The analyst reveals why Bitcoin remains the September Curse star-news.press/wp

September was traditionally a difficult month for Bitcoin (BTC), where price plans often appear. However, some experts predict a possible increase, noting the fall of the stock market reserves as a sign of the bullish momentum.

The optimistic view comes despite the recent Bitcoin conflicts. The largest cryptocurrency decreased by 2 % over the past week, reflecting the broader uncertainty in the market.

Outlook Bitcoin: its lowest seasonal or height forward?

Sponsored

According to data from Coinglass, the average Bitcoin returns in September -3.33 %, making it the worst month in the encrypted currency. BTC ended the month in red for six consecutive years between 2017 and 2022, which made its horizons for this year as well.

It is worth noting that many experts agree on this perspective. An analyst Premium The current market is similar to the “classic stock market”. This referred to increased weakness for more corrections.

Moreover, analyst Timothy Peterson highlighted that the value of bitcoin decreased by 6.5 % last month. The analyst expected that the price range would range from $ 97,000 to $ 113,000 by the end of September, which reflects the continuation of this trend.

“It is part of a seasonal pattern that has been shown for many years,” Peterson Add.

Sponsored

Meanwhile, many expect that although the declines may come, the currency will wear the next quarter. Based on the previous patterns, October and November are the most powerful for Bitcoin, so that this can happen well.

Historically, Bitcoin was always in September half a year after a year. books.

This opinion is supported by Benjamin Quinn, CEO of Cryptoverse. he male September often represents a low point in the afternoon years, and is usually followed by a recovery at the height of the market cycle in the fourth quarter.

Sponsored

However, some maintain a more optimistic vision. Data Rand encryption analyst showed a steady decrease in BTC, which was held in exchanges. Moreover, the exchange supplies decreased to the lowest level in six years.

These signals reduce the pressure pressure. In addition, if the demand increases, this shrinking supply can support a more up -to -bitcoin look.

“Shock Shock Shock”, Kadi Bergman Add.

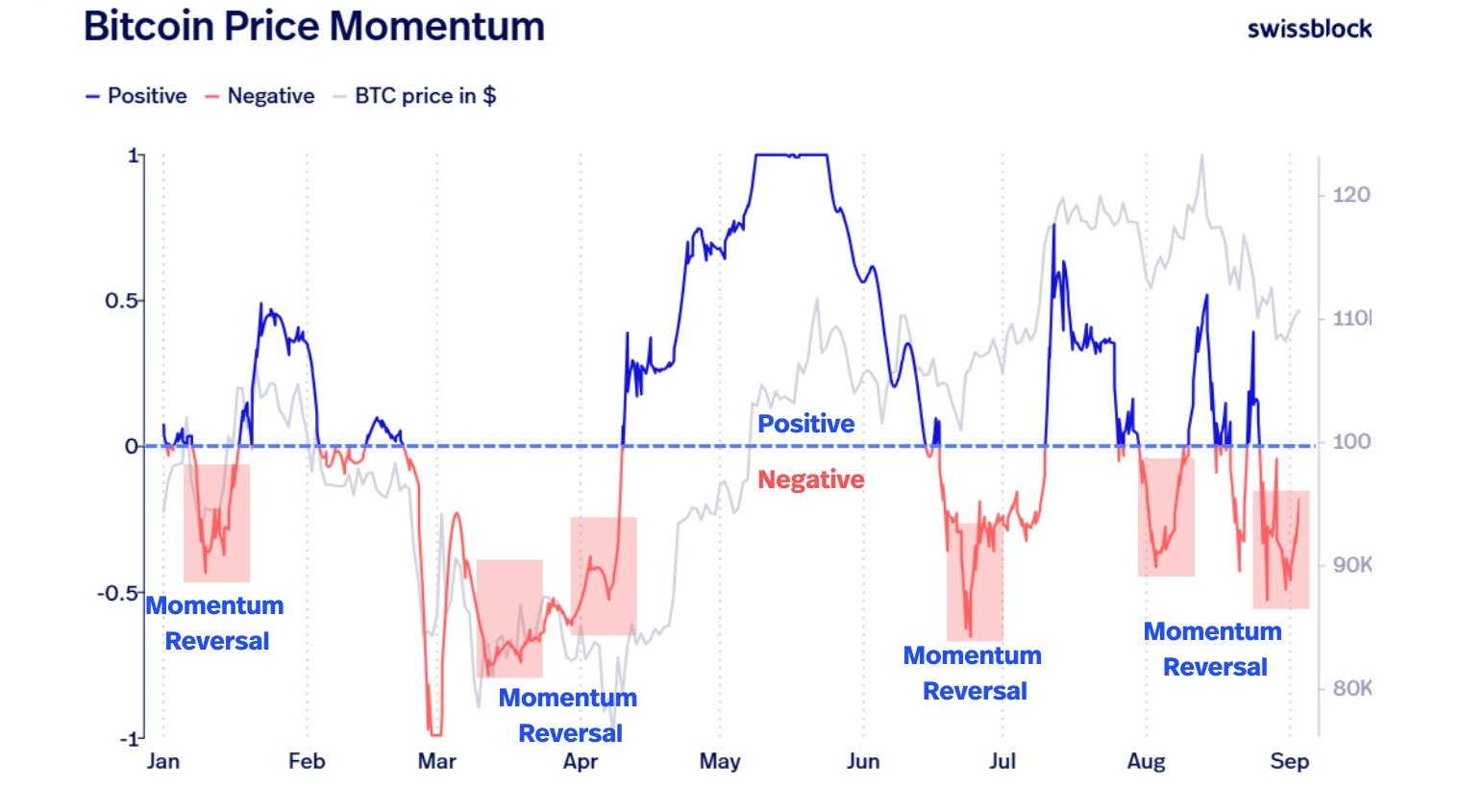

Rand also emphasized that the momentum seems to reflect from negative to positive, indicating a possible transformation in the market morale. With just less than two weeks until the expected federal reserve price discounts on the market, the analyst suggested that the policy transformation can provide a catalyst for a stronger recovery in September.

Sponsored

Finally, market monitors are also looking for major dates. Analyst Marti, the party party, referred to September 6 as a possible operator, linked to the market maker’s activity.

Sponsored

“Bitcoin market makers on the sixth of every month. IMO: September 6 is a step. This is the window of the event until September 17,” He said.

Now, the Bitcoin price is still under pressure, with experts dividing whether September will celebrate a continuous decrease. The coming weeks, especially about the expected federal reserve decision, will be very important in determining whether the cryptocurrency can challenge its seasonal weakness and benefit from the current show dynamics.

https://beincrypto.com/wp-content/uploads/2024/04/BIC_bitcoin_highs_alltimehigh-covers.png

2025-09-04 16:30:00