Bitcoin 42 SCINAL Analysis flags from ChatGPT critical test 121 thousand dollars after 123 thousand dollars at ath ath ath star-news.press/wp

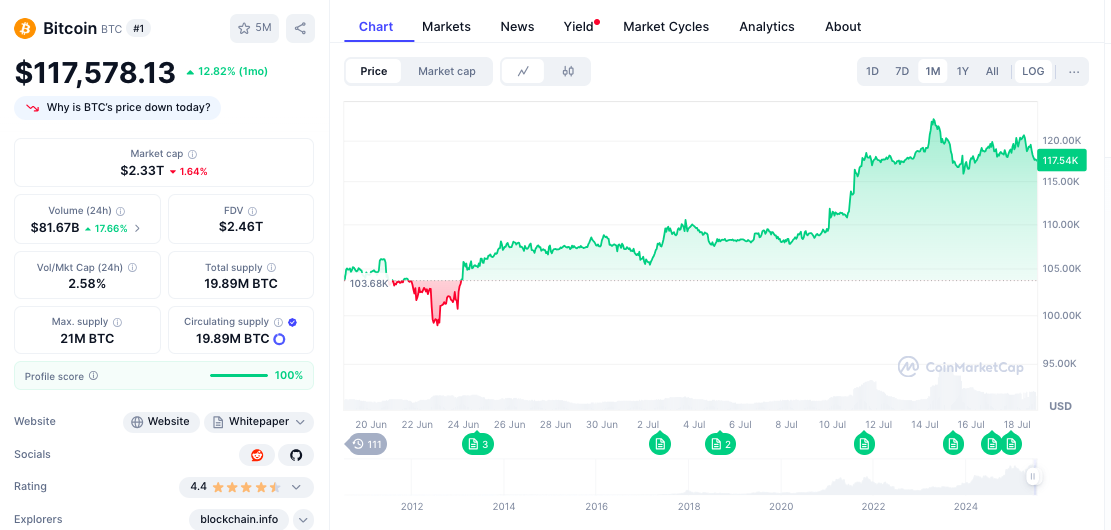

The AI Model from Chatgpt has been treated 42 Live indicators, reveal momentum as monotheism as Bitcoin He carries 117,600 dollars Historical 123,091 dollars Alia (ATH) was achieved in July 14with -1.32 % Daily decline testing whether the gathering represents the beginning of the bull market or the peak depletion.

Trading above all EMAS while RSI is in good health 64.37 It is proposed to reset a technology amid uncertainty in the status of institutions.

A strong structural basis appears, with the price 16.9 % above 200 days EMA (97,723 dollars), While MACD maintains the upscale momentum despite the decline from the historical highlands.

The market cover stands at 2.34 trillion dollars, With a daily size of 82.25 billion dollars, While Charles Schwab calls Bitcoin and “Genius’s Law” for Trump opens a 9 trillion dollars The retirement market for encryption investments.

The following analysis plans Chatgpt’s 42 Technical indicators in actual time, retirement market developments, institutional adoption acceleration, and the high historical effects of BTC’s evaluation 90 days The path is in a critical turning point that determines whether the continuation or correction will occur.

Technical crossroads: Historical decline tests in the classroom market

The current bitcoin price for 117,600 dollars It reflects a minor 1.32 % The daily decrease from its highest level ever 123,091 dollarsIt was achieved in July 14On the occasion of the stage of critical unification.

the $ 3,505 Domain inside the day represents 3.0 % From the current price, which indicates the fluctuations that it controls during periods of adjusting the institutional position.

Rsi and 64.37Healthy leveland It provides optimal sites with a space for a continuous estimate without fears of his arm, indicating a technology reset rather than reflection of the direction.

These sites indicate a sustainable structure in the bull market instead of high fatigue, although it is a decisive action above 121 thousand dollars Resistance is still crucial to verify health.

MACD indicators show a strong upward momentum, with a positive graphic drawing in 2,836.92, Confirm inherent strength despite the short -term decline.

A combination of RSI healthy location and powerful MACD signals creates an ideal setting to continue to do so 125 thousand dollars -127 thousand dollars Objectives as soon as the merger is completed.

Retirement Market Revolution: “Act Genus Act” for Trump’s 9 trillion dollars portal

President Trump’s planned signature on the “genius law” is a revolutionary incentive that opens 9 trillion dollars The American retirement market for Bitcoin and Cryptocurrency Investments.

This development can lead to an unprecedented institutional demand 401 (K) Retirement funds are gaining organizational approval to allocate digital assets.

The integration of the retirement market addresses the previous organizational barriers that prevented institutional participation, creating demand drivers of the subordinate to speculative trading.

Vocational pension managers, who are subject to credit compliance, are now a regulatory framework for bitcoin customization for their wardrobe.

Charles Schwab’s launch of Bitcoin and Ethereum Trading services is validate to embrace the encrypted currency infrastructure.

the 10 trillion dollars The entry of the asset manager provides credibility and attracting conservative institutional capital, which was previously excluded from direct exposure to the encrypted currency.

Market dominance: Altcoin season speculation

Market dominance on bitcoin, in 60.86 %It shows a slight decrease as the speculation of the Altcoin season is intensified after a high btc.

This shift in dominance creates a dual scenario in which Bitcoin maintains its leadership or capital transformations towards altcoin alternatives.

The dominance of BTC, which falls “difficult”, according to analysts, refers to a major interest season in the coming as the high -performance institutional capital is exploring.

