Bitcoin mining is difficult for the highest level ever – and for this reason the miners do not decline star-news.press/wp

- Bitcoin mining has decreased slightly, but the high costs and towels pressed the smaller mines workers.

- Public mines are enhancing production and storing bitcoin as a long -term strategy

The difficulty of mining in Bitcoin (BTC) decreased slightly to 126.4 trillion, after getting the highest level ever at 126.9 tons on May 31.

Although the decline seems simple, it reflects the increasing economic pressure on miners with high beams, reducing rewards, and high costs that drive many to the edge of the abyss.

However, the general mining giants rewrite the rules of the game by intensifying production and BTC for a long time.

The cost of bitcoin mining in 2025

Although Bitcoin is hovering over 105 thousand dollars, profitability is increasingly far for many miners. In April 2024, the mass bonuses reduced to 3.125 BTC, which reduced revenues overnight.

Source: Cryptoquant

Meanwhile, energy costs and infrastructure requests continue to climb, raising the operational tie point.

Bitcoin was recently topped 1 zethash per second, which increases competition and makes it difficult for younger players to remain viable.

The difficulty is still near peak levels, as it acts as a continuous barrier to enter … and survive.

General miners challenge the possibilities

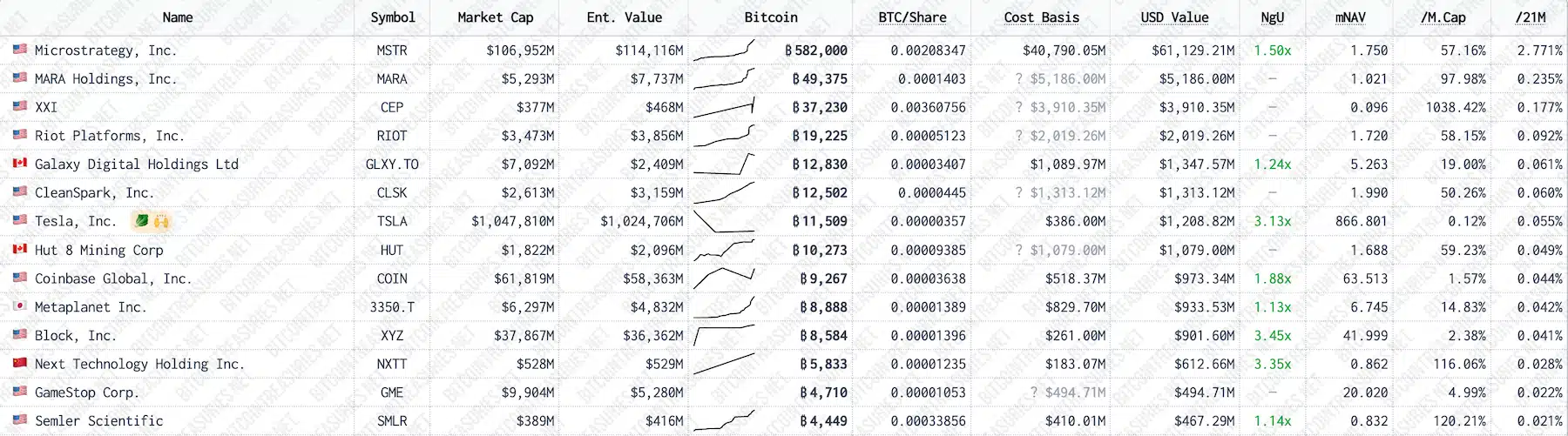

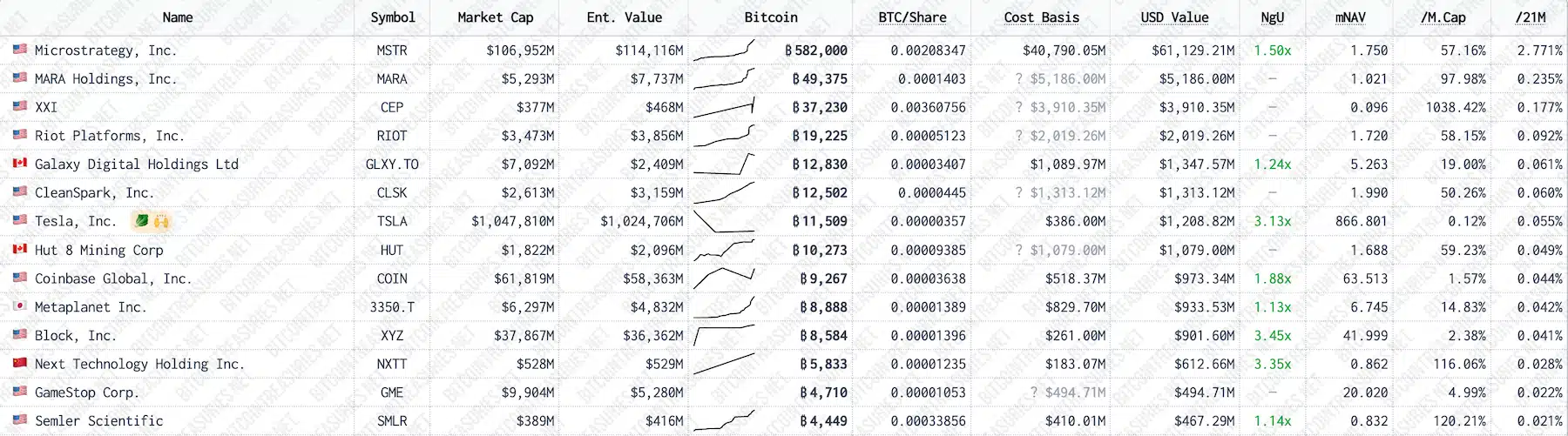

While young mines are increasingly pressure, public companies such as Marathon Digital and Cleanspark are strongly expanding.

In May, the marathon 950 BTC – an increase of 35 % from April – was extracted from market fluctuations and the increasing network difficulty. Cleanspark also gained a ground, producing 694 BTC, an increase of 9 % over a month.

Both companies have expanded the scope of operations, as Cleanspark seizures reached 45.6 EH/S. Its size and strategic implementation helps them prosperity, even with tightening profit margins in the mining sector.

Bitcoin cabinet turned

The new trend is crystallization: public mines are skewed.

Source: Bitcoin bonds

Mara now has more than 49000 BTC and confirmed that it is sold in May. Cleanspark joined the ranks, collecting 12,502 BTC in total property.

This indicates an increasing condemnation of the long -term BTC value and the strategy of the broader companies to comply with the spirit of cash bitcoin.

https://ambcrypto.com/wp-content/uploads/2025/06/Samyukhtha-25-1000×600.webp

2025-06-16 13:00:00