The “no purchase” cabinet leads to declining panic – he sees smart money the opportunity, not afraid star-news.press/wp

Bitcoin fell on Thursday after the US Treasury Ministry made it clear that it would not expand the planned Bitcoin reserves through the purchases of direct market. The prices were touched for a period of $ 124,120 before reflection sharply, and slipped to 118,550 dollars upon closing.

As of Friday, BTC is trading at $ 117,929, which was combined near the main support after the sale led to the appearance of forced qualifiers in parts of the Crypto Futures market. Cabinet Al -Amin Scott Besin said Fox Business The government will depend only on the assets confiscated to develop its Bitcoin reserves, which ranges between $ 15 billion and 20 billion dollars, and will stop selling its current property.

The situation contradicts the former President Trump’s executive order, which requests neutral budget strategies to expand the strategic bitcoin reserves.

BESSENT also highlighted an increase in customs tariff revenues, as July groups amounted to approximately 30 billion dollars. He said that annual receipts can exceed $ 300 billion, he said, providing room for other asset strategies, although none of them will include fresh purchases BTC.

The effect of the market and the total background

The Treasury Ministry’s position removes the long -term market buyer, which increases the possibility of more severe price fluctuations. On Thursday, a reflection of the strong producers’ price index data in July, with annual PPI 3.3 % increase Monthly numbers climb 0.9 %, flow broader discussions on inflation and a modified policy.

By relying on confiscated assets instead of direct purchases, reserve growth will be slower and less predictable. This makes feelings in the short term more sensitive to total economic transformations, changes in customs tariffs, and institutional flows.

For merchants, the absence of the purchase of the cabinet may reduce the upper stimuli that depends on the title, but also opens the door to opportunistic entries when the fluctuations are high.

Technical expectations Bitcoin: Science formation signs the possibility

From a technical perspective, the prediction of the bitcoin price remains in a position based on the withdrawal. The price is launched from a convergence channel, and it is now directly integrating over SMA 50-periods of $ 118,819, which represents immediate support along with the main trend line from the lowest levels of the last swing.

The 4-hour graph shows BTC, which is a style of bioplasting science, as it is circulated between the re-distribution level of 23.6 % in Fibonacci at $ 117335 and resistance at $ 123,236-a level of direction twice this month. The decisive closure of more than $ 123,236 can pave the way for about $ 126,242 and a psychological important goal.

The RSI is 54.77, to the bottom of the excessive peak levels, while maintaining the upward trend, while the Macd chart is shrinking, and there is often a sign that the bullish momentum is rebuilding. It is possible to attract any re -test of $ 117,774 – $ 118,136 for buyers, with deeper support at $ 113,650 and $ 110,675 if the feeling deteriorates.

If the resistance bitcoin continues in the upcoming sessions and institutional flows fixed, the stage can be placed in a continuous gathering towards the highest bicycles.

For long -term investors, this monotheism can prove that it is a launching platform instead of a warning mark, a point in the plan that may one day be remembered as an introduction not only about 130 thousand dollars, but it is likely to go about $ 250,000 in the coming years.

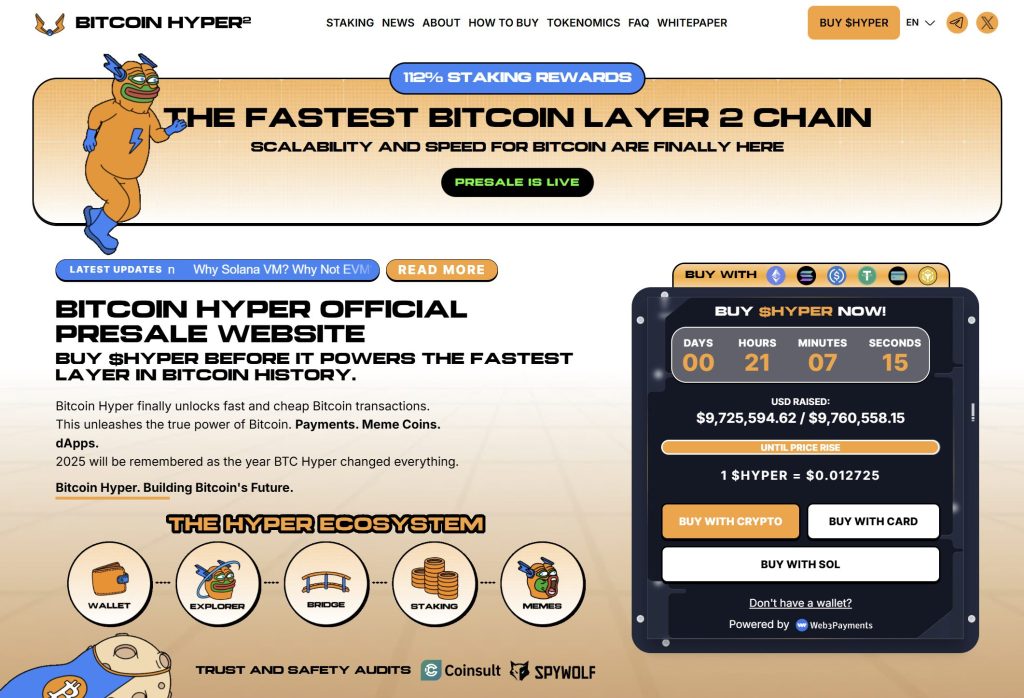

Bitcoin Hyper ($ Hyper) combines bitcoin and Solana’s speed

Bitcoin Hyper ($ Hyper) is the first layer of bitcoin -backed by the Solana (SVM), which is designed to honor the bitcoin ecosystem with fast, low -cost, DAPS, and creation of Mimi.

By combining Bitcoin with Solana performance, it opens strong new use – all with a smooth BTC Dam.

The project is checked by consulting and building for expansion, simplicity and confidence.

The investor’s attention increases, as government representation already exceeds $ 9.7 million and only a small remaining allocation.

Distinguished codes are currently available at only $ 0.012725, but this price is scheduled to rise soon.

You can buy Hyper connected icons on the official Bitcoin Hyper using Crypto or a bank card.

Click here to participate in the pre -preparedness period

https://cimg.co/wp-content/uploads/2025/08/15142355/1755267834-bitcoin-price-prediction-2.jpg

2025-08-15 14:25:00