Flags of BNB Signal’s 42 Signal 670 dollar analysis amid the companies’ treasury revolution star-news.press/wp

The AI Model from Chatgpt has been treated 42 Live indicators, reveal momentum as monotheism as BNB He carries 661.70 dollars Amid a historical wave of adopting corporate treasury, with more 30 BNB reserve strategies for public company.

BNB is traded within a similar triangular style, where Kraken and Backed expands the symbolic shares of the BNB series, and cancel the new Traffi/Defi flows.

Strong institutional verification appears with the completion of Nano A. $ 500 million Convertible note, targeting a 1 billion dollars BNB accumulation strategy for contract 10 % From the circulating offer.

The ceiling of the market remains in 93.8 billion dollars, With a fixed daily size of $ 1.88 billion, CZ also welcomes the shares of the BNB series while providing many cabinet projects to companies.

The following analysis plans Chatgpt’s 42 Technical indicators in the actual time, the cabinet developments for companies, the integration of distinctive stocks, and the expansion of the BNB evaluation system 90 days A path amid the public budget adoption revolution of startups.

Technical Monotheism: The identical triangle defines the penetration area

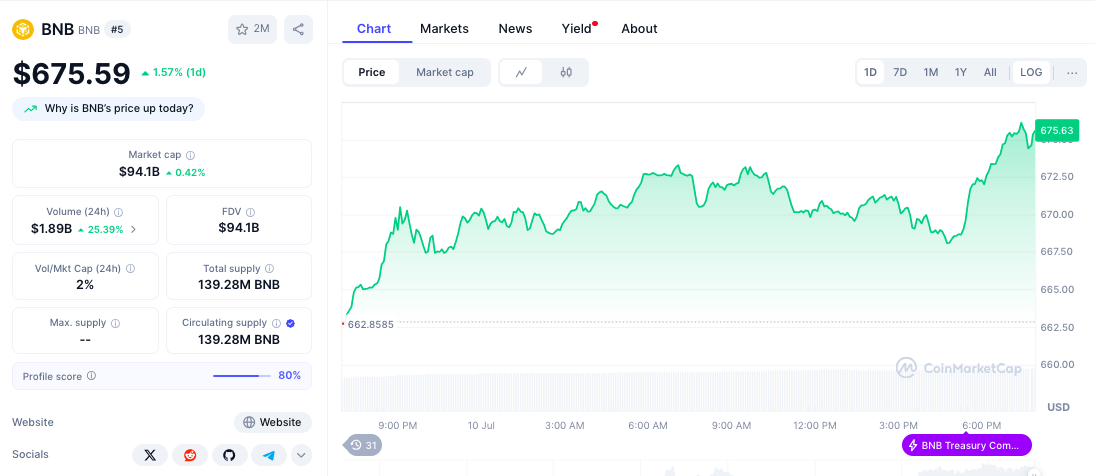

The current BNB price for 661.70 dollars It reflects modest daily gains 0.33 %Show monotheism in a fixed similar triangle style.

Trading range between $ 660 and $ 670 It creates a critical decision zone, as the penetration trend determines the next important step towards correction targets or scenarios.

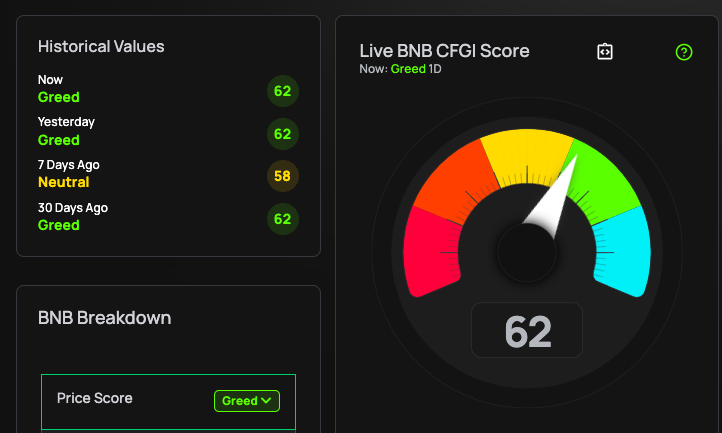

Fear and greed index in 68 (Granding) indicates a strong investor optimism without extremist levels, indicating a sustainable feeling that supports continuous upward momentum.

This provides locations with a balanced basis for hacking attempts without excessive conditions that limit the potential of appreciation.

Technical patterns show the formation of the bullish flag within a larger similar triangle, indicating a stage of accumulation that precedes an ongoing upward movement.

A mixture of monotheism and institutional verification patterns create an ideal preparation to accelerate the momentum by permanently broken resistance.

Corporate Treasury Revolution: 30+ targeting BNB Reserves team

CZ’s advertisement after that 30 The teams prepare public companies ’projects with BNB Treasury Reserves representing unprecedented verification for the adoption of companies.

This places of the BNB institutional treasury movement alongside Bitcoin and Ethereum as the institutional class reserve for the public company’s Blores.

Nano Labs completed the first BNB acquisition of the main company through 500 million dollars In convertible observations, it aims in particular the BNB’s total accumulation of 1 billion dollars.

The strategy aims to keep it 10 % From BNB, a circulating offer, which indicates an advanced institutional commitment to estimate the long -term value.

The trend of the Ministry of Treasury enhances the dynamics of sustainable demand that exceeds speculative trading, as public companies offer predictable accumulation patterns that support price stability during the fluctuation of the market.

This institutional verification is a fundamental shift towards BNB as the origin of the Basic Treasury Department.

