Bitcoin Governor of all sizes purchasing again – even huge whales star-news.press/wp

The data on the series shows that each major Bitcoin group is now compatible with behavior, with dominant accumulation across the network.

The degree of bitcoin accumulation is hinted at the market level

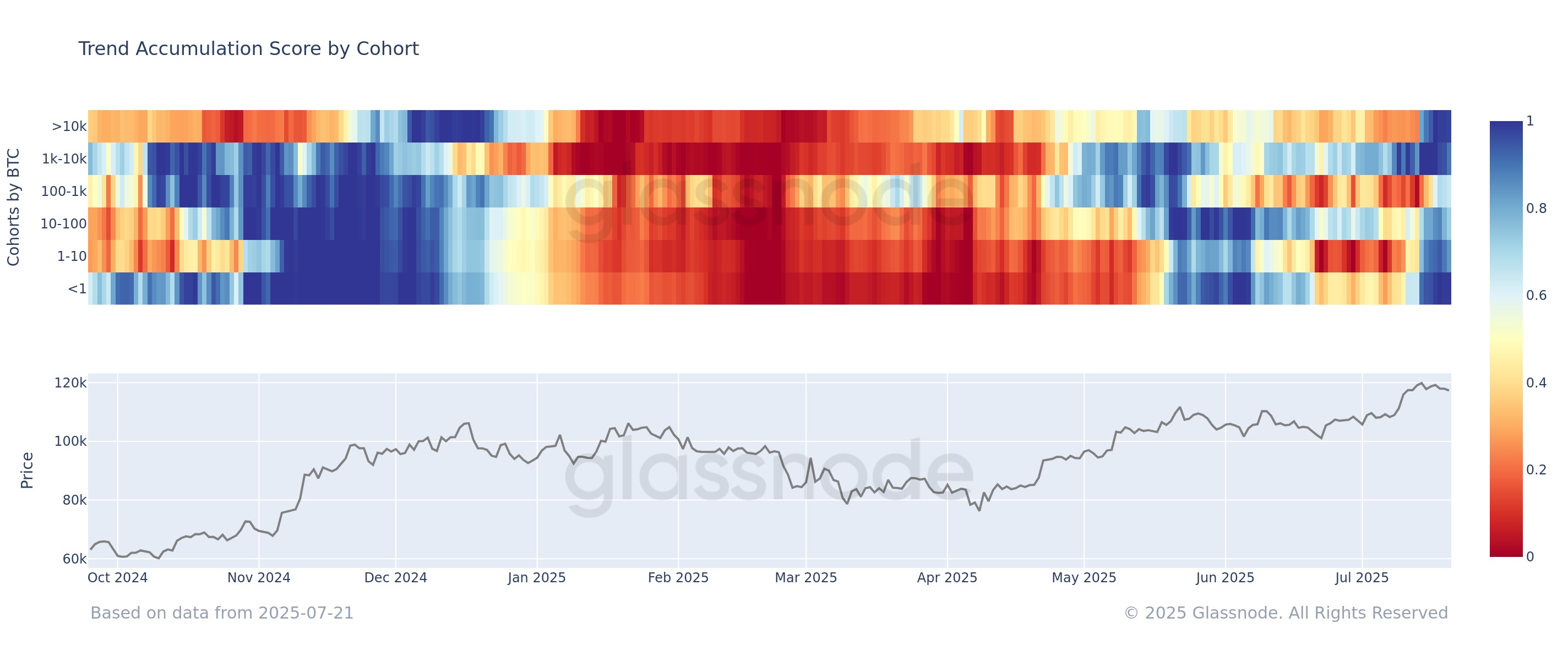

In new mail In X, Glassnode participated in a series of analyzes on how the behavior of various bitcoin groups appeared from the perspective of the trend of accumulation recently. The degree of accumulation is an indicator that tells us whether BTC investors accumulate or distribute. The scale takes into account two factors when calculating its value: the balance that occurs in the portfolio of the holders and the size of the governor itself changes. The second weighting factor means that large entities have a greater effect on the result.

The value of the scale can occur between 0 and 1, with the two extremist parties corresponding to the ideal behaviors of accumulation and distribution, respectively. The 0.5 brand acts as limits between two types of behaviors.

