3 altcoins at the risk of the main rank in the third week of August star-news.press/wp

Altcoin market entered the third week of August in red. The market value (TOTAL3) decreased by 7 %, from more than $ 1.1 trillion to $ 1.03 trillion. This correction has fueled a sense of sales between derivative merchants.

How much risk of liquidation does this offer? The map of the thermal license highlights several altcoins facing high exposure.

1. Solana (sun)

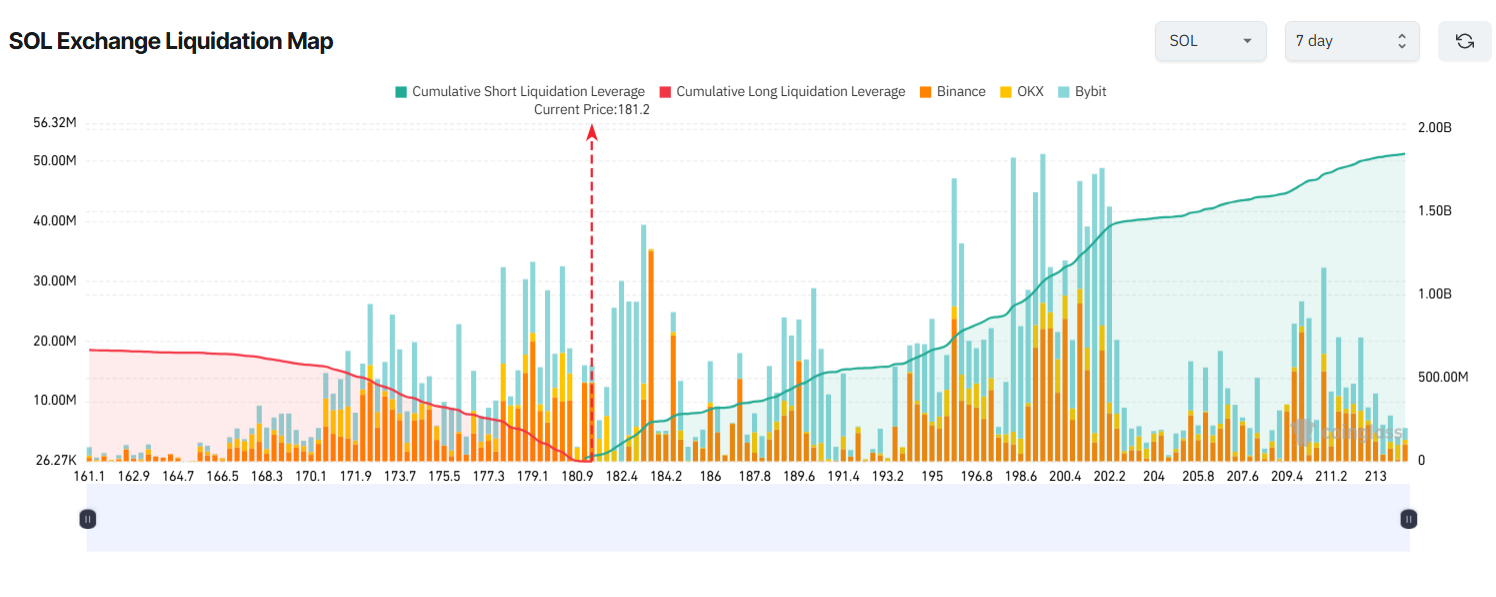

The 7 -day liquidation map in Solana shows that the short liquidation volume (green on the right) dominates long sites starting from the third week of August. However, short situations may face risks as Solana benefits from many biological developments.

Specifically, Solana is reviewing a new governance proposal, SIMD-0326, which presents the alpenglow consensus protocol to accelerate the completion of the mass.

In addition, Solana Declare New record. The network has been processed by more than 104,000 transactions per second.

If the Sol price is more than $ 200 this week, more than $ 1.1 billion can be filtered in short centers. On the other hand, if Sol decreases to $ 161, about 646 million dollars in long centers face filtering.

