Can Ethereum $ 3,800 to break the next while downloading whales and institutions? star-news.press/wp

Ethereum gathered $ 3,700 earlier on August 5, with whale intensification and institutional accumulation. Can it be recovered again over $ 3800 by the weekend?

summary

- ETHEREUM is still 148 % higher than its lowest level despite the recent fluctuations.

- The new whale governor washed away more than $ 3 billion in two days.

- The uncertainty in the macro and the exterior ETF are still in the ascending ascending to the ETH.

According to Crypto.News ethereum data (ETH), the pioneering altcoin in the market increased by 5.7 % to the highest level during $ 3,730 on Tuesday, August 5, before returning to $ 3650 at the time of the press. Its price is currently 148 % higher than its lowest level per year.

The last increase comes just weeks after Ethereum attempted separation from the $ 4000 sign in late July, but it was rejected near $ 3900 due to the overall opposite winds that dealt with the appetite of institutional risks and a noticeable decline in the total value that was imprisoned through its ecological system.

Eth sees the renewal of the accumulation of whales and institutional flows

Ethereum’s recovery this week seems closely related to renewed accumulation by large whales and entities. According to data from Santiment, the number of wallets has significantly carrying more than 10,000 ETHs has grown over the past few days, indicating that adults have a potential upward trend.

Meanwhile, on August 4, newly created headlines were obtained approximately 40,000 ETH. Data From Lookonchain. The purchase trend is intensified on August 5, when three additional portfolios accumulated 63,837 ETH at a value of about $ 236 million.

In total, Lookonchain Reports More than 856,000 ETH, 14 whales, accumulated more than 856,000 ETH, at a value of $ 3.16 billion, for just two days.

This volume of accumulation, especially from new portfolios, often indicates an increasing condemnation of high -value individuals or institutional actors. These buyers usually take long -term jobs and accumulate before estimating the expected price. Their activity is also closely monitored by retail merchants, who often explain such moves as a upscale signal.

In addition to buying the whale, the institutional interest in Ethereum also gains momentum. There was a noticeable height in the cabinet and organized products stationed on ETH.

One of the most prominent developments is the Ser Strategic ETHEREUM Reserve (SER), which tracks ETHEREUM institutional possessions over the main funds, cabinet cabinet, and asset managers.

Just six weeks ago, the total SER assets under management reached less than $ 3 billion. This number has risen now More than 10.8 billion dollarsThe reserve controls 2.45 % of the total ETH supplies, up from only 1 % in June.

Contribution to this mutation, added Sharplink, a game listed on the Nasdaq Stock Exchange and one of its major owners inside SER, 18,680 ETH at a value of $ 66.63 million to the reserve on August 4. This step indicates that the corporate secretary continues to see Ethereum as long -term strategic assets.

What is the following for ETH?

Despite the accumulation of the large whale and the renewed institutional purchase, the Ethereum still lacks the momentum needed to be decisively broken in the resistance area ranging from 3800 to $ 3900.

While Fresh Capital has reinforced the market through the portfolios of the new whales and treasury allocations, these flows have not yet been translated into a widespread shift in market morale.

Last week, the circulating investment funds that focus on ETHEREUM have witnessed discounts totaling $ 129 million, indicating that the main investors are still hesitant, and the total economic uncertainty, from the risks of the trade war to concerns about the American labor market, still weighs assets.

Without a clear or short -term stimulus, the current assembly remains vulnerable to reflection.

