides BNY Melon, Bnand Financial Swiss Amina Bank also offers RLUSD nursery for Ripple.

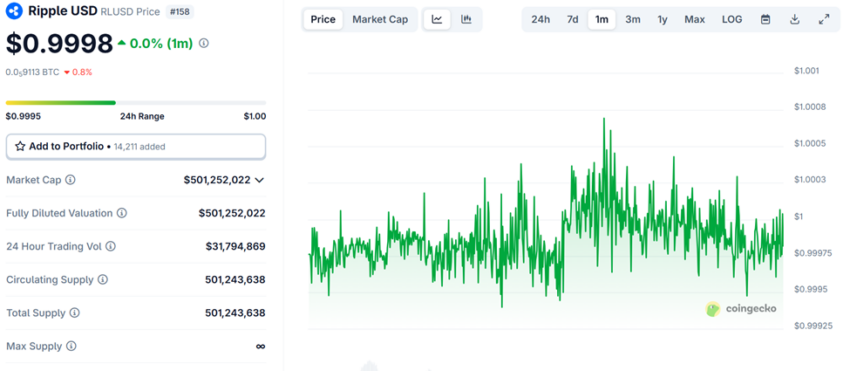

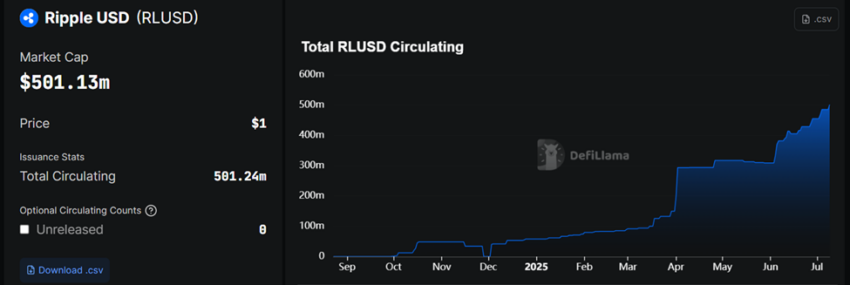

RLUSD RLUSD exceeds $ 500 million in the circulating offer

Meanwhile, the Ripple decision to secure the Wall Street infrastructure comes in the wake of a major landmark. The circulating offer in Rlusd Stablecoin rose after $ 500 million, just seven months after launch.

It was released on both LEDGER and Ethereum XRP, RLUSD was first offered in December 2024. It has quickly became one of the best $ 20 of the cets.

Beincrypto, who stands in the 16th position on Defillalama to this lines, stands, Beincrypto recently reported RLUSD from Ripple as the fastest growing in June after 47 % increased in that month.

According to Coingecko DataThe original sees about 26 million dollars in the daily trading folders, supported by the time of demand for institutional payment and across the borders. To this writing, the trading volume sits shyly of $ 32 million.

The increase in adoption is in line with a wider direction, with the swelling of the Stablecoin market to more than $ 255 billion. The distinctive symbols associated with US dollar account for more than 95 % of this number.

The growth of RLUSD reflects the growing confidence in the organization that focuses on institutions at a time when major institutions explore distinguished financing.

Today’s scheme

Alpha

Here is a summary of more American encryption news that must be followed today:

- Feat thems are used to put a claim of MT. Gox’s Lost 80,000 Bitcoin.

- Why can Trump’s runner -your mosa go up to Bitcoin.

- Ripple CEO is heading to Capitol Hill while Senate discusses the future of Crypto.

- Fidelity feeds ethereum buzz, but Bitcoin sells Risk Stalls Eth Rallly.

- Bitcoin is preparing to compress the supply while mining workers and Hodlers lower.

- Public companies believe that stock prices are rising because investment strategies in Ethereum pay their fruits.

- Is Elon Musk right to criticize the growing roof of debt and bet on Bitcoin?

- Solana Beats Ethereum and Tron with $ 271 million in the revenue of the second quarter network.

- The report reveals that the prevailing financial publications have greatly ignored Bitcoin in the second quarter.

Overview of stocks before the market

| a company | At the end of July 8 | A pre -market overview |

| Strategy (MSTR) | $ 396.94 | $ 399.03 (+0.53 %) |

| Coinbase Global (Coin) | 354.82 dollars | 357.00 dollars (+0.61 %) |

| Galaxy Digital Holdings (GLXY) | 19.46 dollars | $ 19.50 (+0.21 %) |

| Mara Holdings (Mara) | 17.52 dollars | $ 17.70 (+1.03 %) |

| Riot control platforms (riot) | 11.57 dollars | $ 11.70 (+1.12 %) |

| Core Scientific (Corz) | 14.02 dollars | 14.18 dollars (+1.14 %) |

Ripple Post 43 trillion Titan Choose for Stablecoin Reserves | Crypto news first appeared to us on Beincrypto.

[og_img]

2025-07-09 14:30:00

Your digital dollars are protected …

Your digital dollars are protected …

(Tokeenseminal)

(Tokeenseminal)