Analysts warning From the scenario more about. They expect Sol will drop to less than $ 170 before it is bounced above $ 200 during the same week. This means that both long and short merchants may face the risk of liquidation.

2. Dukwin (Duj)

Dogoin (Doge) is located in the spotlight in August where whales and investors accumulate greatly.

In addition, GrayScale with the United States SEC has submitted to convert Dogecoin’s confidence of $ 2.5 million to ETF spot. At the same time, the encrypted bets on Polymark now hiring More than 70 % opportunity for American organizations will agree to Doge ETF by the end of the year.

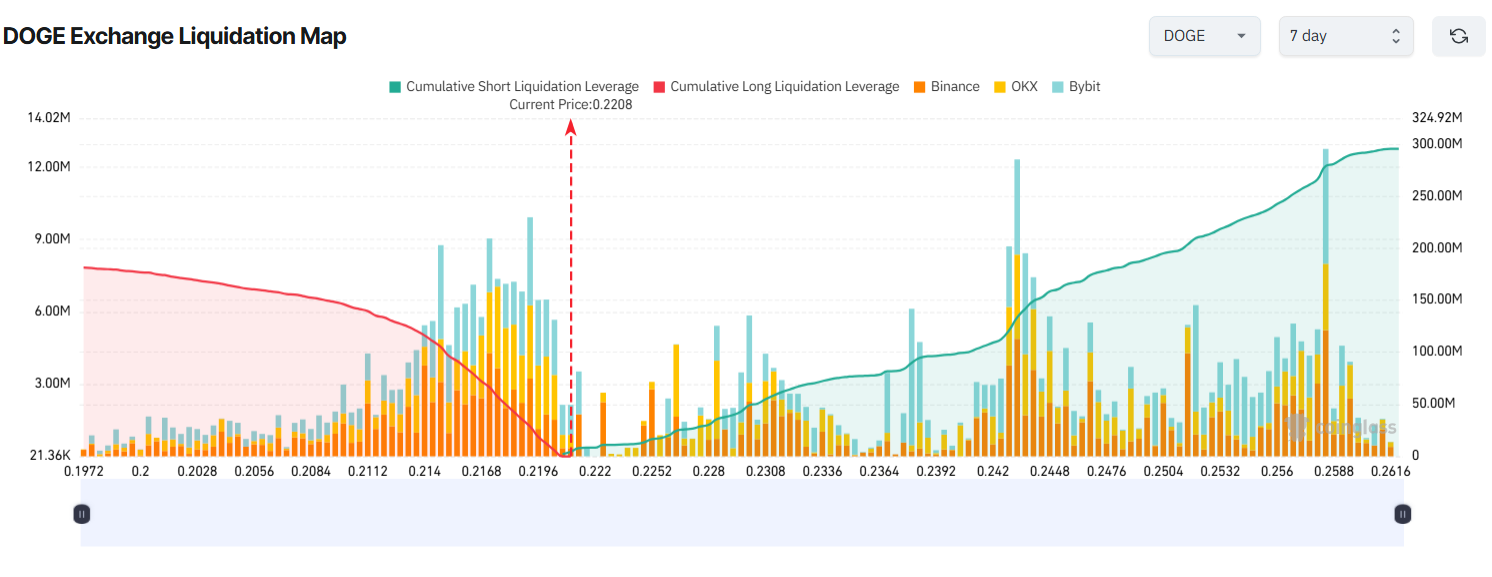

Despite these bullish news, a Dog’s liquidation map shows that short situations dominate the accumulated liquidation. Merchants appear to expect correction. Dog has already gained more than 30 % this month, increasing from $ 0.188 to $ 0.255.

If DOGE decreases to less than $ 0.20 this week, the accumulated long qualifiers may exceed $ 176 million. On the contrary, if Doug regains $ 0.26, about $ 290 million of short pants will be filtered.

Trader Tardigrade argued that now is not the time to stay in Doug. He expected that the currency could approach a strong gathering.

