Trump Tariffs leave Chinese neighbors with impossible choice star-news.press/wp

BBC News

BBC Indonesian

Getty Images

Getty ImagesWhen US President Donald Trump hit China with tariffs in his first mandate, the Vietnamese entrepreneur Hao Le saw the opportunity.

His company is one of hundreds of companies that appeared to compete with Chinese exports that are increasingly facing restrictions from the West.

Le’s Shdc Electronics, sitting in the Hai Duong industrial hub, sells $ 2 million ($ 1.5 million) of telephone and computer accessories in the United States in the United States.

But that income can be dried if Trump imposes a 46% tariff on Vietnamese goods, the plan currently on hold to the beginning of July. That would be “catastrophic for our business,” says Le.

The sale of Vietnamese consumers is not an option, adds: “We cannot compete with Chinese products. This is not just our challenge. Many Vietnamese companies are fighting on their own domestic market.”

Trump Tariffs in 2016. The last name of cheap Chinese imports sent years, originally intended for the United States, in Southeast Asia, to injure many local producers. But they also opened new doors for other companies, often in global supply chains that wanted to reduce their dependence on China.

But Trump 2.0 threatens to close that door, which sees as an unacceptable hole. And that is a blow to a quick growing economy like Vietnam and Indonesia that shoots to be key players in industries from chips on electric vehicles.

They are also stunned between the two largest economies in the world – China, a powerful neighbor and their largest trading partner and the United States, a key export market, which could look for an agreement in Beijing.

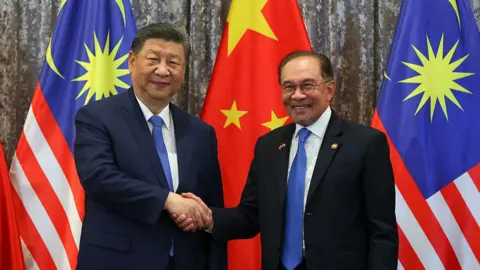

And so xi jinping’s long-planned trip to Vietnam, Malaysia and Cambodia this week took over fresh urgency.

All three countries rolled the red carpet for him, but Trump saw it as a more evidence of them to “fuck”.

Getty Images

Getty ImagesThe White House will use its upcoming negotiations with smaller peoples to press them in limiting their jobs with Beijing, in accordance with the reports.

But that could be a fantastic ambition given the amount of money flowing between China and Southeast Asia.

China is 2024. earned a 3,5TN RECORD from exports – 16% of those to go to Southeast Asia, the largest market. Beijing, in turn, paid Railroads in Vietnam, Dam in Cambodia and ports in Malaysia as part of its “belt” of the infructural program that seeks to increase links abroad.

“We cannot choose, and we will never choose (between China and the United States),” said Malaysia Trade Minister Tengku Zafrul Aziz on Tuesday, in front of the XI visit.

“If the problem is about something we think is against our interest, then we will protect (yourself).”

Wake-up call

In the days after Trump presented his caring tariffs, the governments of Southeast and East Asian were abolished in the business adoption.

In what Trump described as a “highly productive call” with the Vietnamese leader on Lam, the latter was offered in a fully waste tariffs on American goods.

The American market is crucial for Vietnam, an electronic power plant in which giants like Samsung, Intel and Foxconn, contracted the Taiwanese company has contracted to make an iPhone.

Meanwhile, Thai officials move to Washington with a plan that includes larger American imports and investment. The United States is their biggest export market, so they hope to avoid 36% of the following in Thailand that Trump can return.

“We will tell the American government that Thailand is not just an exporter, but also an ally and economic partner that can now rely on long-term,” Prime Minister Paetongtarn Shinawatra said.

The Association of Southeast Asian Peoples (ASEAN) was ruled by retaliation against Trump Tariffs, and not choosing to emphasize their economic and political significance for the United States.

Getty Images

Getty Images“We understand the US concern,” Mr. said Mr. Zafrul for BBC. “That’s why we have to show that actually, ASean, especially Malaysia, can be that bridge.”

It is a role that the exports of the economy of Southeast Asia played well – benefits from Chinese and American trade and investment. But the Trump’s paused streams could break it.

For example, take Malasli. In recent years, manufacturers of the US chip and they have invested elsewhere there, how Washington blocks the sale of advanced technology in China. Last year, China imported 18 billion dollar chips from Malaysia. These chips are used in Chinese electronics, such as the iPhone, usually ties for the United States.

Trump’s proposed tariffs on Malaysia – 24% – could reduce the US dollar US dollar market. But that’s not all.

“If that continues, companies will have to review their investment obligations,” says Mr. Zafrul. “It will have an impact not only on Malaysia Economics, but on a global economy.”