It has previously historically spinning a large altcoin estimate, while Bitcoin enhances its gains.

Historical context: ATH achievement creates a psychological turn

July Bitcoin 14 The highest level of 123,091 dollars It represents the culmination of the momentum of the institutional adoption that was building all the time 2021.

present 4.36 % The ATH discount provides an attractive location while maintaining the psychological importance of achieving historical penetration.

the 15 % Appreciation from June 108,799 dollars Close explains the ongoing institutional demand despite uncertainty in the broader market.

The high historical achievement creates a psychological turning point where Bitcoin leads to the validity of a new evaluation model through continuous estimate or experiences to correct as early adopters.

the next 30-60 days It remains decisive to determine the long -term path.

Support and Resistance: EMA power provides the foundation

Immediate support appears at the lowest level today 117316 dollarsEnhanced with myself support in 115,000 dollars -116,000 dollars.

Ema mode, with prices 3-17 % Above all, the main moving averages emphasize the success of institutional accumulation and verify the health of the trend.

The main support extends through 20 days EMA in 113,968 dollars and 50 days EMA in 109338 dollarsProviding multiple safety networks during any correction periods.

The support structure appeals to this institutional risk management, as it requires protection on the negative side specified during the historically high evaluation levels.

The critical resistance begins at the height of the day 120,821 dollarsFollowed by psychological resistance in 121,000 dollars -122,000 dollars.

A fracture above this area would refer to the continuation of the large resistance in 125,000 dollars -127,000 dollars, The upcoming institutional profit levels and psychological teacher are.

Market standards: Checking the health of the institution maintains momentum

Bitcoin maintains a historical 2.33 trillion dollars Market value, strongly accompanied 24 hours Trading 81.67 billion dollarsAnd, which represents the institutional verification of its store status at unprecedented levels.

the 18.9 % Increased size shows continuous professional participation despite the decline from the heights.

Trading offer from 19.89 million BTC represents 94.7 % From the maximum 21 million The offer, which creates increasingly raising gesture dynamics of the institutional closet customization strategies.

It is close to approaching the maximum intensification of arguments, deviation in favor of distinguished assessments.

Current pricing 4.36 % Less than its highest level ever 241,999,061 % gains from 2010 Its lowest levels, providing a convincing institutional narration for continuing appreciation.

This profile appeals to the risks of professional investors who seek to be exposed to a value -fixed digital store with organizational clarity.

Moon data reveals the participation of mixed society with Altrank’s rejection to 763 With preservation 81 % Positive feelings.

the 130.79 million Total connections with 385.92k Signs indicate that Bitcoin’s ability to attract attention during historical periods.

Social dominance 18.85 % With the decrease in the participation of creators indicates uncertainty in society about the direction after the high historical achievement.

Modern topics focused on the possibility of the Altcoin season and the validity of the institutional adoption, instead of the BTC.

Feelings section between 81 % Positive expectations and decrease in the scales of participation reflect the uncertainty in the market wider about whether the historical highlands represent a continuation or culmination of the current session dynamics.

BTC price expectations for 90 days

Institutional momentum continues (bull issue – 40 % probability)

The integration of the successful retirement market and the adoption of Charles Schwab can pay the continuous appreciation towards 130,000 dollars-140,000 dollarsHe represents 11-19 % upside down.

This scenario requires a fracture above 121 thousand dollars Resistance and confirmation of continuous institutional sites.

The technical goals include 125 thousand dollarsand 130 thousand dollarsAnd 140 thousand dollars Based on psychological levels and institutional flow expectations.

The pension market catalyst can attract the huge conservative capital that is looking for digital exposure to the digital store with organizational compliance.

Historical high unification (base status – 45 % probability)

Extension unification between It can last 115 thousand dollars and 125 thousand dollars through Q3 2025, With the development of institutional sites and organizational applications are advanced.

Support in the EMA group, around it 109 thousand dollars -114 thousand dollars, It is possible that it will remain stable during monotheism, with the normalization of the size to nearly 60-70 billion daily.

This side procedure provides institutional accumulation opportunities while maintaining the ultimate continuity structure.

Correction of historical levels (bear issue – 15 % probability)

Less broken EMA support in 114 thousand dollars It can lead to correction towards 100 thousand dollars -105 thousand dollarsHe represents 11-15 % The downside.

This scenario will require great disappointment in demand or the weakness of the broader market that affects the adoption of digital assets.

Define strong institutional adoption background and organizational clarity trends, extremist scenarios, with great support from scenarios 100 thousand dollars -105 thousand dollars Providing a psychological basis for future recovery courses.

BTC expectations: digital gold meets the institutional infrastructure

The current Bitcoin location reflects the convergence of historical evaluation achievements, the acceleration of institutional adoption, and the developments of organizational integration.

the 42 Signal The analysis reveals that the cryptocurrency is placed at a critical turning point between verifying the authenticity of a new model and the requirements of monotheism.

In addition to the high historical achievement and continuous institutional interests, these developments provide persuasive arguments.

the 121 thousand dollars The resistance penetration is the final test of the new Bitcoin evaluation model after the historical achievement.

A successful penetration leads to the validity of the institutional adoption thesis and leads to its continuation 130 thousand dollars+ Goals, while failure indicates a stage of health unification before the following institutional wave.

https://cimg.co/wp-content/uploads/2025/07/18232155/1752880915-526e998d-45ef-488e-a577-2ee3db1fe73b_optimized.jpg

2025-07-18 23:26:00