Bitcoin miners hold on coins despite low profitability – details star-news.press/wp

According to the latest data on the series, Bitcoin miners refuse to cancel their BTC holding, although profitability is historically low.

BTC transaction fees at the lowest level since 2012

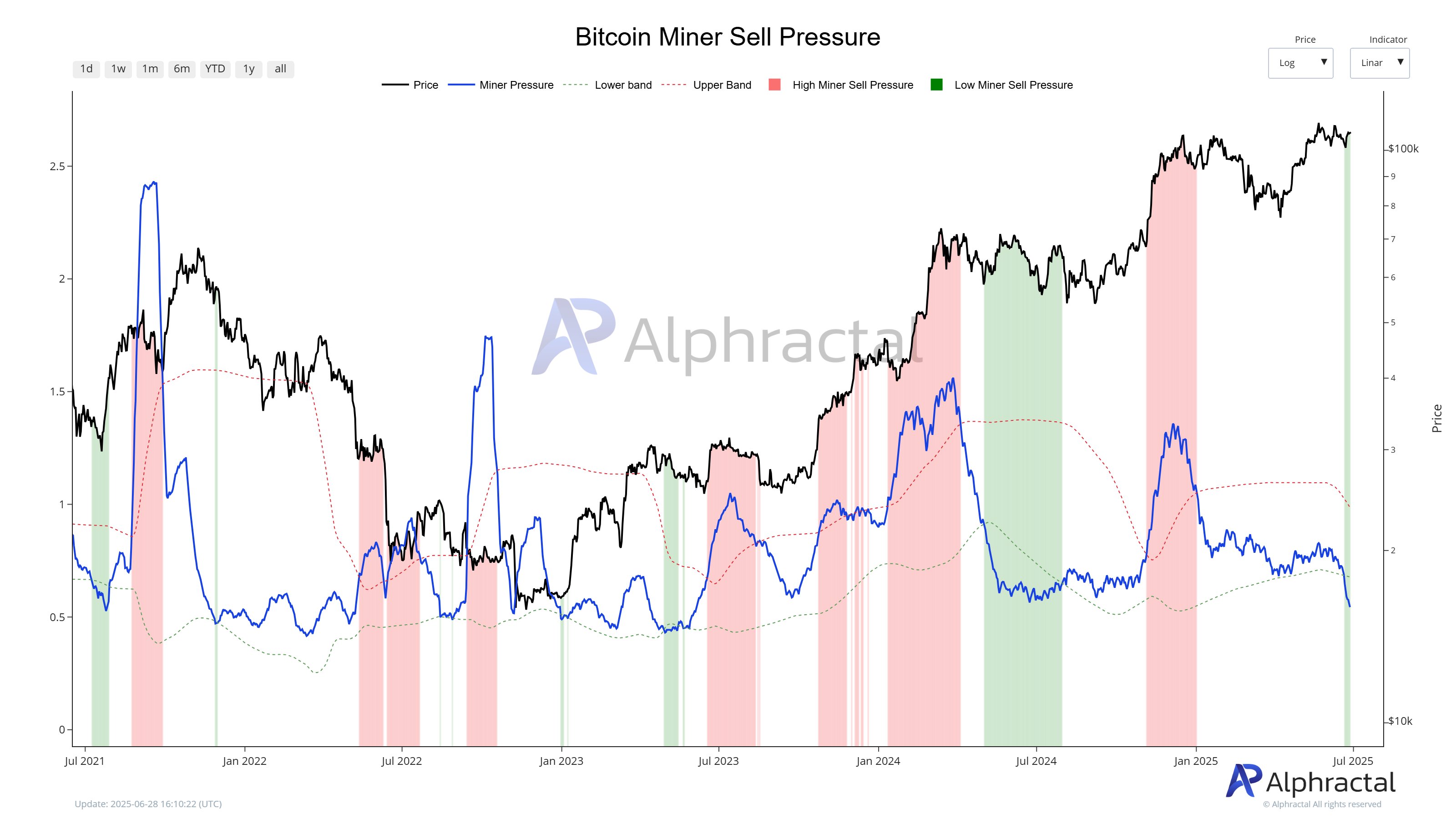

In a new post on X, Blockchain alphractal Analysis Company open Bitcoin miners are still adhering to their reserves despite the low revenue. The data platform on the series discussed the reasons behind this trend and its potential effects on the BTC mining industry.

First, Alphractor highlighted the low activity on the series in this course as one of the reasons behind the significant decrease in mines revenue. As a result of the reduced activity, the total paid transaction fees on the Bitcoin network decreased to its lowest levels since 2012.

The market intelligence platform also stated that the difficulty of mining remained high though The retail rate recently witnessed a decrease. Usually, there is a direct relationship or a positive relationship between retail and the difficulty of mining. However, according to Alphraractal, this delay or the last disintegration increases the profitability of miners and delaying the balance of the network.

Moreover, Alphractal revealed that X that Bitcoin fluctuations have reached the highest new levels ever. This means mainly that the network is witnessing the highest fluctuations with retailers or changes in its history.

Blockchain Analysis Company added:

This is likely to be due to large mining operations that close ASIC machines, and perhaps because of low revenues and low demand for network.

Source: @Alphractal on X

Despite the network revenue and high mining difficulty, the pressure pressure of miners remained at low levels. As shown by the low pressure scale for selling mines, this indicates that miners do not empty their property strongly for profit.

Alphraractal admitted that low -sales pressure from miners is a positive sign, especially for bitcoin price. Blockchain has noticed the possibility of some mining gatherings to reduce its operations in response to low activity on Bitcoin. “Since BTC is trading over 107 thousand dollars, we may simply see miners re -allocate their retail authority to adapt to the current demand,” Alphractal added.

Usually, BTC miners tend to sell their coins for profit during the rapid price increases and high Blockchain activity. However, Alphractor believes that the current absence of both indicates a period of modification rather than surrender between miners.

Bitcoin price at a glance

From writing these lines, the BTC value is estimated at about $ 107375, and the side movement continues only 0.3 % over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Distinctive image from Istock, tradingvief chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/06/iStock-1203525550.jpg

2025-06-29 21:00:00