The best ICO portfolio raises $ 14.3 million, as it pays Bitcoin debt fears star-news.press/wp

The billionaire investor Ray Dalio emerges again, and this time it is clear: allocating about 15 % of your portfolio to bitcoin (or gold) as a hedge against one of the most severe financial crises in the history of the United States.

With the rise in national debt that exceeds 37 trillion dollars, and the reduction of the value of the currency becomes a permanent concern, the Dalio point is cut directly to the essence of the total risk today.

If you are looking to keep the disciplined bitcoin mode over time, one tool is protruding: the best portfolio (better).

The leading Web3 wallet paved more than $ 14.3 million of early capital from investors who admit its capabilities. Her road map includes features specially designed for long -term strategies, including those that are completely in line with DALIO’s BTC allocation advice.

Before walking continues, but only even the next financing stage. At 0.025365 dollars per best code, this can be one of the low -cost entry points before increasing the price in less than 34 hours with the start of the next round.

Ray Dalio’s history of precise market calls confirms its hedge in Bitcoin

Dalio, a former participant in Bridgewateer Associates, the world’s largest hedge box, has a busy record in obtaining great calls.

His defensive company laid out before the 2008 financial crisis. He properly warned of the debt crisis in the eurozone, which highlighted the risk of debt sustainability in southern Europe, especially Greece, Italy and Spain. His concept of “Deverging Beautiful” helped to form the broader debate about austerity and motivation.

Through 2010S, DALIO expects a low environment paid by the central bank policy. He warned that excessive quantitative mitigation would reveal the currencies of Fiat over time, and this is a major reason that turns it into going on gold, and then, on bitcoin.

This printing is only accelerated. M2 Money Supply now exceeded $ 22 trillion. During the same period, the gold – the traditional hedge – rose from about $ 1096 an ounce to more than $ 3324.

Source: TradingView

But the return of gold is pale compared to bitcoin. During the past decade, BTC has risen about 462,266,567 % of early price levels. Since 2020, it has gained an additional 16x, reaching the highest new level ever this month.

It is not surprising that Dalio has raised his proposed customization to 15 % (although it is still partial for gold). Bitcoin is more convincing as hedging against total economic uncertainty, as strong winds of solid origins like BTC prefer.

Institutional demand adds to this view. The heavy pressure on the purchase aspect indicates that the BTC price may have an area to estimate more.

Retamentation traders question is: What is the best way to follow the DALIO advice and build and maintenance of Bitcoin? The answer is increasingly indicating the best wallet.