“The bullish triangle for Dogecoin puts its goal in the middle of the time at $ 1.8,” Trader Tardigrade Climate.

3. Chainlink (link)

Chainlink (Link) is gaining mental projects in August. Investors are enthusiastic about the Chainlink reserve initiative announced earlier this month.

The latest Beincrypto report indicated that the whale governor added more than 1.1 million links in the past seven days.

However, the report itself also revealed that the bond exchange reserves are rising again. This indicates that investors have begun to achieve profits after the Link Rally increased by more than 50 % since the beginning of the month.

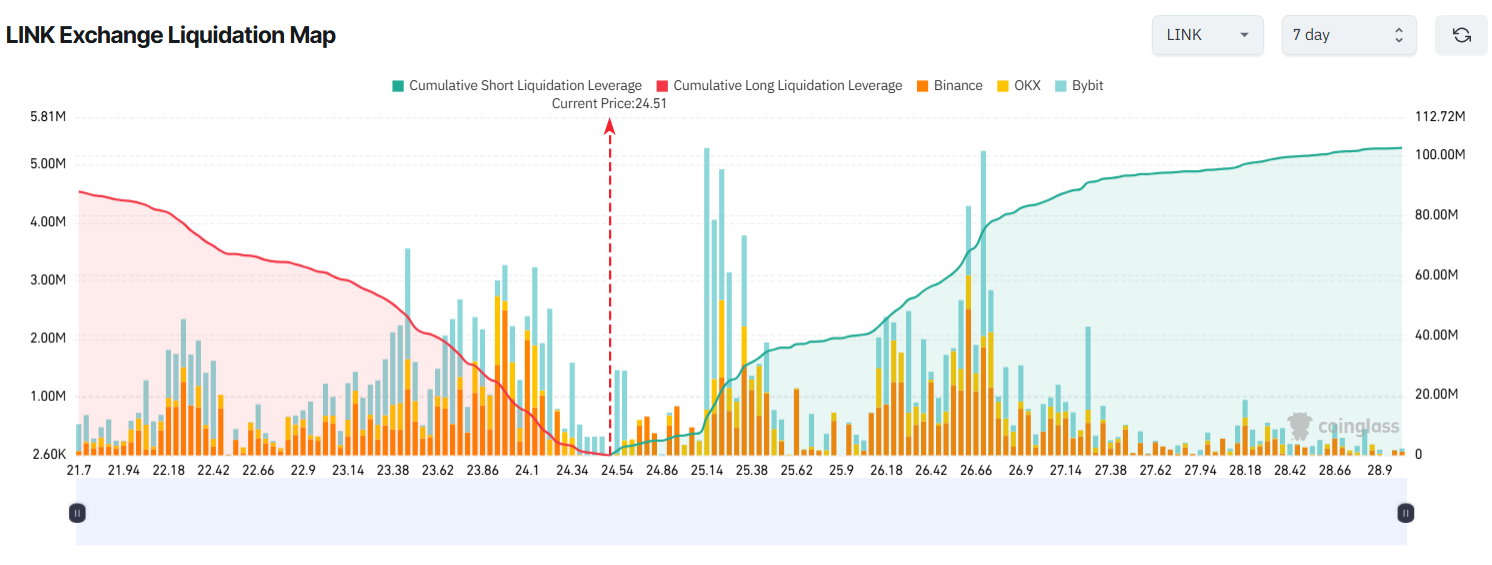

Link’s filter map looks relatively balanced because both bulls and bears have strong incentives.

If the link decreases to less than $ 22, about $ 85 million can be filtered in long positions. If the link collects to 27 dollars, about $ 85 million pants will face filtering. The price range is the same, and the size of the filter is almost identical.

Meanwhile, market morale is still greedy At the time of writing this report, while the Altcoin season stands at 51 points.

Post 3 altcoins appeared at the risk of the main rank in the third week of August for the first time on Beincrypto.

[og_img]

2025-08-18 18:30:00