AI-leadership NDING NDING is secured in a large amount of $ 300 million to receive revolution

London-based AI-driven credit technology company Abundant Up to $ 299.8 million has been secured for consumer loans from Deutsche Bank, further strengthening the ability to give more affordable credit to the UK Orrows.

This latest fund, which will sit along with the existing benefits from the funds, including City, Falls Resources Management and Luminerex, provides additional firepower to scale it, increase financial inclusion and modernize the NDing sector.

It is € 1.9 billion by increasing the ability to take nduing in large quantities.

Gerald Chapel, CEO and lots of co-founders say: “This new advantage of Deutsche Bank leads the AI credit decision technology by proveing our bank-transfer data power. Open Banking has become a mature and widely adopted technology in the UK and now it uses about 20 million people. More countries around the world take up open banking, we are fully prepared to start accepting what works in the UK, GlobalThe “

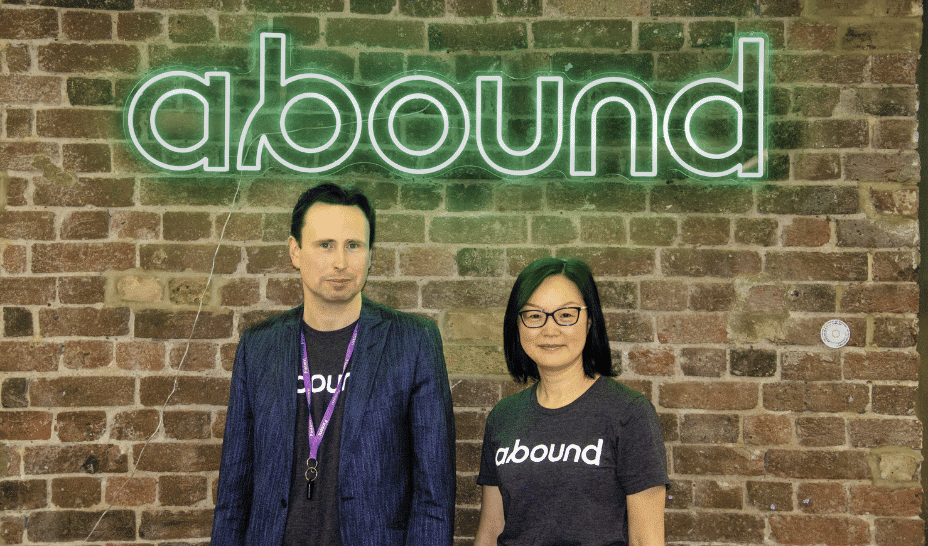

In 2021, senior credit expert Jerald Chapel (Partner in the former McKins) and Dr. Michel Hei (X-II-director) established a wide range, and is now one of the fastest growing fintecas in the UK, which has been launched over 779.7 million loans since its launch.

Based on what they can afford to repay by using open banking and AI to provide fair loans to large quantities. Currently between € 1.1K and 23.9K dollars, up to 8% to 29.8% of APRS with APRS for 8 years.

More data available in the world than ever before, many believe that it is no longer understandable to rely on statistical average and old credit scores.

Their Cashflow is the underwriting platform, render, the unique financial situation of each or dinner, using the AI-driven open banking insights. Using this real-time financial data, render enables reduce its default rates and provide low rates to customers.

Render is Finator Holdings Limited, the technology owned by Ltd. and abundance acts as their consumer arm.

Dr. MichelleCOO and lots of co-founder, added: “As we continues to expand and are increasingly providing our technology to other ND donors ensures elasticity of elasticity evolved in the Credit Veho marketThe “

In order to qualify for LOAN, ND donors must be at least 18 years of age, have the right to stay in the UK, have a major bank account in the UK and have no unresolved default or CCJ.

Their website has claimed that all applicants are ”Making a decision within one day“, And if it is accepted, the money will also be transferred within a day (possible). Payment payment leave is also given.

It has announced that it has become profitable in April 2024, three years after its launch.

[publish_date