What do you expect from Bitcoin (BTC) in August? star-news.press/wp

The Bitcoin workers reserve increased steadily between July 2 and July 22, reflecting accumulation with the currency rising to the highest new level ever at $ 122.054 on July 14.

At that time, miners seemed confident in the momentum of the bullish currency, sticking to their rewards in anticipation of higher prices. However, BTC has struggled to maintain ascending momentum since that peak is beaten. In response, miners began to empty their possessions to lock profits. This shift introduces the new BTC’s opposite winds in August.

Bitcoin bullish stops temporarily as miners turn from sticking to sale

When the BTC value began to climb at the beginning of the month, miners on the Bitcoin network also increased the accumulation, which is reflected in the rise in the Miner Coin Reserve.

According to CryptoQuant data, this scale-which was extracted using a seven-day moving average (SMA for 7 days)-is 0.05 % between July 1 and July 22, reaching 1.808 million coins.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

The MINER Reserve scale tracks the total amount of BTC preserved in the governor associated with the mining entity. When the reserve climbs, it indicates that miners possess their coins instead of selling, which reflects the upward feelings or the expectations of continuous price growth.

However, after the BTC gathered until its peak on July 14 and the subsequent monotheistic stage – which continues to circulate – the Polish feelings began between miners. According to Cryptoquant, the MINER reserve has been heading down since July 22, indicating an increase in profit gain or low confidence in the short -term price expectations of BTC.

Given that miners control a large part of the newly released offer in BTC, changes in their behavior can affect the direction of the price. A decrease in mining reserves such as this can increase the pressure of sales, which increases the risk of correcting BTC prices in August.

Institutional flows can compensate for the pressure of miners in August

In an exclusive interview with Abdel -Rafay Gadit, co -founder and financial manager in Zagnali, he said that the last height in the MINER reserves earlier in July “is likely to be a short -term pause instead of the beginning of aggressive accumulation.”

“The rise in the MINER reserve indicates that they choose to stick to BTC, or they are likely to wait for the strongest market signals or more favorable prices. It does not reflect after a large -scale accumulation; it appears to be a strategic slowdown in the sale. If the Bitcoin price is proven, we may see that we can see that the willingness is to rid it, but this is what is going on around it.

When asked about the relative effect of mining workers activity compared to institutional demand for the current prices of BTC and what can be expected, GADIT note that:

“The institutional demand is the real backbone of the current price of Bitcoin. It flows from the circulating investment funds, especially those run by Blackrock, sincerity, and ARK, creates a fixed structural offer that supports price levels more effectively than the sale of low mines.”

He added:

“Although mining behavior plays a role in relieving the short -term width pressure, the real power behind the market direction is formed by institutional capital, broader participation, and the increasing expectations of the most favorable organizational climate. The truth is that miners no longer put the pace;” Institutions. “

With the increasing institutional demand for BTC-reflected in fixed flows to the BTC-supported investment funds, any possible pressure from miners can be balanced effectively, helping to maintain the price of the stable currency in August.

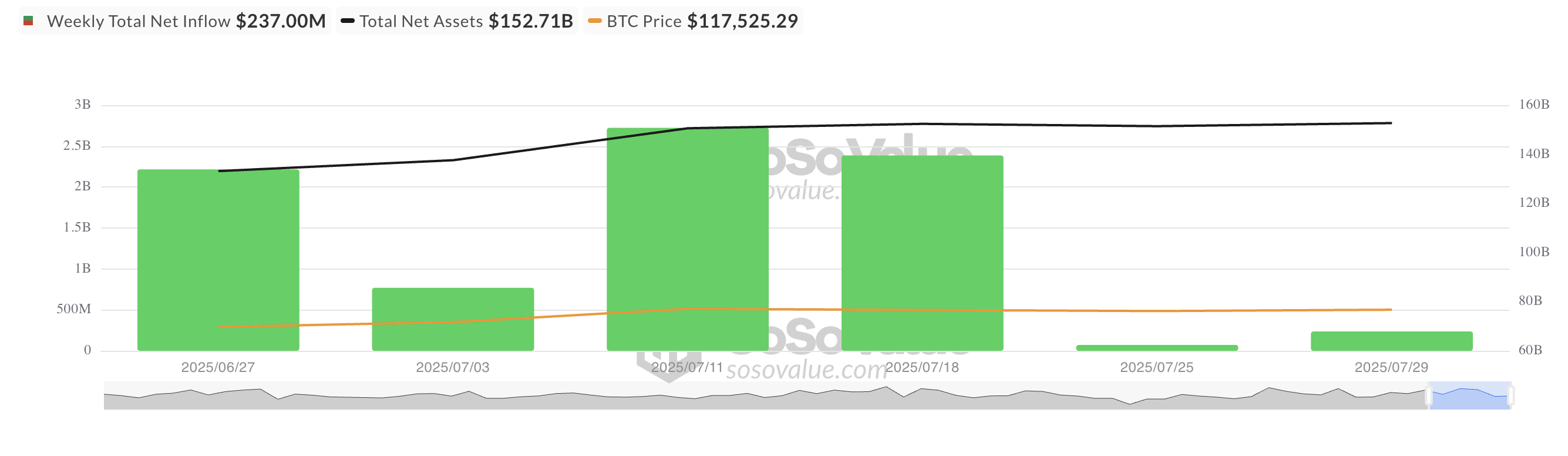

According to Sosovalue data, ETFS BTC has recorded $ 237 million in net flows so far this week, despite the most often trading side currency.

This confirms the view of Gadit that institutional capital, instead of mining activity, is the basic force that supports the BTC price and can help stabilize it next month.

Can Bitcoin get rid of the side direction?

At the time of the press, BTC is trading $ 117,826, hovering between the support floor that was formed at $ 116,952 and resistant at $ 120,811. If the institutional demand increases and the public market’s morale improves, the currency price may be paid after resistance to $ 120,811 and exceeds its highest level ever in August.

On the other hand, if the declining pressure increases, the currency may be broken to less than 116,925 dollars and decreases to 114,354 dollars.

The post what can be expected from Bitcoin (BTC) in August? He first appeared on Beincrypto.

[og_img]

2025-07-31 02:30:00