Infrastructure designed for bitcoin accumulation and long -term strategy

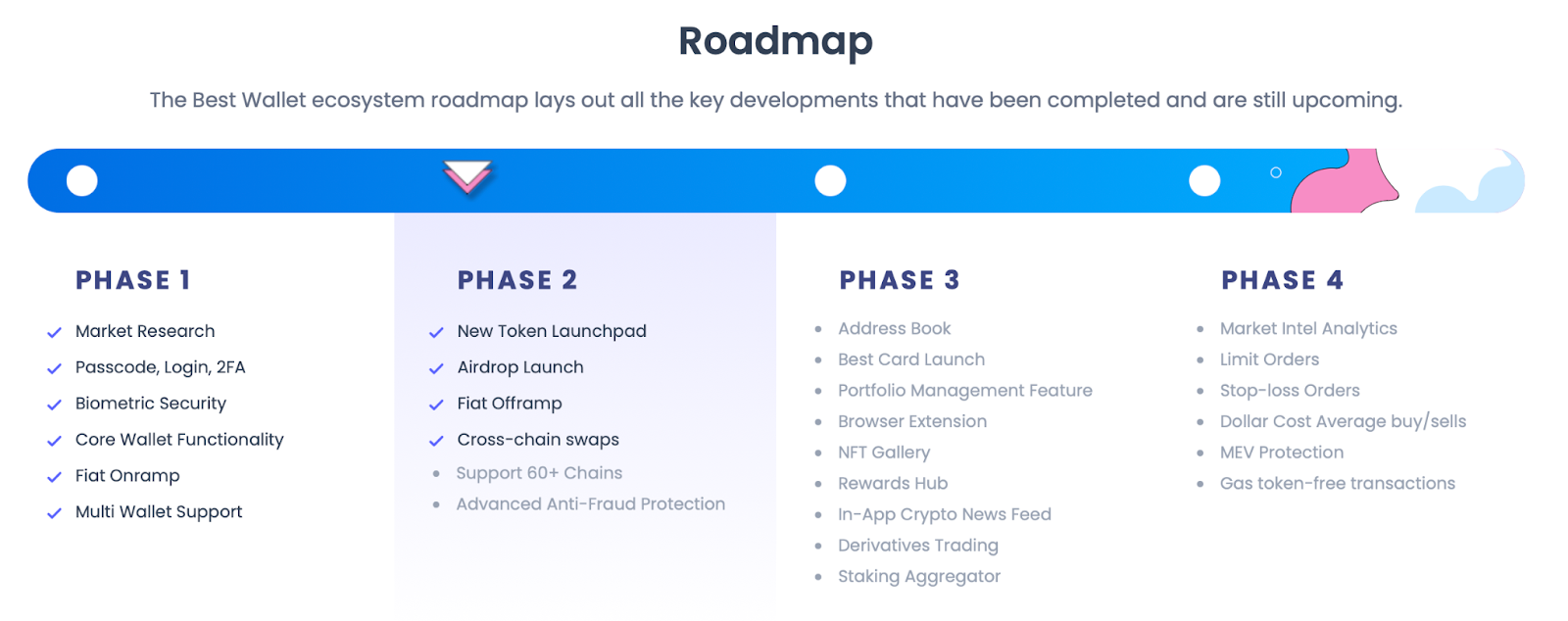

Best Wallet quickly builds a reputation as a pioneering encryption portfolio, with features perfectly in line with the market requirements today.

Its transaction capabilities are operated through smart integration operations with more than 330 protocols and more than 30 bridges across the chain, allowing users to reach deep liquidity and competitive pricing across multiple networks.

According to its road map, getting the best codes will also deduct the lock of transactions free from the distinctive gas symbol. This design selects both active merchants and their long -term holders by reducing costs and increasing returns to the maximum.

Onboarding is made equally simple. With the support of more than 100 Fiat currencies, even new users can easily convert traditional money to encryption, making BTC purchases directly through the best portfolio.

The average cost of the upcoming dollar (DCA) is more relevant to bitcoin customization. This tool, which will be launched in the fourth stage of its road map, will allow users to automatically invest in BTC at specific periods, and to beautify fluctuations over time.

DCA removes guessing and emotional timing of investment, helping users to build steady exposure without pressures of short -term price fluctuations.

By pairing automation with unliked Onramps, it makes the best bitcoin accumulation wallet easier than ever – exactly the approach that is in line with Dalio’s call to a continuous BTC mode.

Best Wallet adds the TRADI power to its own ecological system

However, the best portfolio exceeds the customization of the encryption. Part of its continuous development focuses on merging the Tradfi-style functions directly into the wallet.

