It can be the highest level of the next Bitcoin ever-2 indicators indicating more bullish direction star-news.press/wp

The price of Bitcoin increased nearly 7 % over the past week, which is a sharp step even for OG Crypto. The pace of the assembly is to attract comparisons with the last batch before its height on July 14 (ATH) at 122,838 dollars.

However, taking a closer look at both indicators on the chain and technology shows that the conditions of the market this time differ significantly and perhaps more suitable for another leg.

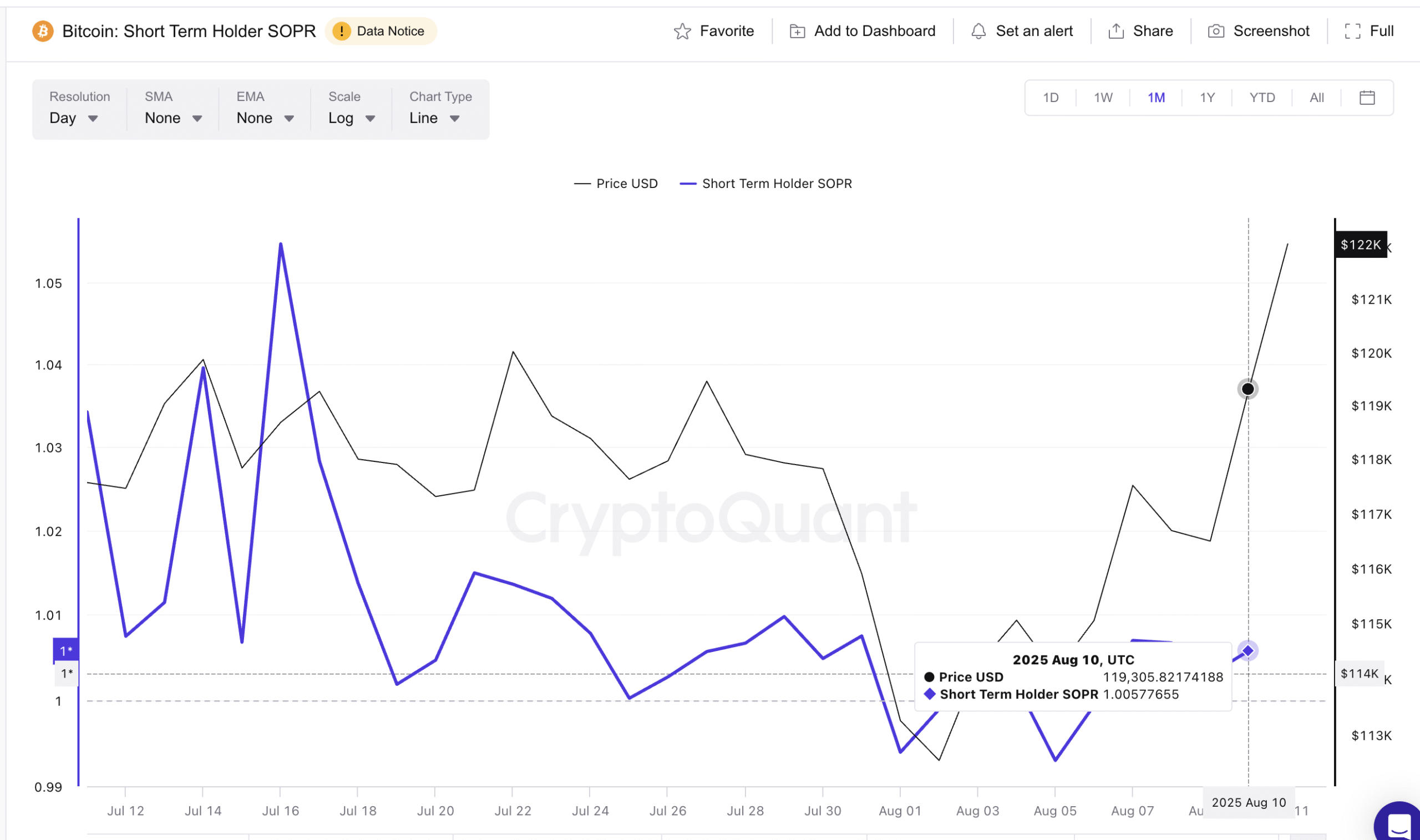

SOPH suggests that this gathering has a breathing space

The short -term profit rate (SOPR) measures whether the metal currencies that were transported on the chain are sold with profit or loss. When SOPR rises in the short term, it indicates an aggressive profit, often precedes local summits.

The short -term SOP holder is more logical in this analysis, as during aggressive price peaks, the short -term regiment is often the first to start selling.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

During the peak of July 14, SOPL rose to feverish levels between 1.03 and 1.05, a red mark that the high price of bitcoin was exhausted. Today, SOPR sits at 1.00, which indicates that profits are achieved less aggressive. This hints to the structure of a healthier market and a crowd that has not yet saturated.

