Hegemony rises after $ 1B-1B- Is BTC the only safe haven? star-news.press/wp

Bitcoin’s dominance increases after one of the most treacherous tremors in modern memory, which caused more than a billion dollars to liquidate the recall through the encryption market. BTC now installs about 104,957 dollars, a decrease of only 0.17 % in the past 24 hours, as trading re -evaluate their risks.

According to data from Coinglass, more than 247,000 traders were filtered in a 24 -hour window. The most prominent archives of $ 200 million from BTC on Binance were the largest one -year liquidation event. Most of the damage occurred on Binance and Bybit, which together formed $ 834 million in arranged locations.

The vast majority have been long, as traders were wandering in the upscale momentum fed by the public subscription momentum in Surke and renewed interest in the US -based DEFI DEFI protocols.

these Forced references As automatic margin calls. When traders fail to meet the required side thresholds, the exchange of closing situations to protect the wider system. But in times of sharp fluctuations, these measures are often snowball, which leads to a large -scale price and surrender in the market.

Bitcoin dominance climbs with Altcoins stumbling

While Altcoins suffered from severe losses, the price of Bitcoin is support higher than $ 104,000. The sale seems to have prompted investors to BTC as a relative safe haven.

Bitcoin’s dominance: BTC’s share of the total code ceiling has increased sharply, indicating that merchants flee from the most dangerous assets in favor of the original cryptocurrency.

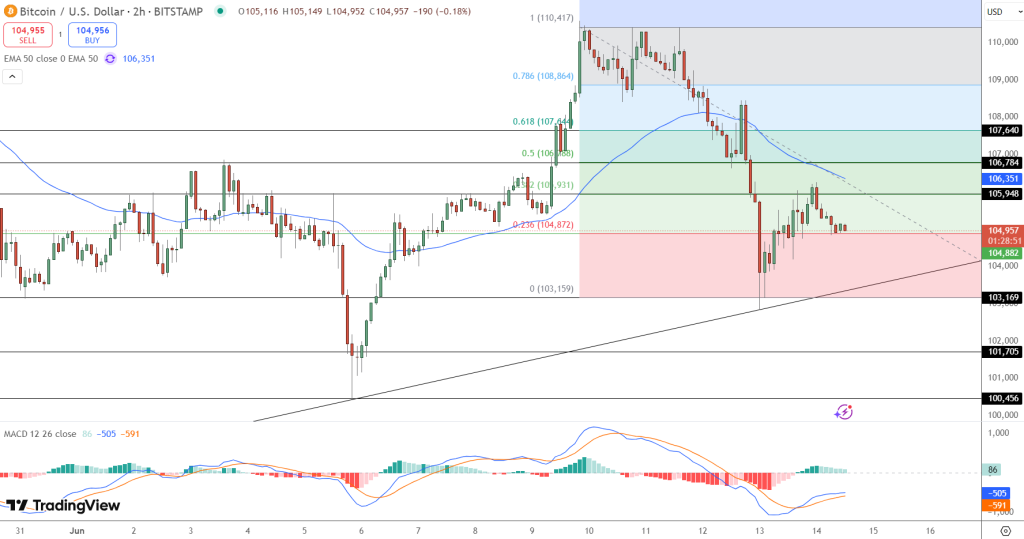

Technically, the BTC is hovering a little the highest level of 0.236 of the Vibonacci retreat level at $ 104,872 and sits on the rising trend line that has supported the price procedure since early June.

The MACD chart is flat, and early signs of declining decline in dumping momentum. If the bulls can recover the EMA 50-periods near 106,351 dollars and exceed the level of 0.5 FIB at 106,788 dollars, there is still a move about 108,864 dollars.

This pattern indicates a possible decrease in making, especially if the current monotheism area is kept. Small stereoscopic candles indicate frequency and accumulation-behavior resulting from the bottom of the correction cycles.

Short -term expectations: Bitcoin eyes are 108 thousand dollars in the event of a momentum construction

Despite the disturbance of the market, the structure of the bitcoin chart is still technically constructive. The step of more than $ 106,350 indicates a short -term outbreak, which leads to the correctness of a reflection pattern and BTC may pay about 107,640 dollars and 108,864 dollars.

Summary of the idea of trade:

- entrance: Above 106,350 dollars with size

- Stop: Less than 104,000 dollars

- Goals: 107,640 dollars (primary), 108,864 dollars (extended)

With the main bleeding in Altcoins and a feeling of risk, bitcoin can attract comfortable capital. Unless BTC is divided into less than 103,169 dollars, the broader upward trend remains intact. In the current environment, Bitcoin is not just an encryption – it’s The Crypto Safe Haven.

BTC Bull Token is approaching the maximum of $ 8.1 million, as it attracts 58 % of APY StAKing buyers at the last minute

With Bitcoin trading near 105 thousand dollars, the investor’s concentration turns towards Altcoins, especially BTC Bull Token ($ BTCBUL). The project now raised 7,141,005.09 dollars out of $ 8,216,177, leaving less than a million dollars before raising the next distinctive code. The current price of $ 0.00256 is expected to increase as soon as the maximum is hit.

BTC Bull Taken connects its value directly to Bitcoin through two basic mechanisms:

- BTC Airdrops holders of holders, with pre -Maskil participants get priority.

- The supply burns occur automatically every time the BTC increases by $ 50,000, reducing the supplies circulating in BTCBLL.

The code is also 58 % APY StAKING, which includes more than 1.81 billion icons, offered:

The code is also characterized by 61 % APY StAKING, which is more than 1.73 billion icons, submitted:

- There are no fees or fees

- Full liquidity

- Stable negative returns, even in the volatile markets

This model appeals to both old warriors and new arrivals looking for hands income.

With only hours and almost solid cover remains, the momentum returns quickly. BTCBLL Mix of the value associated with Bitcoin, scarcity mechanics, and flexible trick provides strong demand. The first buyers have a limited time to enter before activating the next pricing layer.

https://cimg.co/wp-content/uploads/2025/05/13150120/1747148479-btc.jpg

2025-06-14 13:17:00