Bitcoin price can exceed $ 4.81 million by 2036, and new prediction offers star-news.press/wp

A new study from Satoshi’s work education Projects The possibility of 75 % that Bitcoin will exceed $ 4.81 million by April 2036.

The research, led by economist Murray A. Rudd, an updated possibility model for studying how supply restrictions and institutional demand can affect long -term assessments.

Scenals of shock and bitcoin price

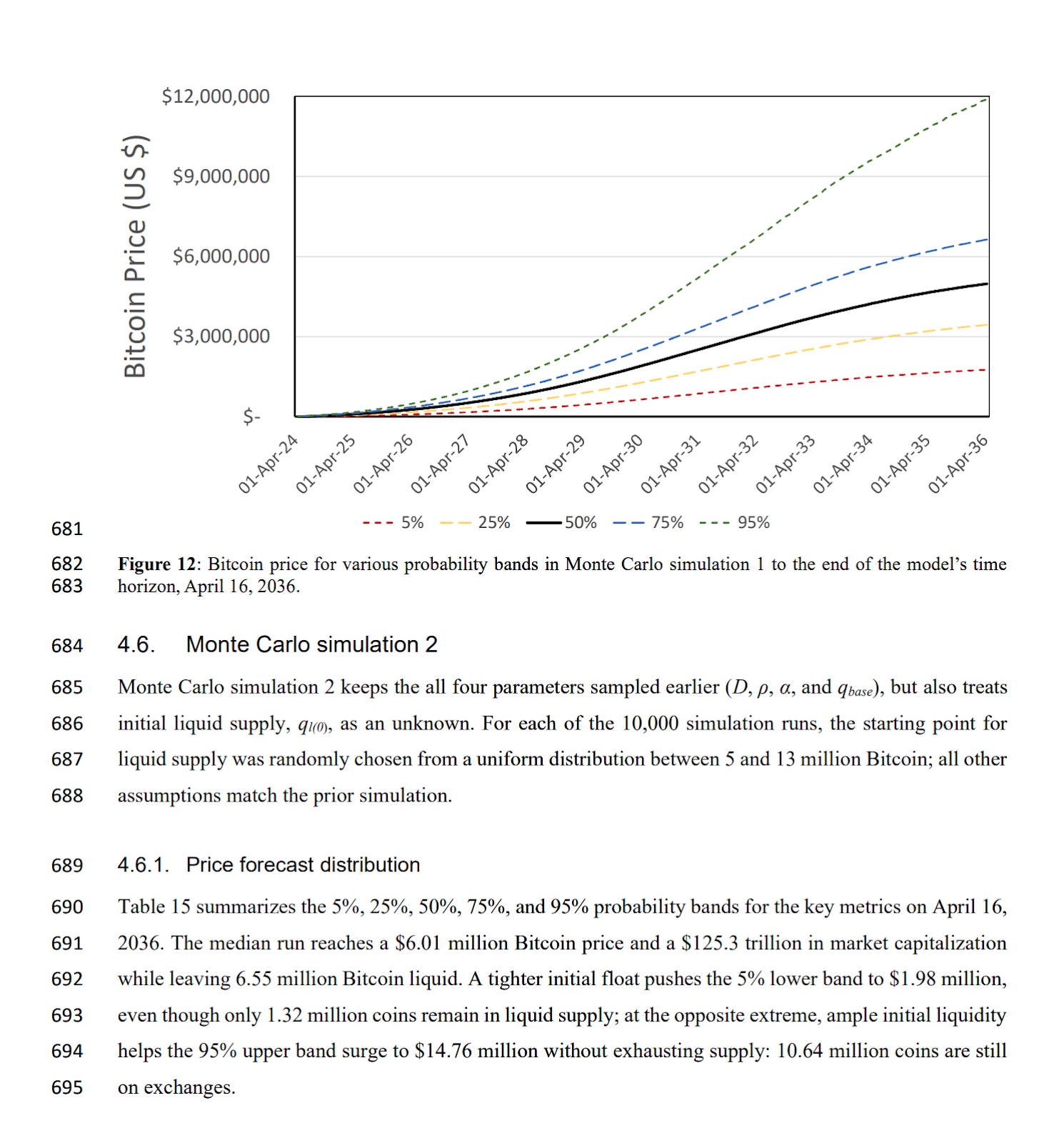

The updated results appear 75 % price exceeding $ 4.81 million For April 2036. 25 % to 10.22 million dollarsWhile the upper limit ranges from 95 % from $ 11.89 million to $ 14.76 million, depending on simulation parameters. In the maximum percentage of simulation, the peaks approach $ 50 million. The average expectations are about 6.55 million dollars to $ 6.96 million for the same date.

The width cap of 21 million bitcoin and a liquid amnesty is estimated at 3 million BTC anchor, the width side. It is expected that the storage in the long term, the guarantee of companies, the activity of Defi, and the second layer networks will increase the remedy. The basic and medium scenarios maintain the liquid supply between 6.55 million and 6.96 million BTC by April 2036, which is subject to severe expectations.

Stress simulator simulation shows how continuous exchange with clouds can accelerate. If the circulating liquid supply decreases to less than two million BTC with a decrease in contraction allergy, the model shows that prices can escalate quickly. In the worst one percent of the paths of depletion, liquid supply decreased less than two million BTC by January 19, 2026, and less than a million BTC by December 7, 2027.

The updated model projects are much higher than the January report, which used more conservative adoption and liquidity assumptions. The researchers attribute this to the imbalances and duties after 2026 and the structural restrictions that limit the available offer. The model includes institutional accumulation patterns, slow purchases during gatherings and increased during stable conditions.

The study indicates that awareness of the investor about the risks of liquidity will be necessary with the growth of adoption. And it confirms that there is a narrow margin between sustainable scarcity and destabilization, as the latter may cause great volatility.

The effects of the portfolio strategy

The results have effects on the strategy and policy of the preservative. For long -term allocated, the right right tail supports price distribution strategies that represent asymmetric upward trend while respecting liquidity restrictions. Political makers may need to address the custody concentration and the cross -border capital flows, as the treasury bonds increase for companies, sovereign reserves, and the distinctive symbol initiatives to pressure the circulating offer.

Combining adoption curves at the total level with liquidity events at the exact level, provides Monte Carlo specifications and EPSTEIN-ZIN specifications, a more comprehensive view than simple projection models. Multiple restrictions are combined to simulate how bitcoin can develop under the different market conditions and policy.

As Beincrypto said, Bitcoin entered an unknown area on Thursday, breaking more than $ 124,000 to determine the highest new level ever. The price increased by approximately 8 % during the past week. Analysts indicate the meeting of the bullish signs on the chain, indicating that the assembly may still have an area of operation.

The post -bitcoin price may exceed $ 4.81 million by 2036, new prediction offers first appeared on Beincrypto.

[og_img]

2025-08-15 01:45:00