Excellent stock integration: Trafi meets with Defi Innovation

Kraken and Packed expansion of the distinctive papers (Xstocks) to the BNB series creates a revolutionary bridge between traditional financing and decentralized systems.

This integration allows 7/24 Exposure to shares with the possibility of composing encryption, opening issues of new institutional use and the demographics of the investor.

Distinguished stock development addresses major restrictions on traditional markets by providing access to continuous trading and Defi integration capabilities.

This tradfi/Defi Contruction Series are placed as a financial services infrastructure from the next generation, which may get a large share in the market from traditional mediation platforms while expanding the scope of encrypted assets beyond the original digital assets.

Historical context: the steady recovery towards the previous highlands

BNB 2025 It shows the performance of flexibility after January 745.29 dollars The peak, with a later correction in February to $ 500.00 Create support levels.

Fixed recovery during the month of March (605.07 dollars) , April (599.68 dollars), maybe (628.36 dollars) And June ($ 657.03) Consistent accumulation patterns appear.

The current price procedure is a 16 % Divide to December 2024 The highest level 793.35 dollarsProviding attractive entry points for the adoption of the institutional treasury. The recovery is achieved in institutional attention while maintaining a space for great appreciation of the previous resistance levels.

Support and Resistance: The triangle style determines critical levels

Immediate support appears within the upscale demand bloc in 600.91 dollars -628.75 dollarsAnd providing a strong technical basis for any recovery during the unification of the triangle.

This support zone represents a major accumulation area that appeals to the requirements of institutional risk management.

Critical resistance occurs at the upper limits of a third around it $ 670-675 dollarsIt represents the level of penetration that determines the acceleration of momentum towards higher goals.

Breaking this resistance would indicate the completion of a pattern and verify the identification of institutional sites.

The main resistance is expected to extend to 698.00 dollarsand 730.95 dollarsAnd $ 746.00, Depending on the measurements of the technical style and historical levels. The ultimate goal remains the highest area around it $ 793.35, Which represents the peaks of the previous session and the fields of institutional profit.

Market standards: fixed institutional participation

BNB maintains 94.1 billion dollars Market value with consistent 24 hours Trading $ 1.89 billionIt represents a stable institutional participation. Caping the sound to the market from 2 % It indicates that the scale trading activity supports uniformity instead of the speculative surplus.

Distribution of the offer from 139.28 million BNB is the advantages of controlling the management of the institutional treasury, with a long -term shrinkage mechanism.

Equishing the maximum supply 200 million It creates the dynamics of scarcity that supports institutional accumulation strategies.

It reveals the feelings of society almost 70 % Al -Sawilahiqa, with a focus on the Treasury Ministry’s accreditation for companies and the integration of distinctive stocks, instead of speculative trading.

Social media discussions emphasize the evolving role of BNB as the origin of the Ministry of Treasury, as members of society highlight the distinctive symbol, the capabilities of the generation of return, and the expansion of the benefit of the ecological system.

The bound to adopt companies is strongly adopted with the long -term community members.

The developer and institutional participation are increasing about the integration of distinctive stocks and cabinet solutions for companies.

BNB price expectations for 90 days

The Ministry of Treasury accelerating companies (bull issue – 45 % probability)

The continued adoption of the Ministry of Treasury for companies and a successful collapse of the triangle can push the estimate towards 750 dollars -800 dollarsHe represents 13-21 % upside down.

This scenario requires multiple ads for the public company and continuous institutional accumulation, while confirming the size above $ 670 resistance.

The technical goals include $ 698and 730 dollarsAnd $ 780 Depending on the measurements of the triangle style and the momentum of the adoption of companies.

The Ministry of Institutional Treasury recounting can attract companies that focus on the return that seeks to obtain alternatives to traditional cash management strategies.

Extension of unification (basic case – 40 % probability)

The tanning uniformity continues between $ 620 and $ 670 It can extend through Q3 2025, While the Treasury Ministry is gradually evolving the adoption of companies.

This scenario allows the reset of technical indicators during the progress of institutional sites without immediate prices.

Support in $ 620-640 dollars It is likely to hold during the unification, with the normalization of the size around it 1.2-1.5 billion daily.

This side business provides accumulation opportunities for companies’ tanks that seek to obtain a strategic situation without impact on the market.

Technical correction (bear condition – 15 % probability)

Fracture under the support of the triangle in $ 620 It can lead to correction towards $ 580-600 dollarsHe represents 8-12 % The downside.

This scenario will require a wider market weakness or disappointment that builds companies that affect institutional confidence.

Challenge the background of the Ministry of Strong Treasury and the distinctive symbol of contraction, negative, extreme scenarios, with great support from the scenarios $ 580-600 dollars Providing a basis for future recovery sessions under the continuation of institutional adoption.

BNB expectations: The cabinet is distinguished in companies that meets the integration of traditional financing

The current BNB mode reflects the convergence of the Treasury Ministry’s adoption of companies, the integration of traditional financing, and technical unification.

The outbreak of the identical triangle is higher than $ 670, the final stimulus of the next main BNB move towards $ 750-800.

Failure to break the resistance leads to the unification of the extension of monotheism, while the successful penetration is validated by the location of the cabinet for companies and accelerates the institutional FOO.

It creates the convergence of technical preparation, the accreditation of companies, and the integration of traditional financing, a scenario of convincing bilateral results, as BNB confirms its first institutional development or merges until the next treasury wave is embodied.

https://cimg.co/wp-content/uploads/2025/07/10203505/1752179704-chatgpt-image-jul-10-2025-09_34_31-pm_optimized.jpg

2025-07-10 20:39:00