Then there is the Indonesia, which could face 32% of tariffs, and the Chamber is to provide nixel reserves and has its sights set on the global supply chain of electric vehicles.

Cambodia, the Chinese ally, is facing the steepest levies: 49%. One of the poorest countries in the region has managed to have a chinese hub for Chinese companies who want to attack the tariffs. Chinese companies currently own or operate 90% of clothing factories, which mainly export to the United States.

Trump may have hit a break on these tariffs, but “the damage is done,” says Doris LEC, Economist in Malaysia Institute for Democracy and Economic Affairs.

“This serves as an invitation to wake up the region, not only reducing the reliance on the United States, but also for re-balancing the predominance to any individual trade and export partner.”

Chinese loss and winning Southeast Asia

In these precarious times Xi Jinping tries to send a steady message: to join with their hands and resist “harass” from the US.

It is not an easy task because Southeast Asia also has trade tensions with Beijing.

In Indonesia, the owner of the business has a false concern that Trump Tariffs for 145% in China means more competition from Chinese rivals that no longer can export to the United States.

“Small businesses like us feel squeezing,” says the owner to sleep Brand Helopopia. “We fight to survive against ultra cheap Chinese products.”

Getty Images

Getty ImagesOne of the favorite folk pajamas is sold for $ 7.40 (119,000 Indonesian rupees). Isma says she saw similar designs from China go about half of that price.

“Southeast Asia, proximity, with open trade regimes and fast-growing markets, of course, has become a landfill,” says Nguyen Khac Giang, visited the guy on ISEAS Yusof-Ishak Institute in Singapore. “Politically, many countries are reluctant to face Beijing, which adds another layer of vulnerability.”

While consumers greeted Chinese products at competitive prices – from clothing to shoes to the phone – thousands of local businesses failed to match with such low prices.

More than 100 factories in Thailand have been closed each month in the last two years, according to the assessment from the Thai Research Tank. During the same period in Indonesia, about 250,000 textile workers were dismissed after closed producers of 60 clothes, they say local trade associations – including Srijex, after the largest textile region manufacturer.

“When we see news, there are a lot of imported products that flood the domestic market, messing your own market,” Mujiati, a worker fired from Srijex in February after 30 years, says BBC.

“Maybe there was simply not our happiness,” says a 50-year-old, who is still hunting for work. “Who can we complain about? There is nobody.”

Getty Images

Getty ImagesSoutheast Asian governments responded to the wave of protectionism, because local companies sought to be protected from the influence of Chinese imports.

Last year, Indonesia discussed 200% tariffs on a series of Chinese goods and blocked e-commerce theme, popular among Chinese traders. Thailand taut inspections of imports and imposed additional tax on goods worth less than 1,500 Thai Baht ($ 45; £ 34).

This year, Vietnam imposed temporary antidersan duties in Chinese steel products twice. And after the latest tariff announcement of Trump, he was allegedly placed in Vietnam to break into Chinese goods transferred through his territory in the United States.

He would be investing these fears in the XI’s agenda this week.

China is worried to channeling their American export to the rest of the world “ended indeed alienating and aggravating” their trade partners, David Rennie, former Peakin Bureau for Economists.

“If the tidal wave of Chinese exports ends the overwhelm of these markets and damage to employment and jobs … It is a huge diplomatic and geopolitical headache for Chinese leadership.”

China has not always had a simple relationship with these regions. The ban on Laos, Cambodia and War Minmarke, remained careful in Beijin’s ambitions. Territorial disputes in South China wrote connections with the Philippines. It is also a problem with others like Vietnam and Malaysia, but trade was a balanced factor.

But it could change now, experts say.

Getty Images

Getty Images“Southeast Asia had to think about whether they really wanted to offend China. Now complicates things,” says Chong Ja-Ian, an associate professor at the national university in Singapore.

Chinese loss can be the winning of Southeast Asia.

Hao Le, in Vietnam, seeing an increase in the query of American buyers who spring for new electronics, out of China: “In the past, American customers should take over suppliers. Today such decisions are made within the day.”

Malaysia, with blowing of rubber plantations and the largest glove producer in the world, has almost half of the world market for rubber gloves. But she is ready to catch a bigger share from her main competitors, China.

The region still faces a 10% basic tariff, like most of the world. And that is bad news, says Oon Kim Hung, president of the manufacturer’s association of Malaysian rubber gloves.

But even if paused tariffs come out, he says, customers will find the payment of an additional 24% on the Malay gloves largely desired for 145% imposed for coughed for Chinese gloves.

“We didn’t really jump with joy, but it can be in favor of our manufacturers, as well as those in Thailand, Vietnam and Cambodia.”

Additional reporting Tessa Wong and Abhiram – subramaniam

2025-04-18 04:27:00