GOP refers to the Tax Cut Strategy and Medicaid Tkurit through a Senate Budget star-news.press/wp

Washington – Senate Republicans managed to move on to their mass budgetary plan on Thursday evening, but not before an unexpected delay caused by some concerns about their tax reduction and potential reduction strategy.

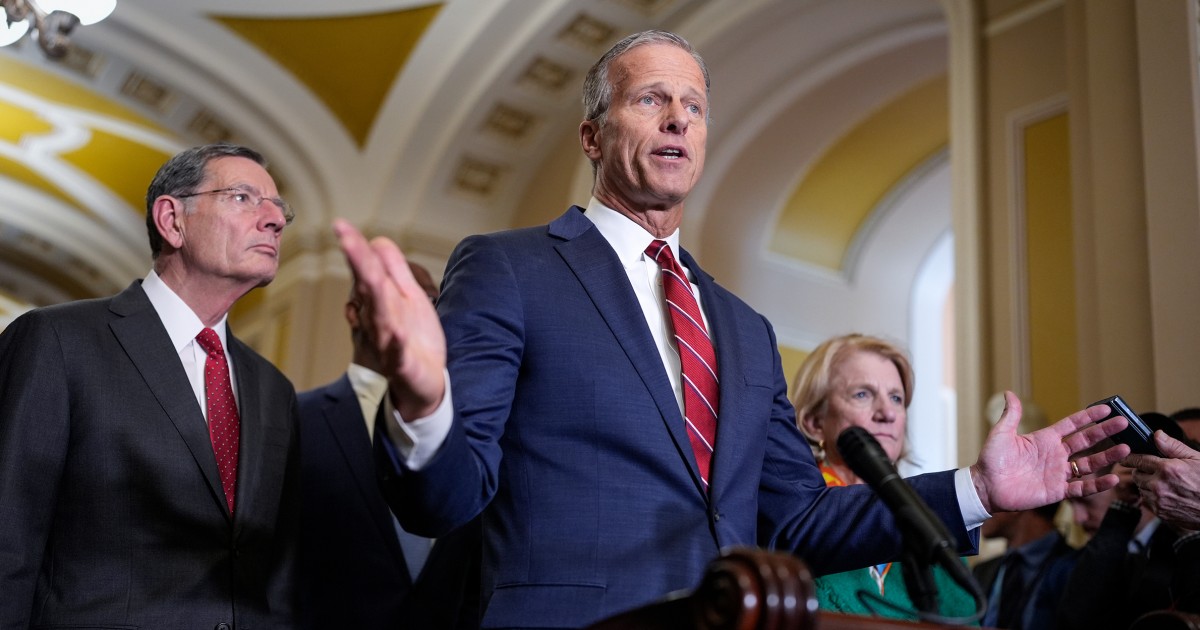

The delay happened as these Republicans met with the Senate leader most John Thunea, Rs., To talk to their concerns.

Some centrist senators take care of the budget change, the party is used to pricing the NULT Dollar President Donald Trump, in which 4.6 trillion in the amount of 4.6 trillion in the amount of 4.6 trillion.

Republicans delay counting on the issue after killing the parliamentary senate to the question of whether they can use the “current policy” basic line for the treatment of Trump 2017, which expired this year. But that means that the move could be caused later, and would potentially blew up the account if the parliamentary rules against him – unless the Senate votes are overcome, which some compared to some of the rules for targeting 60 votes.

The clergy of the Republicans are concerned about asking them to do so later in the process.

“I’ll just say and say that I would never vote that I can undo parliamentary” “Susan Collins, R-Maine, one of the senators met with Thuna, said NBC News.

And Thuns insists on the insistent republicans are just followed by law, because he expects to work through discussion, amendments and approve the resolution this weekend. That would be just the beginning of the process.

“We wouldn’t move forward if we didn’t think we were clearly following the law, the Budget Act,” Thune said. “We have long ways to go. But you know, the model we chose to continue, think that all the boxes are checked.”

Thune said “heard people and obviously giving them a chance for one, explain his concerns and hope that they answered some questions and just make sure everyone had the level of comfort with you, doing.”

Chairman of the Board of the Senata Lindsey Graham, RS ..

“It’s not her decision, it’s mine,” he said.

Graham said that as long as there was 51 Senate votes to use that budgeting method, it is all that matters. And if not? “Then that approach would fail. And that the party would not suffer because I think the current policy is good policy for the economy. I think that President Trump wants,” he said in an interview.

Did not say what will happen if democrats request parliamentary to expect and she rule against the GOP approach, saying only to doubtwith It will happen.

Another Senator, Josh Hawley, R-Mo. He said “great concern” in connection with Medicaid Kochams – and was directly taken by Trump in the evening before the vote.

“I said there was this language in the account. And he said,” Chamber will not reduce the medical benefits under any circumstances, they will not reduce the medical benefit and I will not sign the intersection on Medicaid. “So that’s good, and I hope our leadership will take over that sign,” Heawley told reporters before the vote.

Twenty-one percent “My Medicaid Prima Medicaid – Chip I’m clearly not to vote for Medicaid Shees. And it is a presidential insurance tonight, saying it was certified to completely voted to start the process.

It’s easier to say than to do. The budget approved to the house, which Trump approved, mathematically impossible for Republicans to achieve its goals without cutting Medicare or Medicaid. MPs say they want to reduce waste and fraud, along with the imposition of a potential MEDICAID work requirement. They did not identify ways to reduce consumption.

Overall, GOP leaders say they want to find trillion dollars in reducing spending to equalize the balance on the other side of their tax breaks, as well as spending on the saying of immigration implementation and army.

Buy they still lack a consensus about what needs to be reduced.

Other Republicans remain optimistic that it will work.

Sen. Mike Round, Rs., Who did not attend the meeting on Thursday evening, said the leadership “not the twisting of weapons”, but “Some people wanted to understand how they understood those people who were very familiar with that and passed it a little longer.”

2025-04-04 15:55:00