Japan is widely preparing for encryption policies star-news.press/wp

The Japanese Financial Services Agency (FSA) prepares comprehensive changes on the framework of digital assets. The changes, which combine tax repairs and organizational promotions, can provide the exchange funds on the stock exchange (ETFS) associated with encrypted currencies.

The initiative refers to Japan’s intention to integrate encryption into prevailing financing and attract wider investments.

The tax burden is under review

The reform package, at the local level, includes two main parts. First, it consists of a review of the tax law that would transfer encryption from comprehensive taxes to the same category as stocks. Second, it includes a legal amendment to re -classification of encryption as a financial product, which allows the Federal Communications Committee (FSA) to implement the trading rules from the inside, the standards of detection and protection of investors under the Financial Tools and Stock Exchange Law.

Currently, Japan is taxes on encryption gains as a “diverse income”, with progressive rates that can exceed 50 percent once the local fees are included. Instead, stocks and bonds are subject to a 20 percent fixed tax.

according to NikkiFSA suggested moving encryption in the 20 percent system in 2026. Investors will also be able to move forward for three years. Officials believe that parity with stocks will reduce the burden of investors and increase market activity.

Organizational transformation to enable the circulating investment funds

The second column of FSA includes the amendment of the Securities Law for Crypto Classification as a financial product. This would wipe the path of investment funds circulating in encryption, including instant bitcoin funds, which are still not available in Japan. Observers argue that ETFS can provide an organized options accessible to investors while increasing the market transparency.

According to Beincrypto, the agency also plans to restructure internal, creating an office for digital financing and insurance. This reflects how encryption has become intertwined with wider financial systems, which requires steady supervision.

The history of Japan with encryption shows both risks and flexibility. In 2014, MT. was addressed Tox, based on Tokyo, is more than 70 percent of the global bitcoin deals before collapse. The organizers have included lessons from this crisis into strict frameworks today.

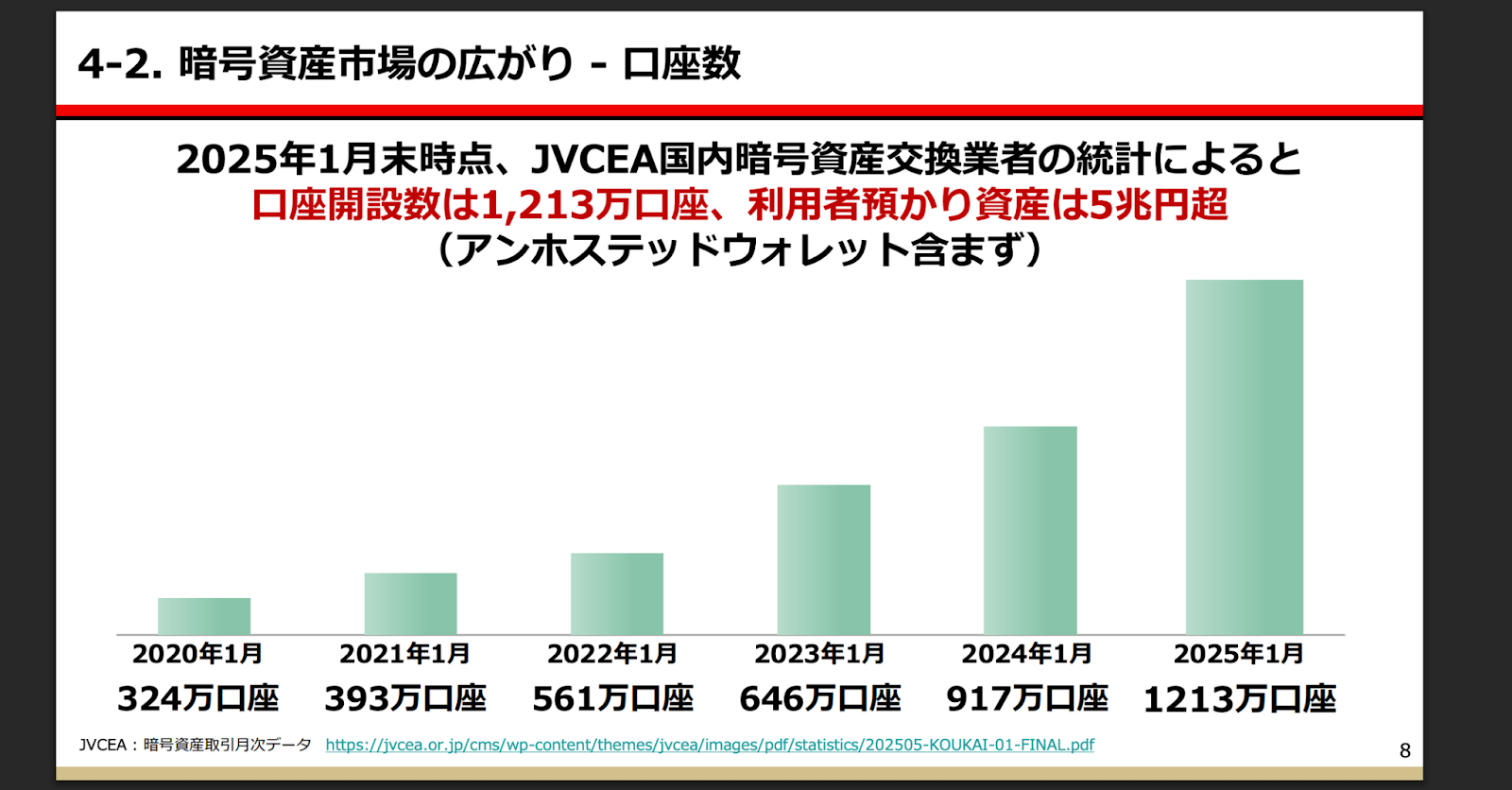

The momentum has since turned towards constant but constant growth. The Vice President of the Crypto Business Association in Japan has documented the global market from $ 872 billion to $ 2.66 trillion. On the other hand, the local trading volume in Japan advanced from $ 66.6 billion in 2022, and is expected to double to 133 billion dollars. This confirms that although the adoption of companies is accelerating, retail sharing remains defeated.

88 % of citizens never have Bitcoin currency

A survey conducted by the Cornell Bitcoin Club, which was cited by Documentbtc, found that 88 percent of the Japanese population never owned Bitcoin. Analysts suggest that the tax burdens and organizational uncertainty have stopped adopting the wider family. FSA reforms aim to address these barriers by simplifying tax transaction and providing reliable ETF structures.

Institutional interest, however, rises. Joint Survey before Nomura Holdings Digital laser revealed that 54 percent of Japanese institutional investors are planning to invest in encryption assets within three years, with 62 percent of the benefits of diversification. the FSA The results were also published, noting the preferred allocations of 2-5 percent of the assets under management. The results shed light on the preparation among the main financial players to embrace the traded investment funds as soon as the organizational conditions allow.

Reforms are in line with the “New Capitalism” agenda in Japan, focusing on the growth -led growth growth. By clarifying the legal framework and reducing tax burdens, officials hope to encourage families to treat digital assets as part of long -term portfolios instead of purely speculative bets.

Post -Japan is a major adjustment to the encryption policies first appeared on Beincrypto.

[og_img]

2025-08-23 04:30:00