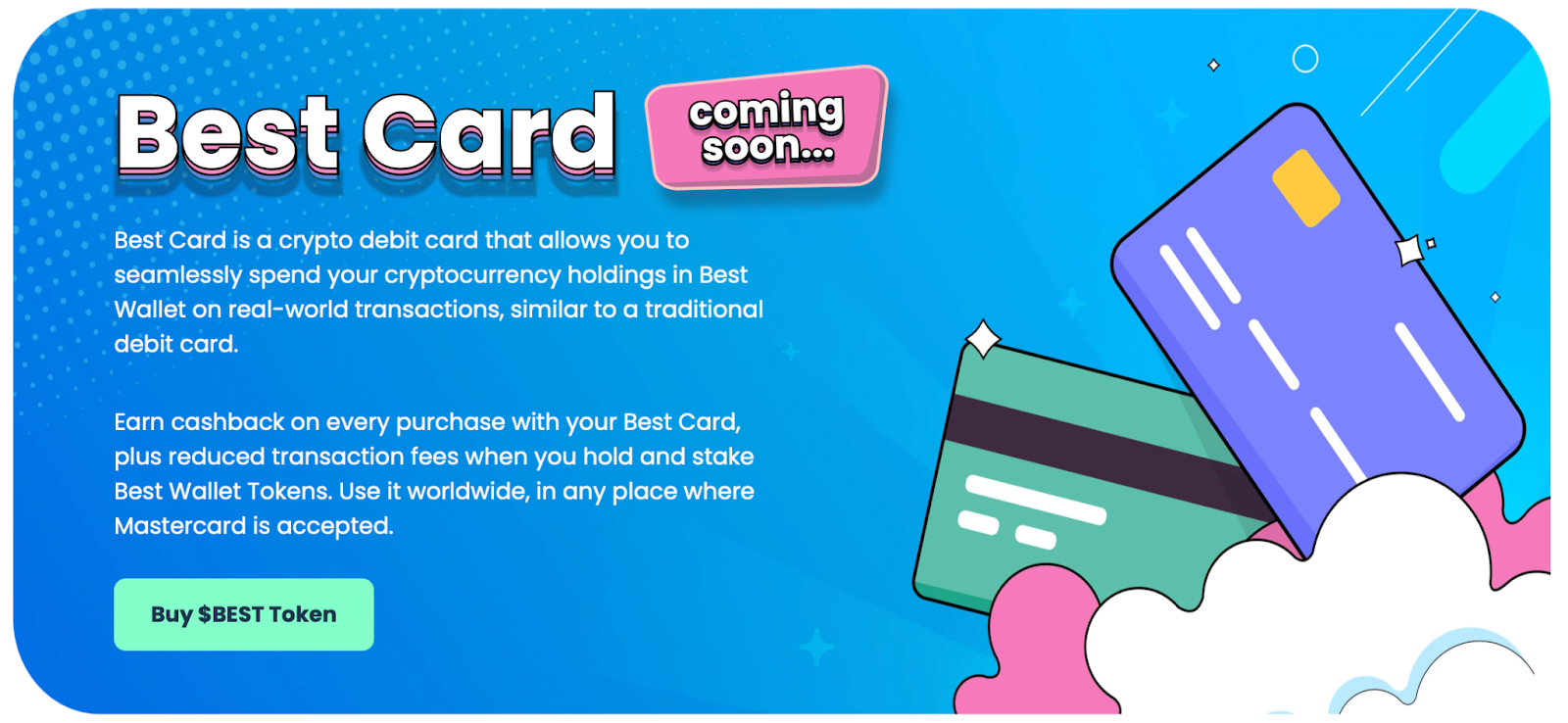

The main feature of this development will be the best card, which is the next debit card service that allows the use of distinctive features within the application for use in transactions in the real world.

This means that if you have accumulated enough spares for morning coffee, you can spend it immediately through the best wallet in a fast, effective and smooth way.

The card also provides up to 8 % cash recovery on purchases, with low fees to not for users who carry the best symbols.

His interest in details in addition to looking at the real world’s ability is part of the reason The best wallet recently got a Walletconnect certificateWhich attests to its commitment to a smooth and reliable user experience across the thousands of DAPS.

A fixed accumulation that meets alpha chances in the icons coming from Best Wallet

Regardless of strategic bitcoin accumulation and discipline, the best portfolio meets high -end opportunities in encryption. One of the features in particular has become a favorite among its users because of its busy record in discovering early stage projects with strong upward potential.

This feature is the next symbols. It is designed on the surface projects that the team has identified as high capabilities before the exchange lists, and has highlighted the winners before the market.

