Cap Market Altcoin sees more corrected since early July star-news.press/wp

Crypto Market Cap printed the first Red Weekly candle after four consecutive green candle. The bullish momentum seems to lose steam, and withdrawal has sparked qualifiers for traders in the short term.

What sparked this week’s correction, and what does it mean to move forward?

Nearly $ 1 billion is classified with a decrease in the maximum market in the last week of July

According to TradingView data, the maximum Crypto Market fell by 5 % this week, from about $ 4 trillion to $ 3.78 trillion. However, the maximum Altcoin (total2) market decreased sharply. About 10 % decreased, from 1.57 trillion dollars to $ 1.4 trillion.

Altcoins corrected more severe than Bitcoin, causing losses of short -term derivatives. Coinglass has registered nearly a billion dollars in the past 24 hours.

“During the past 24 hours, 31,4302 traders have been filtered. The total liquidation comes at 966.04 million dollars,” COINGLASS I mentioned.

Of nearly $ 1 billion, more than 840 million dollars came from long positions, which represents about 84 %. This highlights the failure of many short -term traders who used the leverage and expected prices at the height this week.

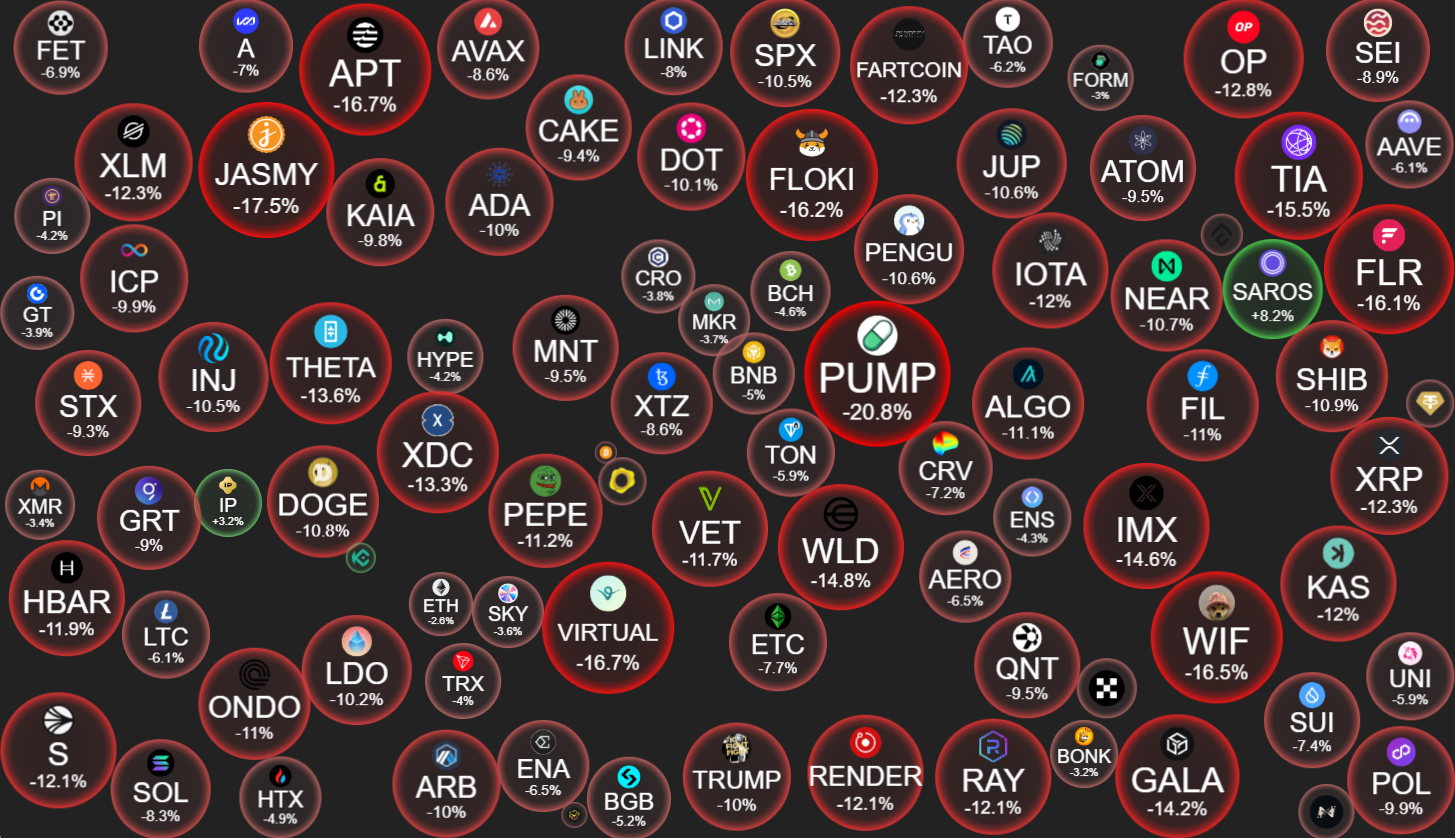

In addition, data from Cryptobubles showed that almost all altcoins decreased sharply today, with losses ranging from 6 % to more than 20 %.

This step can be considered the first wave of profit after four consecutive weeks of market rise in the market.

Who gets profits?

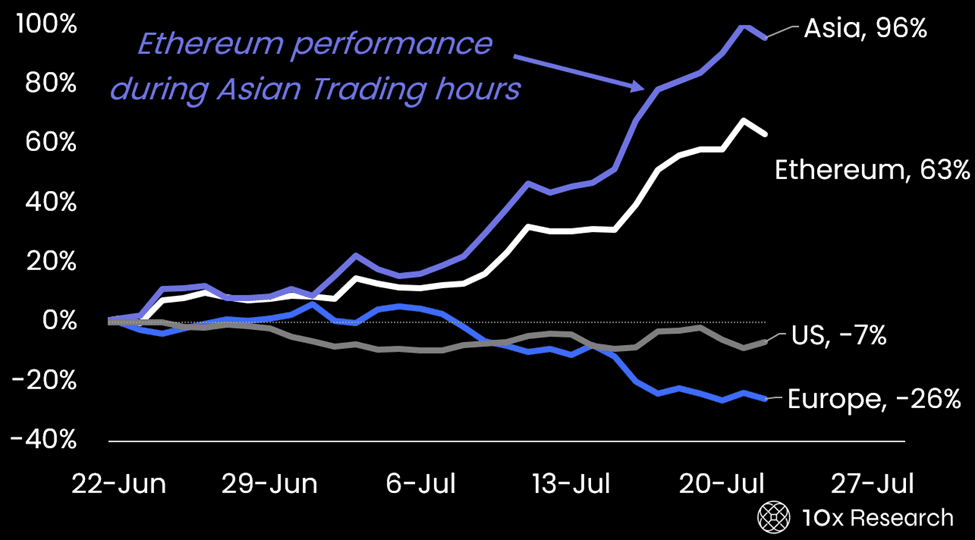

According to New report From 10x research, Asian trading hours were the main engine of the last gathering.

