Bitcoin: Why is the retail trade betting on BTC despite the high income costs star-news.press/wp

- Long -term Bitcoin returns are still strong, indicating the constant condemnation of the investor.

- Retail investors continue to build conviction and enhance retain patterns.

Investors have not always thought about Bitcoin (BTC) a valuable store. In its early stages, it exchanging more like highly dangerous, highly rewarded, highly paid, with speculative benefit.

However, since Bitcoin ripens in the category of trillion dollars, which is now competing with the like “Seven Magnificent”, it continues to provide annual revenue for the cycle significantly.

Does this indicate that the basic demand is the scaling in Lockstep with the Bitcoin market?

Bitcoin challenges the size with continuous returns

In a low 2022 cycle, one Bitcoin was traded by about $ 17,000. At the time of the press, the BTC itself led $ 105,000, which represents a 517 %+ increased in a little more than two years.

Although the return profile is strong and undeniable, the capital required to participate in this upward trend has also been reduced as well.

In other words, obtaining one BTC now requires more than five times the investment it has made in 2022, which represents a much higher entry barrier, especially for retail participants.

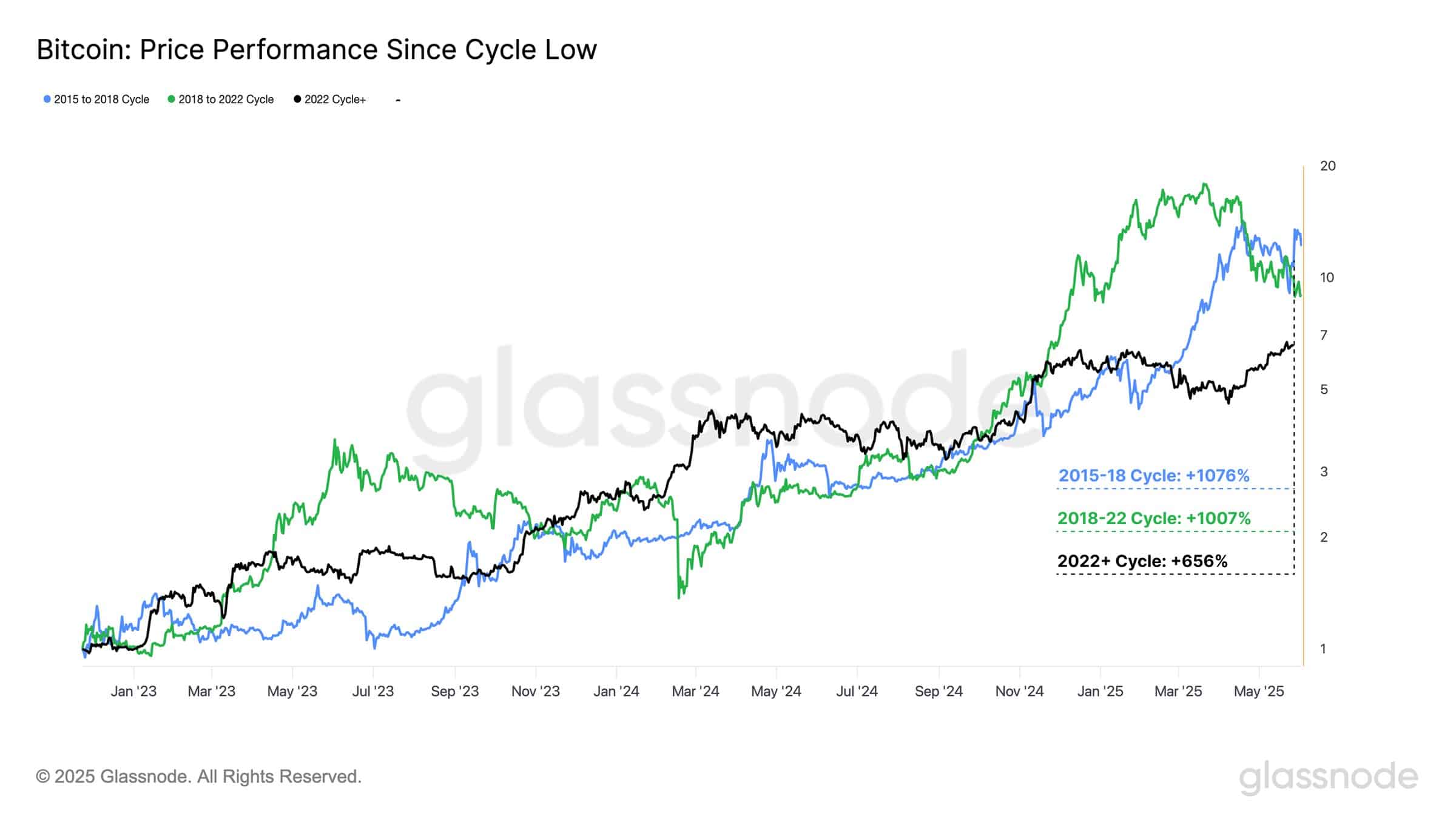

However, Glassnode’s Data It reveals that since the 2022 cycle decreased, Bitcoin has achieved a 656 % return, indicating that long -term holding continues to provide significant returns despite the rise in capital.

Source: Glassnode

AND we only in the middle of the road until 2025. Zooming on the graph, the performance of the current bitcoin cycle is not behind the last running, whether it is 1076 % of 2015-18 or 1007 % from 2018-22.

The consistent return pattern plays an important behavioral role. IT gives long -term holders confidence for A stick around itAlso, FOMO also raises that withdraws new investors. This mixture keeps the market active and moves.

The behavior of the retail investor reflects the strength of the market

certainly, Institutional interest In Bitcoin, a quarter of a quarter has expanded, which reflects his transition from speculative origin to a long -term mature value program.

Thus, you may think that retailers will be receded with the accumulation of institutions. However, the data on the series reveals a noticeable increase of about 33 % in its addresses with more than 0.01 BTC over the past two years.

Source: Glassnode

In addition, the number of addresses that control more than 1 BTC recently They exceeded A million mark, indicates the expansion of accumulation across both retail and institutions.

This continuous accumulation, despite the high price of bitcoin, indicates a strong condemnation across the market sectors.

Smaller holders actively expand parking, betting on large future returns that justify the commitment of the large capital, which enhances the flexible bitcoin framework.

https://ambcrypto.com/wp-content/uploads/2025/06/Ritika1-1-1-1000×600.webp

2025-06-15 05:00:00