Now, here is a plan that shows the trend in the degree of bitcoin accumulation of different sectors of the network during the past year:

The value of the metric appears to have been quite close to 1 in recent days | Source: Glassnode on X

As shown in the graph above, the degree of bitcoin accumulation showed mixed behavior across investor groups earlier, which means that their holders have been divided into the results of the encrypted currency. However, recently, a transformation occurred, as all investor groups showed a degree of accumulation. Three groups are in particular their aggression: shrimp, whales and huge whales.

The shrimp, investors with less than 1 BTC, were offering a light distribution before the last gathering, but their followers changed their melody and began to show aggressive accumulation instead. The whales, which contained between 1000 and 10,000 BTC, were already buying with conviction when the rest of the market was unclear, and they only continued this trend since the highest new level (ATH) originally.

Finally, the largest network holders, who have more than 10,000 BTC, have violated a distribution series to show purchase levels that have not been seen since December 2024.

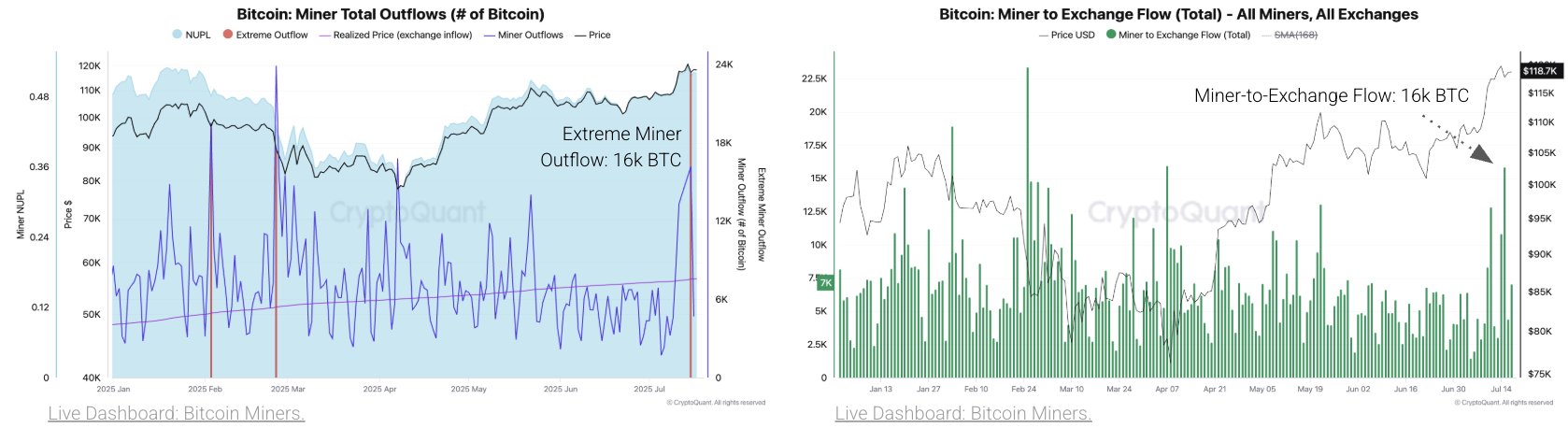

Although investors as a whole were buying, it is not just as there was no sale at all. One group was responsible for distribution at the latest gathering station is miners, according to the data of the Analysis Company Cryptoquant.

The trend in a couple of miner-related indicators | Source: CryptoQuant on X

As visible in the left chart, Bitcoin miners have recently made their portfolios. What they wanted to do with these coins may be answered by the second graph, which shows that most of the 16,000 BTC external flow went to the central stock exchanges.

Miners deposit these platforms when they want to sell, so this can be a sign of withdrawal indicating that this group has benefited from the gathering to achieve profits.

BTC price

Bitcoin has taken a side movement during the past week, as its price is still floating at the level of $ 118,000.

Looks like the price of the coin has cooled down in recent days | Source: BTCUSDT on TradingView

Distinctive image from Dall-e, Glassnode.com, Cryptoquant.com, Chart from Tradingview.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/07/btc_0f45d7.png

2025-07-21 22:30:00