While Bitcoin recorded a profit +16 % in general, the Asian watches alone +25 % contributed to this increase. This means that both Europe (-6 %) and the United States (-3 %) have already seen a net sale, probably due to profit.

A similar pattern appeared with ethereum. ETH increased by 63 % last month – impressive profit. However, almost all of this (+96 %) happened during Asian trading hours. On the other hand, Europe (-26 %) and the United States (-7 %) are sold with an increase in price.

“Although some of this may be due to news related to the emerging treasury after the American market hours, the most likely explanation is to increase the enthusiasm and aggressive purchase of Asian merchants,” the report. Explain.

According to the study, American and European investors may be in detention. Ironically, they were also the source of positive news that feed the narration of strategic encryption.

It seems that Asian merchants were from the Fomo dependent on news from the other half of the world, just to be hurt today through the same headlines.

However, this type of decline may not be sufficient to refer to the long -term landmark. Many analysts see it as a natural stage for profit, believing that the broader trend is still intact.

“Not interested in retreating in Als today. It was reasonable to sell by looking at the amount of everything he gained recently. The most important thing is that BTC is strong. Alts will wear soon enough-more likely more than the last match match. Propagate.

CZ, Binance Founder, also Displayed This correction is simply “declined again.”

At the time of writing this report, the market morale remains in “”greedThe region. Despite nearly a billion dollars in liquidation, there is no sign of panic.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/02/bic_Altcoin_coin_2-covers_bearish.jpg.optimal.jpg

2025-07-24 10:24:00