Ethereum led the July gathering, where companies have increased by 127 % star-news.press/wp

ETHEREUM (ETH) highlighted the encryption market in July, where Corporalate Holdings recorded the largest monthly increase in the record.

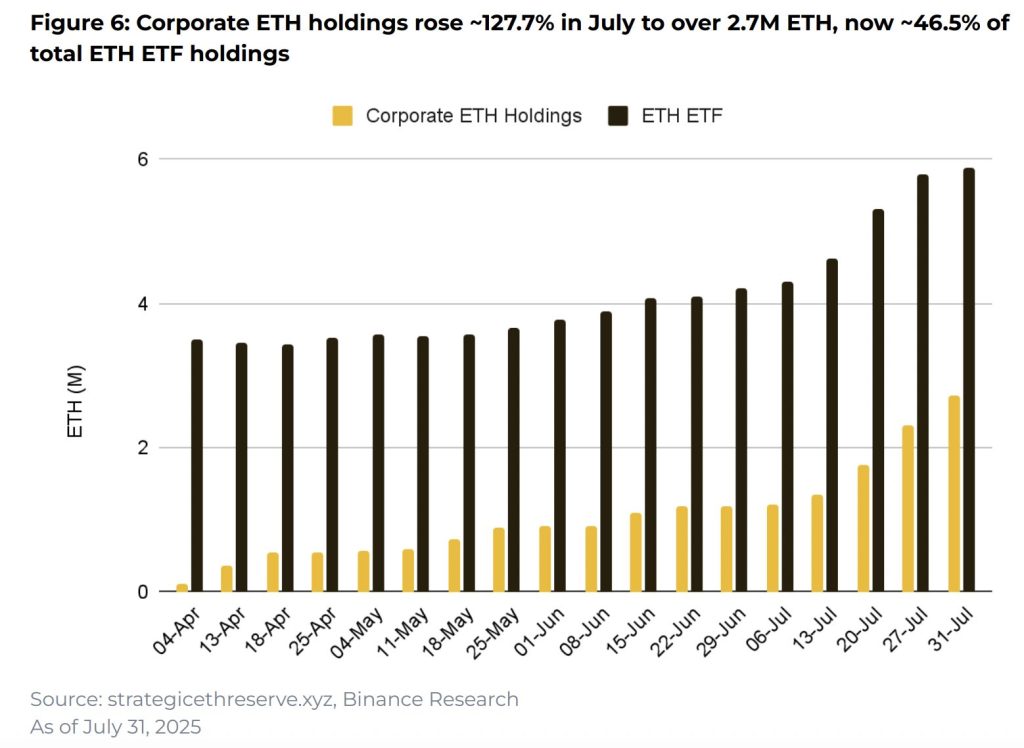

Binance Research said in Monthly market visions report These balances, which companies maintain, increased by about 127 % to more than 2.7 million ETH ($ 11.6 billion).

The assembly accompanied an increase in the number of companies that maintain Ethereum on their books. Twenty -four new entity joined the ranks, where the total reached 64.

The report said that these companies now have about 46.5 % as ETH, such as the boxes circulating on the stock exchange, which saw that their assets rise by 39.5 % to more than 5.8 million ETH.

ETH Corporate Eth Otpace ETHEREUM FOUNDATATION as the adoption is accelerating

This mutation reflects a shift towards direct exposure to insects, and exceeds the negative ETF allocations. Some companies now have eth more than ethereum itself. BitMine leads to 1.1 meters ETH, followed by Sharplink with 521,000 ETH.

Additional disclosure is expected to reveal in the coming months, as more companies reveal similar strategies. The ethereal machine was a prominent participant in late July, reflecting the momentum in the ETH adoption of companies.

This accumulation coincided with holdings with the strong market performance. Ethereum increased by more than 50 % during the month, becoming one of the best digital assets with great performance. The ETH to Bitcoin was the highest level in six months at 0.032, indicating a renewed force for Bitcoin where investors recycled capital.

The revenue is embodied on the return of ETHEREUM and the backbiting design of companies

While Bitcoin Corporate was in the spotlight for a while, many of these new ETHEREUM strategies are inspired by the playing book Michael Celor.

However, it also benefits from the unique ETHEREUM features, such as exciting rewards, the deflation mechanism and its role as a basic guarantee in decentralized financing.

The regulatory background winds added to the appeal. SEC’s implicit recognition of the United States of America as a commodity, as well as the approval of the legislation of prominent monuments, has strengthened confidence in the vicinity of the long term.

July brings the most powerful institutional request to ETH so far

This trend reveals against the background of the wider market gains. Binance Research said that the global market value of the cryptocurrency increased by 13.3 % in July 2025. Climbing was driven by bitcoin that puts repeated levels at all, institutional interest in ETHEREUM and the main altcoins increased, and record levels of the Treasury Ministry’s accreditation for companies, and stronger regulatory clarity.

Although Bitcoin remained dominant force, July witnessed a clear rotation in Altcoins, led by Ethereum. Assets have acquired flows from both the traded investment funds and the cabinet for companies that yearn to capture additional returns, which enhances their role in the mixture of advanced digital assets.

The market share of Ethereum increased to 11.8 %, while Bitcoin dominated about 60 %. The month also celebrated 19 consecutive days of positive net flows in the ETHEREUM investment funds, confirming the investor’s continuous request.

The ETHEREUM adoption view of companies is still promising, although the market is still mature.

High fluctuations compared to bitcoin can test the durability of these treasury strategies, but at the present time, the Ethereum attractiveness between institutional buyers and companies grows at the fastest pace to date.

https://cimg.co/wp-content/uploads/2025/08/12065605/1754981764-ethereum_optimized.jpg

2025-08-12 07:20:00