Bitcoin decreases to less than $ 110,000 – the following support levels to watch star-news.press/wp

Bitcoin Less than the main support zone of $ 110,000 has broken weeks after the declining difference and technical deterioration, which raised questions about whether it could settle at $ 105,000 or face deeper corrections towards the level of $ 100,000.

The decline follows a declining pressure from multiple technical indicators, including a pattern on a double top with a neck line of about $ 112,000 and 50 days of EMA at $ 114,000, and is now a strong resistance.

The momentum indicators, including MACD, have turned into negative with multiple time -frame transitions, while RSI readings are about 59 indicating additional capabilities on the negative side towards the key level 50.

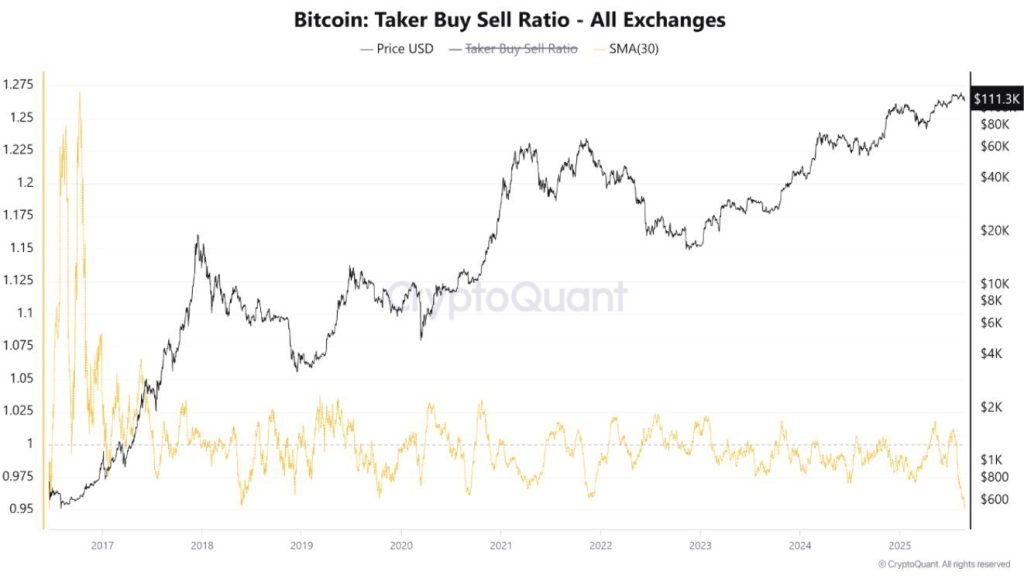

In fact, the 30 -day moving average for the purchase/selling ratio of Taker has reached its lowest point since May 2018, indicating that the Bitcoin market may face some of the short -term sale and corrections.

Haboodi differences indicate a deeper correction in front of us

Many analysts have set strong differences across the weekly time frames, every two weeks, and a monthly built over a period of several months.

The relative strength index is currently at 59 years, indicating another possibility on the negative side towards the main level based on historical patterns where the previous declines have tested the moving average for 50 weeks before creating a new trot.

The dual -top pattern formed about $ 123,250, and the neckline has been decreased decisively to less than $ 112,000, confirming the declining reflection structure.

MACD indicators via multiple time frames show decreased transmission, while weekly plans are displayed in terms of wick formations that often indicate the chapters of the cycle.

The collapse of less than $ 110,000 opens immediate negative targets about $ 105,000, with more severe scenarios indicating the psychological support zone tests from 100,000 to 102,000 dollars.

The historical cycle analysis reveals that all major bitcoin peaks precede local summits, followed by technical deterioration.

Strategy’s failure to achieve new levels of levels since November 2024, despite the continued BTC accumulation, confirms the primary weakness in listing “unlimited money defects”.

