The correlation of the link in danger with the signs of exhaustion of the flash fee star-news.press/wp

ChainLink (Link) was one of the most powerful performance artists in the market, as he gathered more than 109 % during the past year. Even in the past three months alone, the bonding price has gained about 68.5 %.

However, last week, he revealed weakness, as the distinctive symbol indicates more than 9 %, and both standards indicate the series and artistic plans now that the upper trend that has continued throughout the year may lose Steam, at least at the present time.

The pressures of profit while holders of gains sit

One of the clearest signs comes from the percentage of supply supplies in profit, which is still hovering at high levels historically.

As of August 29, approximately 87.4 % of the offer in profit, near the last peak of 97.5 %, was seen on August 20. That peak coincided with the increase in the bonding price to $ 26.45, which quickly recovered more than 6 % to 24.82 dollars the next day.

Another look shows the same style. On July 27, the profit offer reached 82.8 %, before the link was corrected from $ 19.23 to $ 15.65, making a decrease of 19 %. Current reading near 87 % is uncomfortable again, hinting to high risk of profit.

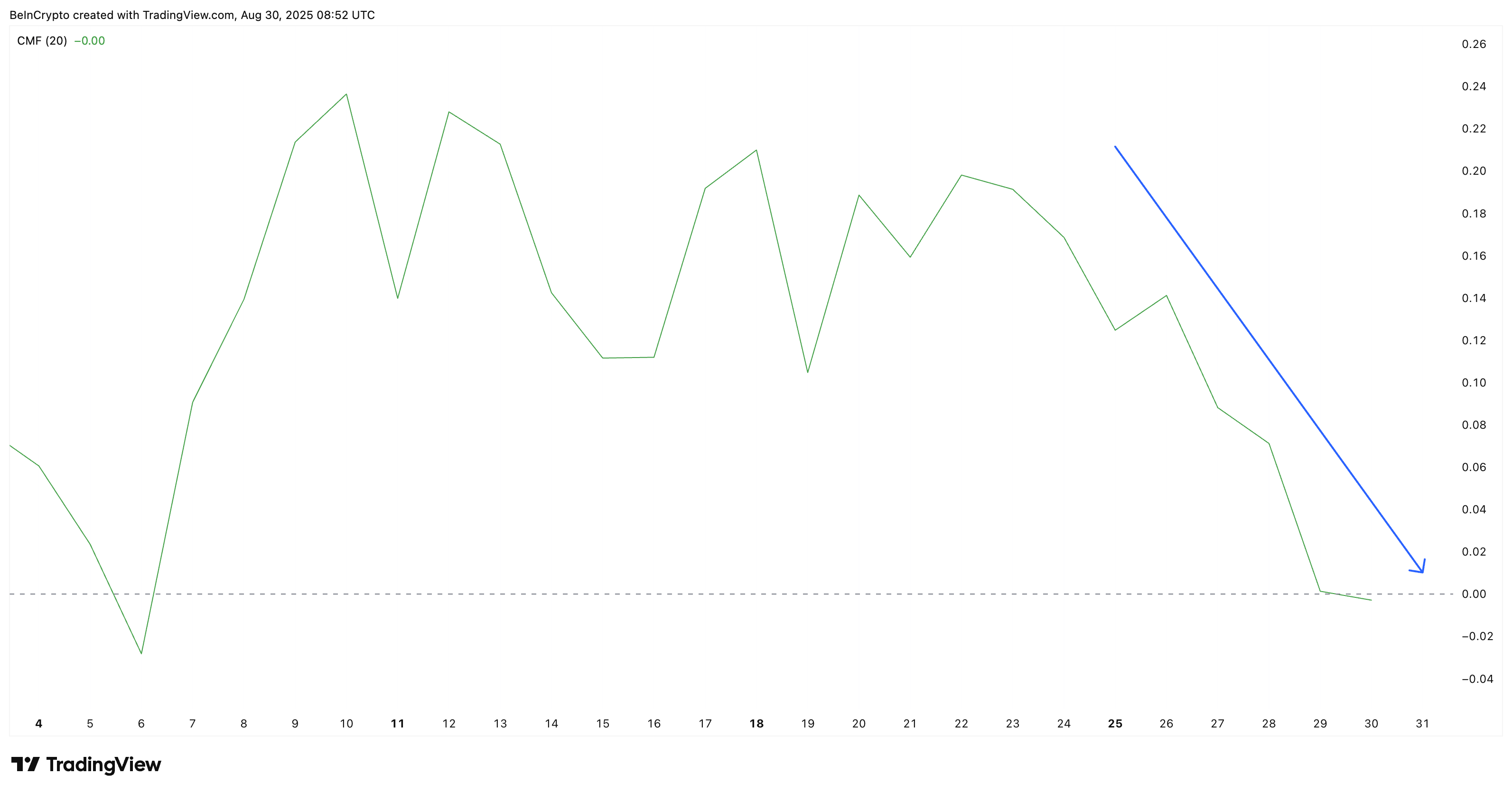

In addition, the flow of Chaikin (CMF), which tracks capital flows and external flows, has been heading down since August 22, and finally slipped to less zero on August 29 for the first time since August 6. This shift to negative land signals fade from pressure on purchase pressure and capital flows, which enhances the issue for potential withdrawal.

To get TOKEN TA and the updates on the market: Do you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Harsh Notariya newsletter here.

Prices of the price procedures for the series (LINK)

Daily chart enhances this caution. The association price is currently trading at $ 23.31, and sits in an escalating spoiler – often a structure linked to the loss of upward momentum near the end of the upper stage. This “Megaphone” is like a notorious pattern to start the dysfunction, which is now a risk of looming.

The main support for watching is $ 22.84. The decisive break that is less than this level would offer the goal of the next negative side at 21.36 dollars, and it may decrease under this that may risk a deeper decline. This can be anywhere in a range of 6 % to 19 %, as it is experienced during the peak of the local “profit”.

On the other hand, if the link price can recover $ 25.96, he may still try another higher step.

But even such a recovery will not completely turn on the signs of wider exhaustion unless the symbol is able that the distinctive symbol can break more than 27.88 dollars.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/08/chailink-price-prediction-1.png

2025-08-30 20:06:00