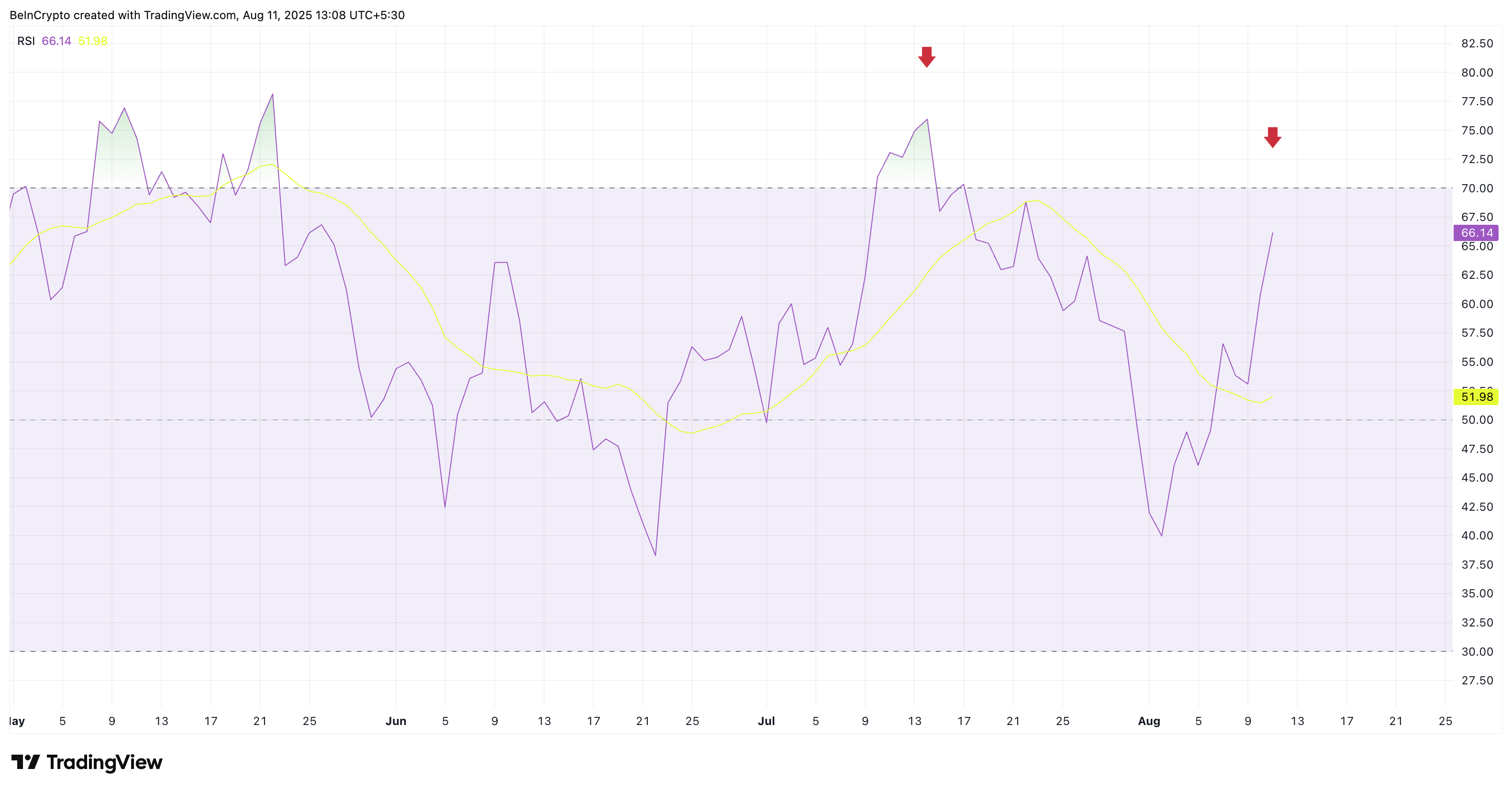

Taker and RSI purchase/selling ratio indicates strong demand

Instant market flows confirm the upscale impossible. The Taker’s purchase/sale, a measure about whether the aggressive market you buy or sell it, has jumped from 1.02 neutrals in 10 to 1.14, which is its highest reading since early July.

This shows that buyers interfere with conviction, and sellers who overcome.

RSI supports this. On July 14, RSI was in the peak area of the purchase above 75, which limits more upward trend. Now, RSI is located near 66 where the price is located only 0.6 % south at all, which is much lower than excessive peak thresholds, giving Rally Bitcoin more “Agroom” before technical exhaustion.

RSI (Relative Power Index) is an index of momentum that measures the speed and size of modern price movements on a scale from 0 to 100: The above can indicate 70 to the peak of excessive purchase, less than 30 years.

These standards indicate that the gathering can extend beyond the current resistance area. SOPR shows that this gathering is not yet weighed by achieving heavy profits. The last jump ratio in Taker Buy/Sell, along with the relative power index, which is still comfortably located below the excessive lands that have been provided, indicates that buyers have intent and technical space to push the assembly further.

Bitcoin eyes eyes are ever beyond the highest level

On the daily chart, Bitcoin is still moving inside a well -specific upward channel. The price is compressed for the level of 123,230 dollars, Vibibonacci 1.0; The same area that crowned the July 14 march. It can target a clean outbreak here 130,231 dollars.

The main support for watching $ 120,806 (FIB 0.786) and 118,903 dollars (FIB 0.618). Keeping over these levels would maintain the thesis of the hack intact, while approaching below may stop momentum.

If the bullish reservation, the penetration removes $ 12,200 with size, traders can see high levels of new levels faster than the last time, and perhaps higher than the market is currently pricing. However, a decline in less than $ 118,900 will defeat the short -term upward trend.

It can be the highest level in the next Bitcoin ever-2 indicators indicating that more bullish trend first appeared on Beincrypto.

[og_img]

2025-08-11 08:45:00