Bitcoin holders often sell – but the main regiment buy star-news.press/wp

The data on the series reveals that bitcoin holders are largely involved in distribution, but one basic group shows a strong accumulation instead.

Bitcoin accumulation points say that 1000 to 10,000 BTC holders buy

In new mail In X, Glassnode participated in the series of analyzes in the series, an update on how to search for the degree of accumulation for various investor groups of Bitcoin.

This indicator tells us whether Bitcoin holders accumulate or distribute now. It takes into account two factors when determining this: the balance that occurs in the governor of the investors and the size of the governor concerned changes.

The scale represents the behavior of the market as a result between 0 and 1. Of course, where the size of the wallet is also considered, the large entities have a greater effect on this result.

When the indicator is less than 0.5, this means that adult investors (or a large number of small entities) are involved in the distribution. The closer the value is to 0, the stronger this behavior.

On the other hand, the scale above the mark indicates that the market is in a stage of accumulation. For this aspect of 0.5, the extreme point lies in 1, which corresponds to the strongest possible purchase behavior.

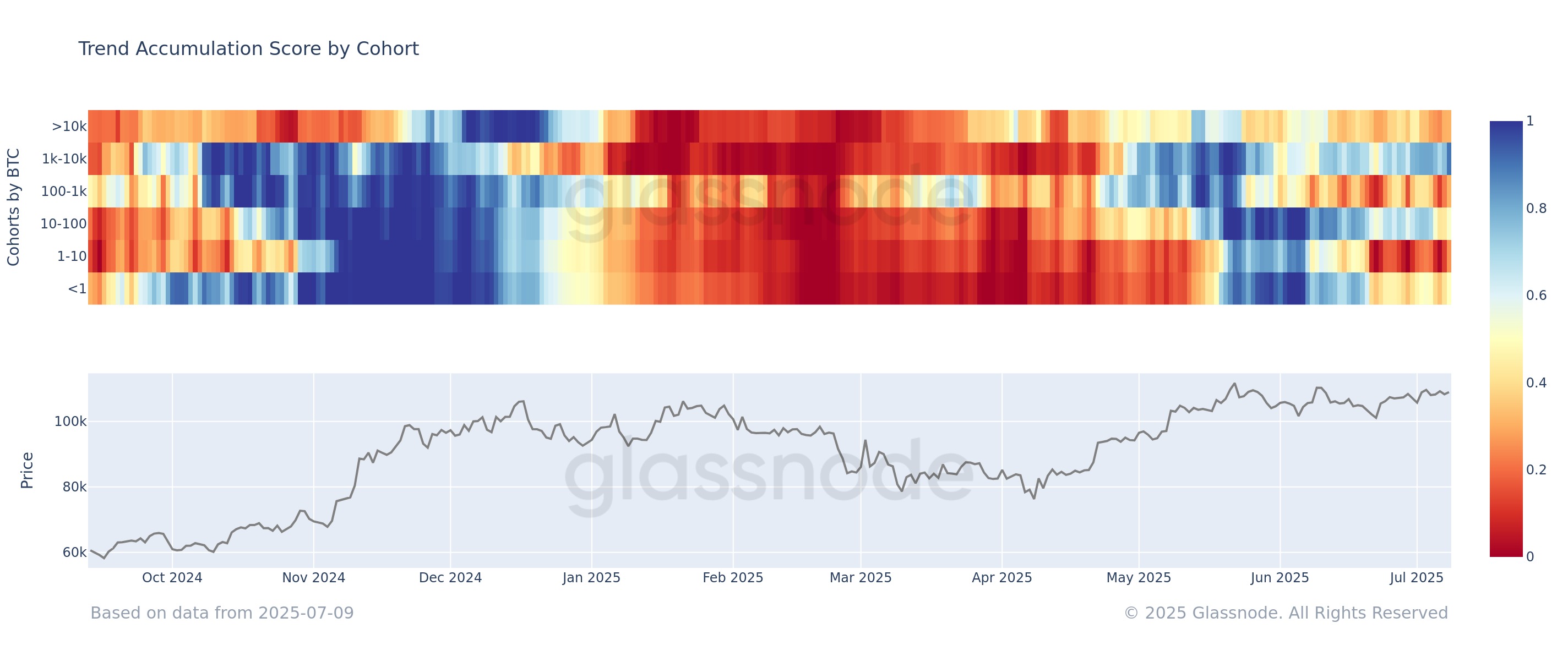

Now, here is the graph that Glassnode shares, which shows the trend in the extent of accumulation in a separately sectors of the Bitcoin user base:

Looks like the score isn't uniform across the market at the moment | Source: Glassnode on X

As visible in the graph above, the degree of bitcoin accumulates tends to be red for most investors, indicating that the distribution is followed.

A regiment that displays the most powerful sale behavior is 1 to 10 single metal currencies. This group includes retail hands, which are among the smallest entities on the network.

While distributing the market as a whole, one group emerged: from 1000 to 10,000 BTC holders. At the current exchange rate, the range limits turn to $ 109.5 million in the lowest one and $ 1.095 billion at the top. Thus, this group represents the great merchants known as whales.

From the graph, it is clear that the degree of direction to accumulate in the regiment is approaching 1, which indicates that these huge entities show almost ideal accumulation behavior.

The sharp trend contrasts with what is exposed by retailers. “This difference highlights a clear division of condemnation between young and old holders,” the analysis company notes.

It remains now that we see whether the oud condemnation showed by the whales will take its fruits, or whether the investors who come out now will become smart.

BTC price

At the time of writing this report, Bitcoin floats about $ 109,500, unchanged for one week.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView

Distinctive image from Dall-I, Glassnode.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/07/btc_e49f40.png

2025-07-10 12:00:00