Bonk rises 98 % in size, but the possibilities of reflection, if … star-news.press/wp

- Bonk Spot Buy Buy Volume Beat Pressi Pressure with 127 billion icons.

- BONK must restore $ 0.000015 or slide again towards its last support of $ 0.000013.

Bonk (Bonk) has recovered from its lowest level of $ 0.00000013, and benefited from $ 0.00001480 before recovering to $ 0.00001446 at the time of the press.

Throughout the same period, the size of memecoin increased by 98.33 % to 160.5 million dollars, reflecting the high activity on the chain.

But was this just a technician or a start to something bigger?

Punic buyers are strongly returning

After retreating to the market amid higher sale, buyers returned to the displacement sellers.

According to Coinalyze, Bonk witnessed 309 billion in purchase compared to 182 billion in the volume of sale on June 29.

Source: Coinalyze

Of course, this has led to the Delta of purchase +127 billion purchases-a clear signal of aggressive immediate demand.

Such high purchase boom reflects the new demand as investors have returned to purchase the decline.

Source: Coinglass

In the midst of the growing accumulation, Netflow turned from the negative Memecoin, and reached -765K at the time of the press.

When you leave more symbols more than entering, it usually reflects accumulation and a decrease in the risk of the sale side.

This type of behavior, historically, has already been ascending ascending, especially during local direction episodes.

Follow derivatives procedure

Interestingly, when we study derivatives, we find that these buyers entered the market to take strategic positions, especially long jobs.

Source: Coinglass

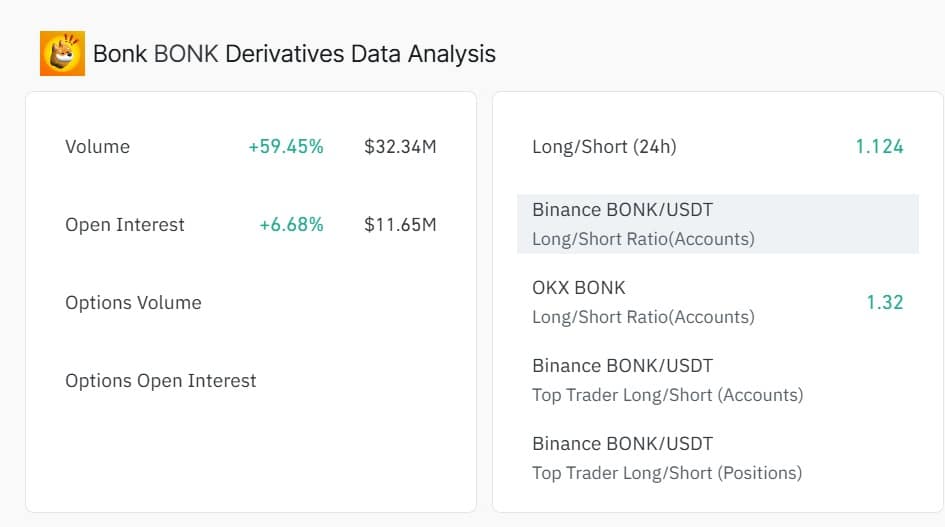

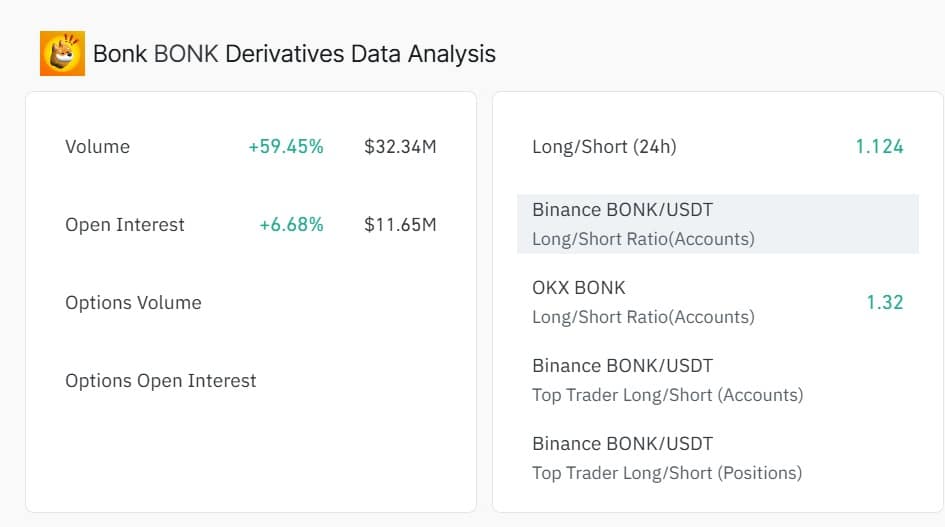

Bucker’s open interest jumped by 6.68 % to $ 11.65 million, while the volume of 59.45 % increased to 32.34 million dollars, confirming the increase in futures participation.

At the same time, the long/short percentage was 1.124, reflecting the tilt of long locations.

Usually the highest demand for long positions, along with high open interest, means that investors are optimistic and betting on high prices.

Facial indicators, but …

According to Ambrypto, Bonk saw a sharp upward as the buyers re -inserted the market strongly.

As a result, the General Reserve Officers Index for RAM in Memecoin rose to 89, indicating excessive conditions at the peak of purchase.

Likewise, the relative Vigor Index (RVGI) has risen to -0.0332, enhancing the presence of a strong upward momentum.

Source: TradingView

However, when the vibrations are heated like this, they often alluded to two things: a constant outbreak or the reflection of the injury.

If the purchase continues, the Bonk can restore $ 0.000015 in a relative easily. But if the bulls are hesitant or running out of fuel, the currency may recover towards its last base at $ 0.000013.

https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-1000×600.webp

2025-06-29 12:00:00