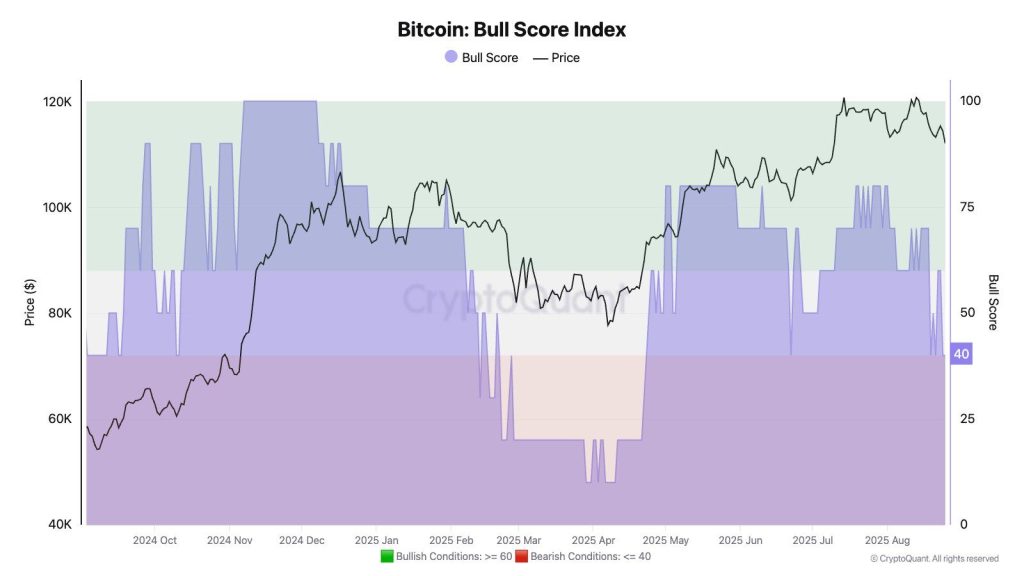

According to data from this month, at Cryptoquant He pointed out that the bull degree index is now 40 He moved to “Get a drop” phase.

Seasonal patterns and extreme feeling creates mixed signals

September is historically the weakest month of Bitcoin performance, with average losses of 3.77 % during the years of the bull market, creating additional winds for recovery attempts.

The retail dealer’s morale has reached extremely extreme levels after decline to less than $ 113,000, which represents the most negative reading since June 22.

Historical analysis indicates that such severe pessimism often coincides with the opportunities for purchase, as markets often move in the opposite direction of crowd expectations.

Institutional accumulation continues despite retail qualifiers, as companies such as the strategy and metapolism continue to acquire Bitcoin.

This creates a difference between the retail situations that are pressured and strategic institutional purchase during weakness.

The expectations of many analysts maintain the long -term targets, as Fibonacci’s accessories indicate $ 155,000 and some scenarios of up to $ 190,000 during the possible “payment” stages.

However, given the current technical deterioration, these goals appear increasingly far and may require months of building the base before they are investigated.

The main turns centers centered on a daily closure of $ 111,000 and $ 108,500, with a decrease in depth correction scenarios towards a range between 92000 and 98,000 dollars.

On the contrary, the successful defense of the current support can put conditions for an anti -direction. However, the Haboodi differences indicate that any marches may face strong resistance.

Artistic recovery scenarios indicate the formation of the gradual basis

Despite the declining collapse, the long -term infrastructure remains intact, as institutional adoption continues through treasury strategies and improvements in organizational clarity.

The withdrawal towards the moving average for 50 weeks is in line with the patterns of historical cycle as the main corrections create launch platforms for subsequent progress.

The main recovery levels include restoring $ 112,000 in constant support, followed by an EMA collapse for 50 days at 114,000 dollars.

A successful closure of more than $ 116,200 would deny the immediate declining structure and open targets towards previous resistance levels about $ 120,000.

Size analysis during any attempts will be a key, as institutional accumulation patterns are likely to appear at low levels of prices where strategic buyers view corrections as an opportunity.

The main support areas test can lead between $ 100,000 and 105,000 dollars to create the foundation for multiple uniformity before renewal.

The momentum indicators require time to reset from excessive sale conditions, as RSI needs less than 50 years to create the lowest levels and MacD expansions that require a positive difference.

The temporal framework for technical reform can extend from several weeks to months, depending on the depth of the current correction.

Recovering scenarios prefer the gradual accumulation stages instead of V-Pottom’s sharp implications. A successful defense of the main support levels provides the basis for resuming the final rise towards the next goal.

https://cimg.co/wp-content/uploads/2025/08/27180814/1756318093-stock-image_optimized-2025-08-27t190738-329.jpg

2025-08-29 10:20:00