Noise? The analysis form holds a value of 765 million dollars of excessive liquid symbols star-news.press/wp

One of the analysts at X (Twitter) claims that the famous investment capital fund model has up to $ 765 million of distinctive noise.

Is this a strategic vote for trust or an introduction to a possible sale that can shake the market?

Share the form with liquid height

According to MLM, Paradigm has approximately $ 765 million in noise (the original symbol of the effective). Although the fund did not formally confirm this number, the model controls about 6 % of the circulating noise supply if it is accurate. Such a large seizure is usually interpreted by a large investment fund in two ways: either a strong belief in the project’s capabilities or inherent risk for sale if the market conditions are undoubtedly transformed.

“We cannot know the average accurate input, but by using time stamps from when the noise is received from the winter or the gate, the average estimated input is $ 16.46, which means that the basis of the total cost is 315 million dollars. Stuck On x

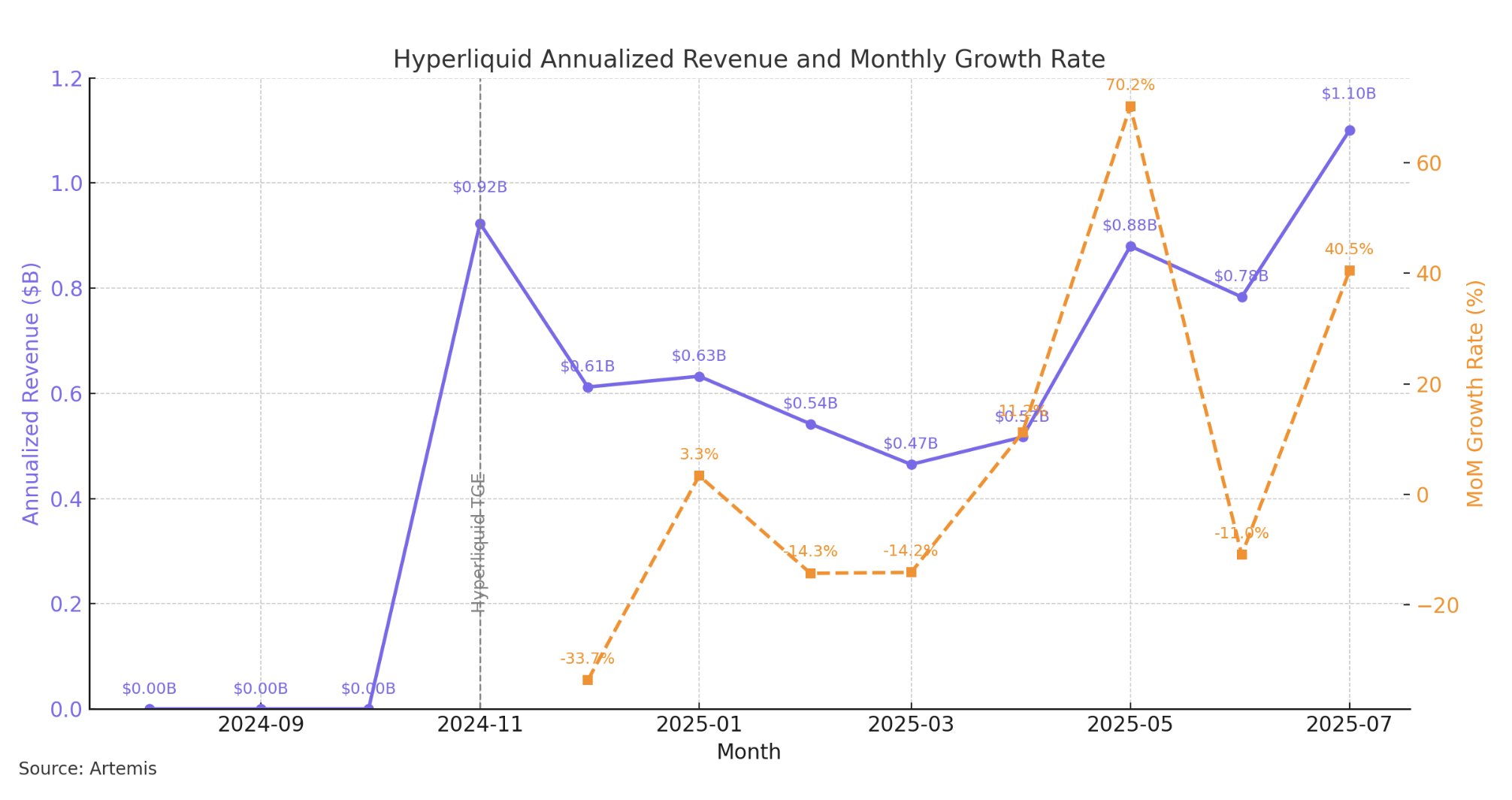

John Ma shared that X is that the growth of HyperLeeliquid, which is 40 % on a monthly basis, has paid annual revenues to $ 1.1 billion. This highlights the great performance of the young Defi platform.

This success is attributed to the improved DEX model, Which enhances the application book technology outside the chain while matching semi -fixed orders. Monthly volume exceeded $ 231 billionThis indicates a major shift in how Dexs competes with CEX giants. However, short -term growth does not guarantee long -term sustainability, which still requires validation through multiple market courses.

The model may be betting at the liquid height as the Dex of the next generation is able to compete directly with the traditional CEXs. However, the concentration of the distinctive symbol ownership and unclear technical signals makes the current Hype path unexpected.

In addition, rapid growth has caused a brief interruption experience on the user interface, making users unable to place, close or withdraw requests. The good news is that the platform later announced its recovery for affected users.

At the time of this report, the noise is traded at $ 38.40, 23 % lower than ATH in July.

Beincrypto has communicated with the model to show them, but we haven’t heard yet.

After noise? An analyst for the excessive declined symbols model has $ 765 million, which appeared first in Beincrypto.

[og_img]

2025-08-04 10:55:00