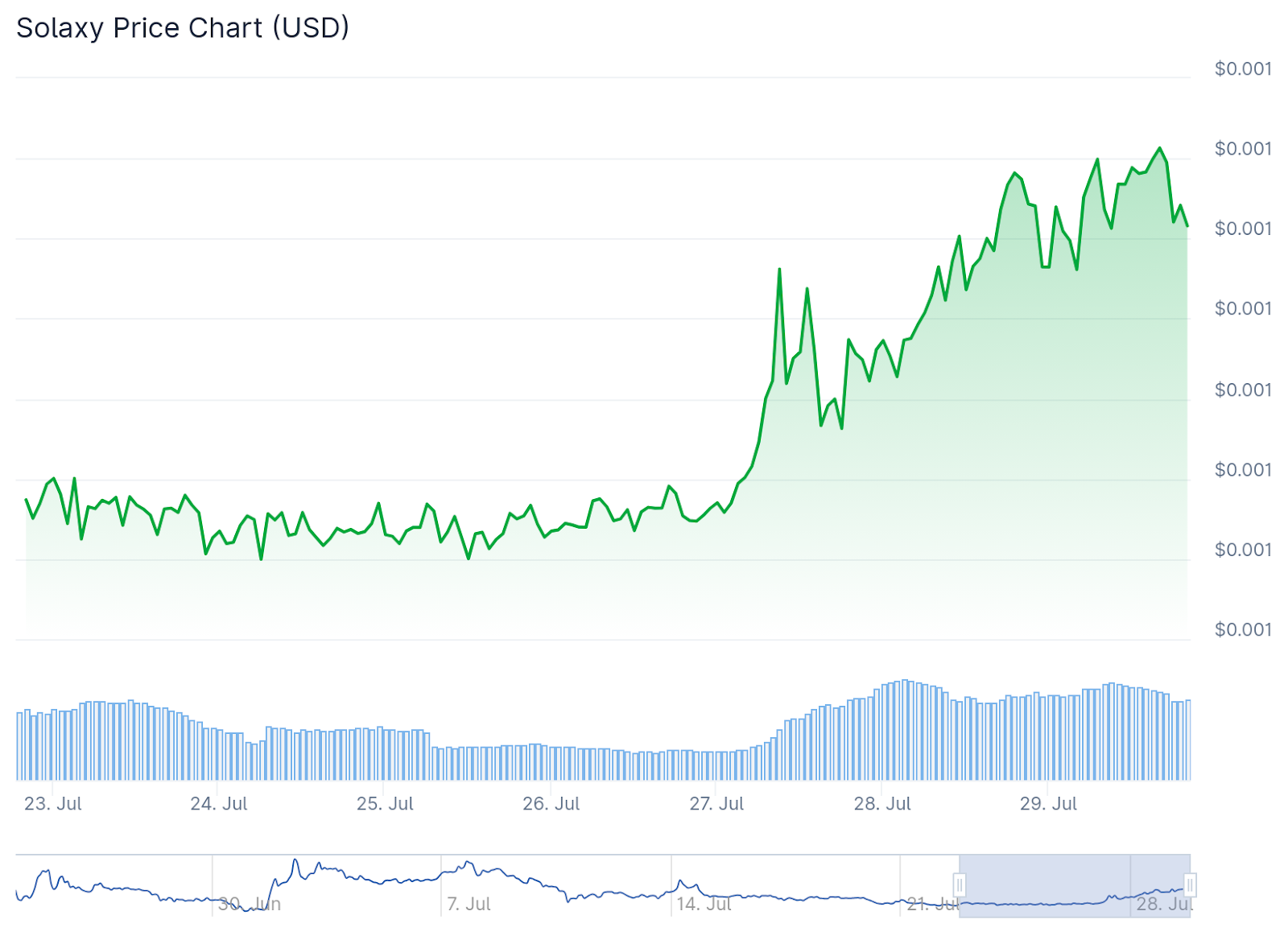

Its calls include Wall Street Pepe (Wepe), an increase of 34.7 % in the past two weeks, and Solaxy (SOLX), the first layer of Solana, which increased by 34 % only last week.

The most prominent previous towers include Pepe (Pepu), which reached 700 % climax, CATSLAP (SLAP), which has achieved returns exceeding 7000 %, and BTC Bull (BTCBUL), which saw 112 % return for many of the best wallet users who explored the project in the arriving individuals.

For users looking for more than long -term BTC strategies, the upcoming symbols provide a possible alpha capacity in high -performance early projects.

Completely, Best Wallet offers a full range of features, which combines stable strategies disciplined with highly drain opportunities, all during construction towards the benefit of the real world through the upcoming features such as the best card.

How to get a 94 % bonus of the portfolio in the best wallet

If you see the best way to reshape the wallet the way the Bitcoin users run and take advantage of emerging opportunities, the next step that exceeds its use is to secure a share in its ecosystem.

This comes by holding the best symbols. With the above -mentioned utility via the platform, the application of the distinctive symbol is primarily driven by its 250,000 active users – and this number is still growing.

Increased value is savings activity. More than 281 million distinctive symbols are already preserved in the independent righteous protocol, and got a dynamic APY by 94 %.

If you want a share of this bonuses or a share in one of the fastest web3 wallets, go to the best wallet site.

The best distinctive symbols can be purchased directly inside the application using a bank card or by switching ETH or USDT.

Stay in contact with the community xand cableAnd disputeAnd visit the best portfolio to learn more.

The best wallet available for downloading on Google Play and Apple App Store.

https://cimg.co/wp-content/uploads/2025/07/29181024/1753812623-image-179-1.jpg

2025-07-29 18:17:00