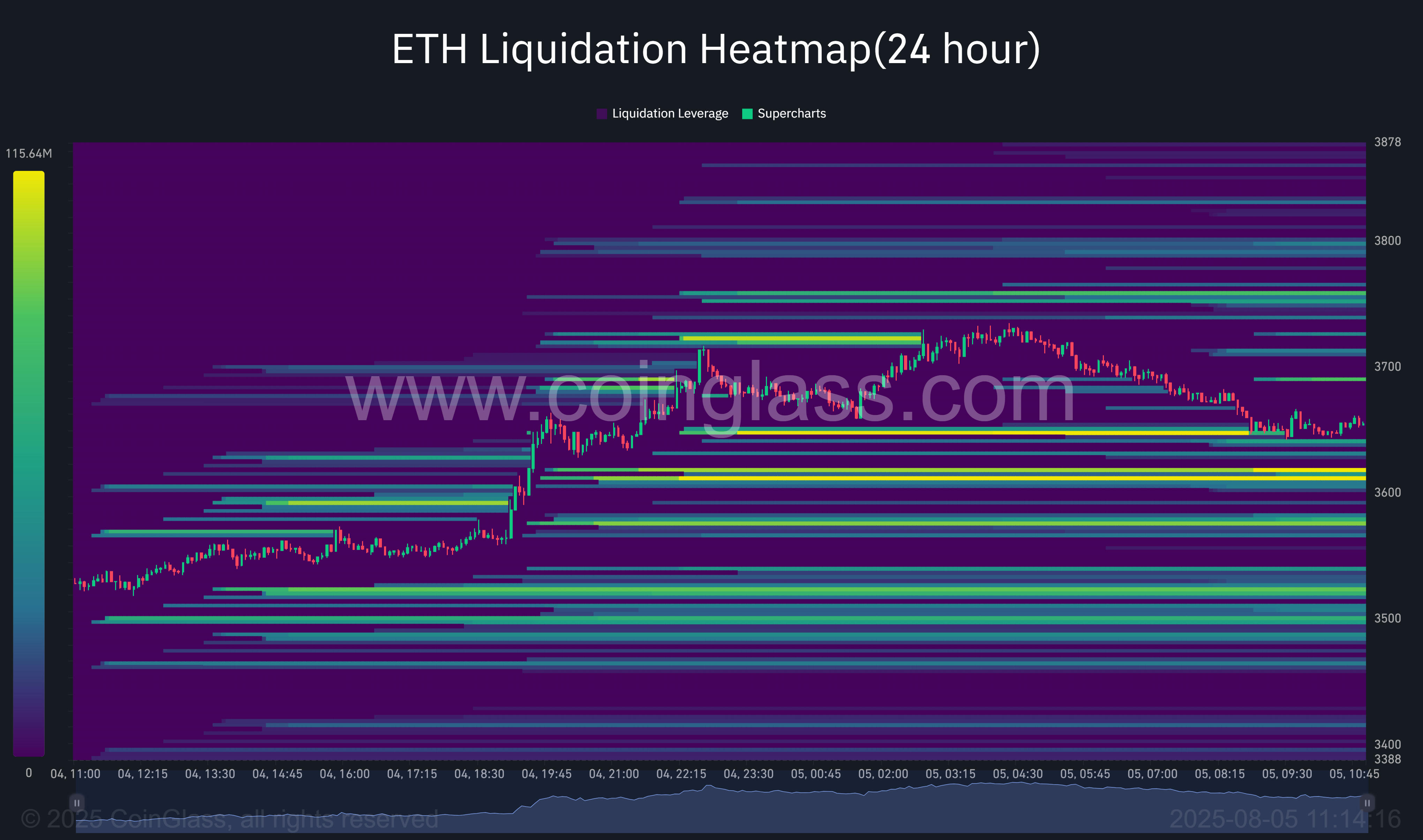

Data from Coinglass indicates that Ethereum is trading near a dense set of long liquidation levels between $ 3620 and $ 3660. This area, luminous with high -density straps on a 24 -hour heat map, represents a large focus of excessive long situations that can be forced to go out if ETH slides more.

This setting provides a short -term negative risk. If Ethereum fails to stick to a brand of $ 3,650, then moving to the pocket ranges between $ 3620 and $ 3,660 can lead to successive filtering.

Such a scenario is likely to increase the pressure pressure, which leads to the approaching ETH from secondary liquidity baths near $ 3580 or even $ 3540, where additional long positions are at risk. These levels act as a liquidity magnet, which means that the price may be attracted towards them to “harvest” open sites before the bounce.

On the contrary, if Bulls managed to defend the current support zone and stimulate a short-term recovery, ETHEREUM may target short filtering groups near $ 3,730-3,780.

However, some market monitors expect that Ethereum recovery will reach $ 4,000, with support from upward technologies.

Detection: This content is provided by a third party. It is not like Crypto.News, nor the author of this article, any product mentioned on this page. Users must conduct their own research before taking any action related to the company.

https://crypto.news/app/uploads/2025/07/crypto-news-Ethereum-Cannes-option03.webp

2025-08-05 08:07:00